Netflix's Largest-Ever Investment

25 Titles Scheduled for Release This Year

Domestic Companies Still in the Red

Government Support Measures Stalled for 3 Years

Global Firms' Volume Offensive

Review Period Extended Beyond 5 Days

[Asia Economy Reporter Cha Min-young] The ‘chicken game’ in the online video service (OTT) market is intensifying. Netflix, which poured 500 billion KRW into K-content production last year, has announced plans to release 1.67 times more works this year, signaling massive investment. Meanwhile, domestic OTT services, which inevitably fall short in terms of content quantity and investment scale, are concerned about a ‘war of money.’ Experts diagnose that relevant government departments should prepare practical support measures instead of engaging in a ‘battle over market share’ so that domestic OTT operators, who are at a capital disadvantage, can escape the crisis of extinction.

Those with less than 100 billion KRW can’t even join the game

On the 24th, Netflix announced plans to showcase 25 Korean dramas, movies, and entertainment programs in 2022. The total investment is expected to reach an all-time high. Domestic companies also plan to invest hundreds to thousands of billions of KRW in K-content. Content Wave, which operates ‘Wavve,’ will invest 80 billion KRW this year and 100 billion KRW next year, with a total investment of 1 trillion KRW planned by 2025. KT, which owns ‘Season,’ and CJ ENM-affiliated ‘TVING’ will each invest 400 billion KRW by next year.

Despite massive investments, success is not guaranteed. Competition is fierce, and users frequently move to popular content. Netflix’s subscriber count increased by 8.28 million in Q4, falling short of expectations by 200,000, causing its stock price to plunge more than 20% in a single day. Disney Plus (+) and Apple TV Plus (+), which debuted in Korea at the end of last year, opened with Korean originals such as ‘Snowdrop’ and ‘Dr. Brain,’ respectively. HBO Max, famous for ‘Game of Thrones,’ is also expected to enter the market in the second half of this year.

Domestic OTTs "Government support is urgent"

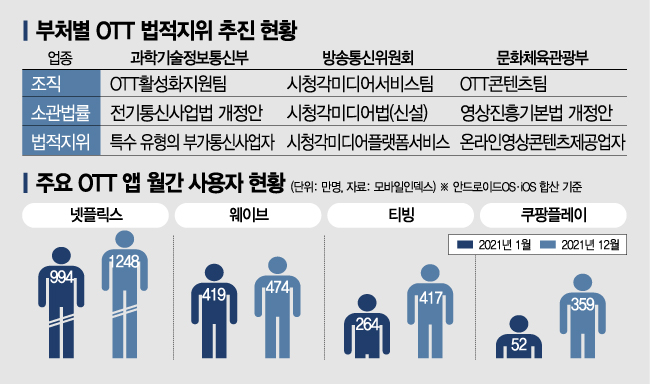

Domestic OTT companies like Content Wave and TVING are still struggling with deficits. The government agrees on the need to strengthen the self-sustainability of domestic OTTs but is slow in preparing support measures. The ‘Digital Media Ecosystem Development Plan,’ announced at the government-wide level in June 2020, is a representative example. Since the launch of the government-wide organization, disagreements among ministries have prevented effective tax support measures, including granting legal status, and various bills have been stalled for two and a half years.

The most urgent demand from the industry is the introduction of a ‘self-rating system.’ OTT operators must receive rating classification from the Korea Media Rating Board under Article 50 of the Film and Video Act. In contrast, general broadcasting programs are autonomously rated by broadcasters under Article 33 of the Broadcasting Act without separate review. The problem is that when general broadcasting programs are serviced on OTT platforms, they must undergo separate rating classification. This inevitably disadvantages domestic operators with a high proportion of broadcast content.

Review periods lengthen under pressure from content giants

As global OTTs continue their volume offensive, review periods are also increasing. According to data submitted by the Korea Media Rating Board to Park Jung, a member of the National Assembly’s Culture, Sports and Tourism Committee, the number of days required for video rating classification was about 12 days as of August last year, an increase of more than 5 days compared to 7 days in 2020. The number of reviews received in August alone reached 10,351. Netflix’s ‘Squid Game’ and ‘Kingdom: Ashin of the North’ each took 21 days for review.

Experts advise that alongside regulation of global OTTs, it is urgent to establish domestic support grounds through inter-ministerial consultation. They pointed out the need for an integrated third legal framework to resolve regulatory uncertainties. Professor Lee Sung-yeop of Korea University’s Graduate School of Technology Management said, “We are in a situation where we are handing over our home turf to global media companies. Without groundbreaking ideas and execution shifts, the future of Korean media looks very bleak.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.