Candidate Lee Jae-myung "Legal Maximum Interest Rate 11.3~15% Appropriate"

Ruling Party Lawmakers Push for Maximum Interest Rate Reduction Bills

Populism Criticism... Concerns Over Illegal Private Loans Balloon Effect and Side Effects

[Asia Economy Reporters Kiho Sung, Jinho Kim] "The statutory maximum interest rate should be between 11.3% and 15%." (May 25 · Lee Jae-myung, Democratic Party presidential candidate SNS)

Less than six months after the statutory maximum interest rate was lowered, the ruling party is accelerating legislative amendments for further reductions. The bill was swiftly proposed in line with candidate Lee's financial policy direction, but concerns are rising that populist pledges are being excessively made amid the presidential election campaign.

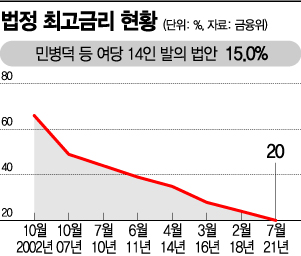

According to the National Assembly on the 24th, 14 Democratic Party lawmakers including Min Byung-duk proposed the "Partial Amendment to the Interest Restriction Act" the day before. The bill aims to lower the maximum interest rate from the current 20% to 15%. It also unifies matters related to interest restrictions, specifying that the law applies to all contractual interest limits on monetary loans. The bill includes provisions to strengthen legal penalties if the interest rate exceeds twice the maximum rate.

Representative Min explained, "Compared to the economic situation where interest rates remain low, the current Interest Restriction Act is a burden on small business owners and the economically vulnerable in their economic activities."

Fellow party member Lee Su-jin also proposed a "reduction to below 13%" bill last month. Lee cited a research result from the Gyeonggi Research Institute, which showed that the maximum interest rate could be lowered to between 11.3% and 15% through cost reductions such as procurement costs. Democratic Party lawmakers Min Hyung-bae, Song Jae-ho, and Seo Young-kyo have also proposed bills to reduce the rate to below 15%.

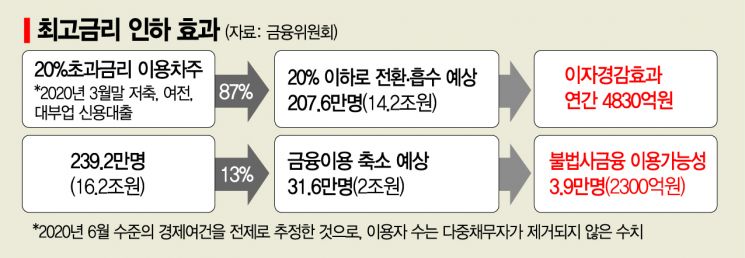

However, the financial sector views this as a "populist pledge." There are concerns that an excessively rapid reduction in the maximum interest rate will drive vulnerable people into illegal private loans. According to the Financial Services Commission, about 39,000 people were pushed into the illegal private loan market due to the interest rate cut in July.

There are also worries that the bill's promotion process will be one-sided. The ruling party, which can pass bills unilaterally, is expected to speed up efforts to win votes ahead of the presidential election. Especially since the Gyeonggi Research Institute, which served as the basis for the ruling party lawmakers' bill proposals, acts as candidate Lee's think tank, the financial sector is taking this seriously.

A financial sector official said, "Populist pledges appear to aim at easing the burden on the vulnerable, but if excessive, they can cause market distortions and lead to many side effects."

Related bills: 13 proposed in one year... 4 percentage point cut already made in July

Concerns about the ruling party's push for additional statutory maximum interest rate cuts are growing due to the excessively rapid pace and the significant side effects expected in the financial market.

While there is sympathy for reducing interest burdens on low-income, low-credit, and vulnerable groups, there are warnings that a sudden cut in the maximum interest rate will inevitably push these groups into illegal private loans. An unreasonable interest rate cut could raise loan barriers at savings banks and mutual finance institutions, which are mainly used by the vulnerable, and could even lead to the collapse of the regulated lending market. Critics also argue that this is a typical populist policy aligned with the ruling party's presidential candidate's financial pledges.

According to the National Assembly's legislative information system, since the agreement to lower the maximum interest rate to 20% in November last year, a total of 13 interest reduction bills have been proposed by the Democratic Party and the government. Among them, six are "Partial Amendments to the Act on Registration of Credit Business and Protection of Financial Users," and seven are "Partial Amendments to the Interest Restriction Act." All bills aim to lower the current statutory maximum interest rate of 20% to between 10% and 15%.

The rationale is to ease the interest burden on the vulnerable due to the prolonged COVID-19 pandemic. The problem lies in the excessive speed and scale of the reduction. The statutory maximum interest rate was lowered by 4 percentage points from 24% to 20% on July 7. Despite side effects already emerging, the ruling party is pushing for a significant reduction in less than half a year.

Excessive reduction makes loans difficult... regulated lending market could collapse

If the regulated financial sector shrinks, financially vulnerable groups in urgent need of funds will inevitably be pushed into illegal private loans. The Financial Services Commission warned that about 39,000 people (2.3 billion KRW) might resort to illegal private loans due to the interest rate cut. In fact, when the statutory maximum interest rate was lowered to 24% in 2018, about 50,000 people were unable to obtain loans from the regulated financial sector and were pushed into illegal private loans.

Lee Yong-jun, senior expert of the National Assembly's Political Affairs Committee, pointed out, "Lending companies may reduce loans to relatively risky low-credit borrowers to maintain profitability, decreasing new funding opportunities for low-credit borrowers. The difficulty in operating lending businesses due to the maximum interest rate cut may lead to the underground operation of small lenders and an expansion of illegal private loans."

The lending industry, known as the "last bastion" of financial services for the vulnerable, is closing or planning to close one after another following the maximum interest rate cut. This is because the reduction in the maximum interest rate has sharply increased bad debt costs, causing negative margins.

The financial sector points out that further lowering the statutory maximum interest rate will be difficult. According to the Korea Federation of Credit Card Associations, among eight companies including seven major credit card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana) and NH Nonghyup Bank, the average card loan interest rates of five companies rose in November compared to October. Particularly, while only Lotte and Woori Card had average interest rates above 14% in October, the number increased to five companies including Samsung, Hyundai, and KB Kookmin last month. The proposed 15% reduction is already approaching. Interest rates at other secondary financial institutions such as savings banks are also soaring.

A financial sector official emphasized, "The financial industry is heavily influenced by regulations and is often used by politicians to win votes. Given the COVID-19 situation, it would be more effective to seek measures to stabilize the economic lives of the vulnerable rather than focusing on vote-catching."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)