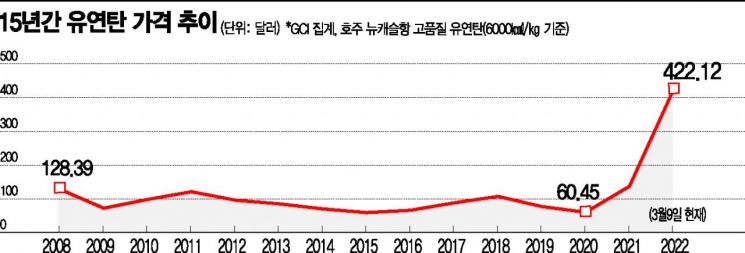

Surging Demand and War Adversities... Historic First Breakthrough Above $400 per Ton

Prices Quadruple in Just One Year, Cement Companies Using Russian Materials Face Double Hardship

[Asia Economy Reporter Kim Jong-hwa] Industries that import raw materials to manufacture products are all in turmoil due to the soaring international raw material prices. Among them, the term "soaring" is insufficient to describe the price of thermal coal. Thermal coal is a type of coal with a high volatile content that ignites easily and burns with flames. Although it produces a lot of smoke when burned, its heat output is stronger than anthracite, so it is mainly used for power generation and is heavily imported by the power generation, cement, and steel industries.

According to the British thermal coal price assessment agency GCI (Global Coal Index), on the 7th (Korean time) at the international commodity exchange ICE Futures, high-quality thermal coal from Newcastle Port, Australia (based on 6000 kcal/kg) was traded at $427.50 per ton. This is the first time in history that the price of thermal coal per ton has exceeded $400. Subsequently, on the 8th it was $414.88, and on the 9th $422.13, with prices continuing to stay above the $400 mark.

The import price of thermal coal was relatively stable at $60?90 per ton during 2019?2020. Then, in January last year, the price broke through $100, surged past $200 in August, and peaked at $272 by the end of the year. It soared to $317 on the 2nd of this year and surpassed $400 on the 7th. This price increase is due to multiple factors including increased demand from China's infrastructure expansion, rising oil prices, and inflation, with Russia's invasion of Ukraine adding fuel to the already blazing thermal coal prices.

Cement Industry Suffers the Most

Cement is made by heating materials such as limestone, iron ore, and clay at temperatures above 1500 degrees Celsius using thermal coal. Thermal coal serves as the fuel generating the high heat and also acts as a primary raw material for cement along with limestone.

The sectors most affected by the soaring thermal coal prices are power generation companies operating coal-fired power plants and steel companies like POSCO. Although they are managing to endure due to their scale, their concerns are deepening. As the price of coking coal used in steel production has skyrocketed, companies such as POSCO Steel Plate, Dongkuk Steel, and Hyundai Steel have successively raised product supply prices last month and this month, and conflicts with demand companies over price negotiations are intensifying.

Major cement companies that have mainly used Russian thermal coal are being hit doubly hard. These companies have factories concentrated along the East Coast of Gangwon Province, and they have imported Russian thermal coal because of its physical proximity and relatively low price.

According to the Korea Cement Association, of the 3.643 million tons of thermal coal imported last year, 74.7% (2.721 million tons) was Russian, and the remaining 25.3% (922,000 tons) was Australian. Not only have prices soared, but imports have also been halted, raising concerns about future production disruptions.

Typically, about 0.1 tons of thermal coal is required to produce 1 ton of cement. Thermal coal accounts for 30% of cement production costs, labor, electricity, and transportation costs make up about 65%, and the remaining 5% is allocated to environmental charges and funds.

A cement industry official said, "With thermal coal prices exceeding $400, even diversifying imports and additional cement price increases due to rising costs have reached a level that cannot be offset. We need to explore measures such as government subsidies to minimize the shock from the rapid rise in import prices or reducing import unit costs through direct bulk purchases of thermal coal."

Three Cement Price Increases in 15 Years

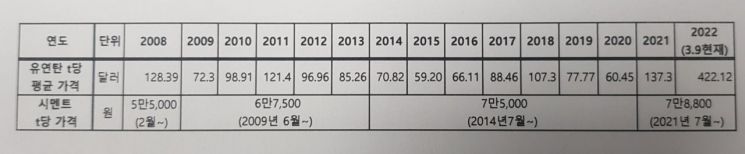

Over the past 15 years, while thermal coal prices fluctuated, cement prices were raised three times. When thermal coal prices rose to $128.39 in 2008, the cement price, which was 59,000 won per ton, was increased by 14.4% to 67,500 won in June the following year. It took five years until July 2014 to raise the price to 75,000 won, an 11.1% increase, and seven years until July last year to increase it by 5.1% to 78,800 won.

The industry explains that the 18% increase to 93,000 won announced in February after just seven months was due to thermal coal prices again exceeding $200 since August last year.

Industries vulnerable to raw material supply and unable to keep up with rising costs inevitably undergo fundamental changes. The cement industry's acquisition of waste disposal companies to increase the recycling resource substitution rate is also a measure to cope with repeated raw material shocks.

Hong Soo-yeol, director of the Resource Circulation Social Economy Research Institute, said, "Reducing the use of thermal coal and rapidly increasing the recycling resource substitution rate, which is currently only 20?30%, is the way to more flexibly respond to raw material shocks." Of course, with the current situation and substitution rate, it is impossible to immediately resolve the runaway raw material price shocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)