[Asia Economy Reporter Lee Seon-ae] The recently fast-growing domestic listed REITs market still remains small relative to the size of the national economy. The distortion is caused by the lack of regular asset revaluation, which fails to reflect the actual value of real estate. The approval process is also identified as a growth bottleneck.

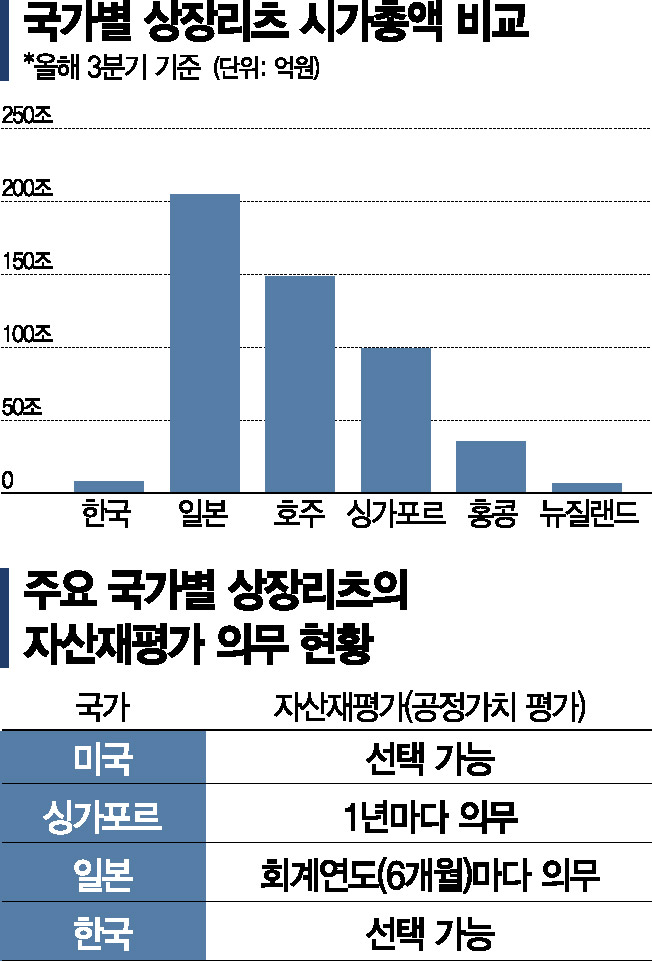

According to the financial investment industry on the 24th, the combined market capitalization of Korean listed REITs is 0.4% of GDP (Gross Domestic Product), which is still minimal compared to advanced overseas countries (Japan 2.9%, the U.S. 6.7%, Canada 3.3%).

REITs (Real Estate Investment Trusts) were introduced in Korea in July 2001. This year marks their twentieth anniversary. Recently, for the first time since the introduction of REITs, the number of REITs surpassed 300 and total assets exceeded 70 trillion won, but listed REITs remain relatively modest compared to advanced overseas countries. The average market capitalization of REITs in advanced countries ranges from 1.4 trillion to 3.7 trillion won, but in Korea, most newly listed REITs within the last three years have an average below 500 billion won.

This is due to the absence of regular asset revaluation, which fails to reflect the actual value of real estate, causing a discount in stock prices (asset value) compared to global REITs. The main reason is that although revaluation gains are unrealized profits without cash flow, under the Corporate Tax Act, asset revaluation gains of listed REITs are considered distributable profits and must be paid out as dividends. Listed REITs are classified as investment companies under the Corporate Tax Act, and if they do not distribute at least 90% of distributable profits, they lose the corporate tax reduction benefits. In other words, to receive corporate tax benefits, when revaluation gains occur without cash inflow, they must pay dividends even if it requires borrowing.

Lee Kyung-ja, a researcher at Samsung Securities, said, "Generally, listed REITs pay out 90% of distributable profits by executing excess depreciation dividends (considering non-cash depreciation as distributable profits). Conversely, it is reasonable to deduct unrealized profits without cash inflow from distributable profits." She pointed out, "For this reason, most listed REITs find it difficult to conduct asset revaluation, causing distortion where book asset values remain recorded at acquisition cost, making financial indicators appear inferior compared to overseas REITs."

Currently, major countries such as Japan and Singapore mandate regular asset revaluation for listed REITs, but cases of distributing unrealized profits are rare. Japanese REITs conduct asset revaluation every six months and disclose unrealized profits in footnotes to assist investors' judgment on REITs, distributing disposal gains as dividends only upon asset disposal.

To exclude revaluation gains from distributable profits requires lengthy and heavy procedures such as amendments to the Corporate Tax Act. Since this is practically difficult, Japan's method emerges as a reasonable alternative. The proposal is to mandate asset revaluation for listed REITs and encourage regular footnote disclosure of revaluation gains to provide investors with accurate asset values. Lee Kyung-ja of Samsung Securities emphasized, "While promoting the mandatory regular asset revaluation of listed REITs, it is worth considering measures to reduce appraisal costs," adding, "An environment should be established in various ways to facilitate investors' valuation of listed REITs."

Improvement of the approval process is also required for the continuous growth of listed REITs. The prolonged approval time has become an obstacle to the competitiveness of listed REITs. Kim Hyun-wook, senior researcher at Shinhan Financial Investment, explained, "While real estate funds use a notification system when acquiring assets, REITs can decide on real estate purchases only after approval," adding, "As the approval period lengthens, REITs are facing some difficulties in securing competitive assets, so improving the approval process is urgent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)