International grain prices are reaching record highs. The war between Russia and Ukraine, both major wheat exporters, is also prolonging amid the resurgence of COVID-19. This is compounded by poor crop yields in South America due to abnormal weather. Concerns over grain supply disruptions have driven grain prices sky-high, causing domestic feed and food prices to rise accordingly. Related companies are facing uncertainties due to raw material price fluctuations while simultaneously expecting improved earnings from product price increases. Asia Economy analyzed Mirae Life Resources and Hanil Feed, representative grain-related stocks.

[Asia Economy Reporter Jang Hyowon] Feed and food manufacturer Mirae Life Resources has recently attracted attention in the stock market due to rising grain prices. This is because the increase in raw material costs is expected to lead to higher selling prices, driving sales growth. Mirae Life Resources is pursuing business diversification into pet food and home meal replacement (HMR) while maintaining its core feed business stably.

Steady Feed... Focus on Pet Food and HMR

Mirae Life Resources operates a feed business producing single feed, supplementary feed, and pet food, as well as a food business selling edible eggs, functional materials, and HMR products. As of the end of last year, the feed segment accounted for more than 80% of total sales.

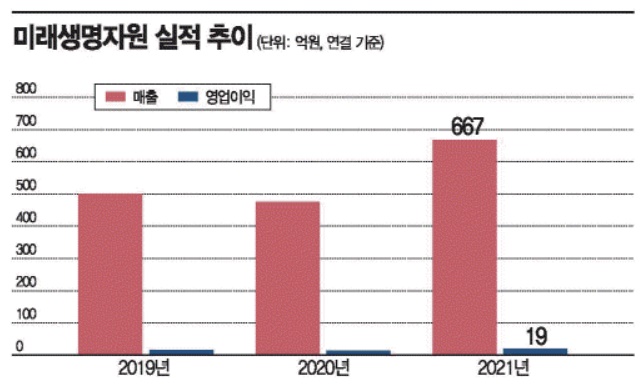

Last year, Mirae Life Resources reported consolidated sales of 66.7 billion KRW, a 40.4% increase compared to the previous year. Operating profit and net income for the same period were 1.9 billion KRW and 1.1 billion KRW, respectively, up 31.1% and 12.9%. Sales increased more than profits.

The performance growth of Mirae Life Resources is attributed to rising grain prices. In the feed market, the company's main business, selling prices are linked proportionally to raw material costs. When raw material prices rise, selling prices also increase. Even with price hikes, if livestock production?the main consumer of feed?increases, demand also grows, so rising grain prices positively impact sales growth. Recently, international grain prices have strengthened due to the Russia-Ukraine war. Russia and Ukraine account for about 9% of the global grain market. In Ukraine, sowing is expected to be difficult from April due to the war, and production disruptions are anticipated in the second half of the year due to diesel shortages. Additionally, last year's grain production in the U.S. declined due to natural disasters such as hurricanes, cold waves, and fires, which also contributed to price increases.

Last year, Mirae Life Resources' core domestic feed segment saw sales growth driven by increased demand for special processed raw materials (EP) and compound feed such as Corn Plus (corn), Soy Plus (soybean), and Oat Base (oats), as well as expanded pet-related facilities. The domestic food segment also saw sales growth as selling prices rose following increases in edible egg farm gate prices. Particularly, the overseas segment expanded sales due to increased raw material demand amid rising grain prices. Consequently, the overseas sales ratio increased from about 31% in 2020 to over 42% last year.

Mirae Life Resources' growth drivers are pet food and HMR segments. In 2018, Mirae Life Resources built a specialized pet food factory and obtained HACCP (Hazard Analysis and Critical Control Points) certification. Since then, it has supplied functional products through original design manufacturing (ODM) to Coupang's pet brand 'Kkoribyeol' and animal nutrition specialist 'Cargill's' snack brand 'One Day Care.' Furthermore, in May last year, the company acquired a 5.4% stake in 'Avec,' a total solution company for pet and owner health and hygiene care, focusing on expanding related businesses. The HMR segment has strengthened B2C (business-to-consumer) and product sourcing capabilities by increasing capital in 'Food Tree,' an HMR manufacturer acquired in October 2020.

150 Billion KRW CB Conversion Date Approaching

Mirae Life Resources' financial condition is stable, with steady earnings each year bolstering equity capital. As of the end of last year, the debt ratio was 57.1%, but cash and cash equivalents exceed total borrowings, resulting in a negative net debt position. The debt ratio had consistently stayed in the 10% range since 2017 but rose last year due to the issuance of convertible bonds (CB).

On March 16 last year, Mirae Life Resources issued the second tranche of privately placed CB worth 15 billion KRW. The funds were intended for new facility expansion but have not yet been used and are held as deposits. This large cash holding results in a negative net debt position. Although the funds have not been utilized yet, the CB became convertible starting from the 16th of last month.

The conversion price per share is 5,962 KRW, which, compared to the current stock price of about 10,000 KRW, implies an expected valuation gain of 67.7%. If the entire 15 billion KRW is converted into shares, a total of 2,515,934 shares will be released into the market. This represents 14.2% of the total outstanding shares as of the end of last year.

A financial investment industry insider expressed concern, saying, "Since the stock price has recently surged due to the grain price increase issue, a large volume of CB shares being released at once could cause a significant shock."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.