Participation in 2nd Round of IFC Sale Bids

First Round Bids Valued at 4.3 Trillion Won

Generous Investment in Yeouido Landmark

Big Plans for Shopping Mall and Hotel Entry

Jung Yong-jin, Vice Chairman of Shinsegae Group.

Jung Yong-jin, Vice Chairman of Shinsegae Group.

[Asia Economy Reporter Kim Yuri] Chung Yong-jin, Vice Chairman of Shinsegae Group, has made a bold investment to plant the Shinsegae flag at the landmark in Yeouido, Seoul.

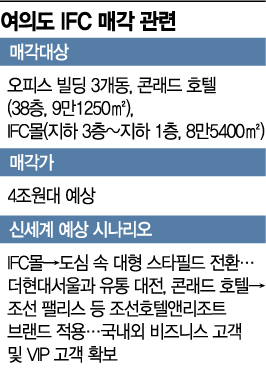

According to the investment banking (IB) industry on the 15th, Shinsegae, together with Aegis Asset Management, entered the second round of the main bidding for the sale of the International Finance Center (IFC) in Yeouido, Seoul, the day before. Shinsegae participated in the Aegis consortium through Shinsegae Property, a comprehensive real estate development company operating Starfield. The acquisition target includes four IFC buildings and the IFC Mall in Yeouido, owned by Brookfield Asset Management of Canada. One of the buildings houses Conrad, the premium brand of the global hotel chain Hilton.

Shinsegae highly valued the opportunity to introduce its core businesses?retail chains (shopping malls) and hotels?into Yeouido, which has emerged as a hot place after the opening of Hyundai Department Store Group’s strategic department store, The Hyundai Seoul, last year. Vice Chairman Chung is known to be deeply interested in everything from site selection to future operations related to the Starfield shopping mall and the Chosun Hotel & Resort brand hotels. In particular, since IFC is a landmark in Yeouido, it appears that symbolic significance for enhancing the Shinsegae brand value was also emphasized.

Industry experts believe that if the IFC Mall, which spans 85,400 square meters, reopens as a large-scale Starfield in the city center, it will attract not only office workers in Yeouido but also demand from the MZ generation (Millennials + Generation Z). This was proven by The Hyundai Seoul, which opened in Park One across the street in February last year. Although department stores and shopping malls differ in nature, they are expected to create synergy in attracting customers and elevate Yeouido as a shopping mecca.

Shinsegae Property previously purchased a 25% stake in the fund of Aegis Asset Management, which owns Centerfield near Yeoksam Station in Gangnam, on the former Renaissance Hotel site, for 360 billion KRW. In 2017, it acquired COEX Mall and reopened it as COEX Starfield. The industry expects the Yeouido IFC investment to follow a similar approach. The Conrad Seoul Hotel can be operated under the Chosun Hotel & Resort brand. There is also a possibility of applying ‘Chosun Palace,’ the top-tier brand of Chosun Hotel introduced last year, to attract domestic and international business and VIP customers.

While the COVID-19 pandemic accelerated the restructuring of the retail market with online platforms rapidly rising, offline success has been achieved by applying ‘killer content’ in ‘metropolitan centers.’ Shinsegae is sparing no investment to secure market leadership. Last year, Shinsegae invested 3.4 trillion KRW to acquire Gmarket Global (eBay Korea) to strengthen its online base. Having confirmed the offline success formula through Shinsegae Department Store, the industry expects Shinsegae to actively invest in the Yeouido landmark as well.

However, the key issue is the sale price. In the first round of bidding held last month, a price as high as 4.3 trillion KRW was proposed. The industry expects a similar price level to have been offered in this main bidding as well. Competitors are also aggressive. Besides the Aegis-Shinsegae consortium, other participants in the main bidding conducted by Eastdil Secured, the IFC sale manager, include Marston Investment Management, ARA Korea, Koramco Asset Trust, Mirae Asset Maps, and Midas Asset Management.

A financial investment industry official said, "Since this acquisition is very large in scale, the final selection of the buyer will comprehensively reflect not only the price but also the ability to raise funds and investment history. Strong candidates with a track record of successful big deals are actively participating, so we need to watch the outcome closely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)