Rapid Spread of Omicron Lowers Growth Forecasts in US and Europe for Next Year

'Concerns Over Slowing Growth' China Cuts Benchmark Interest Rate by 0.05%P

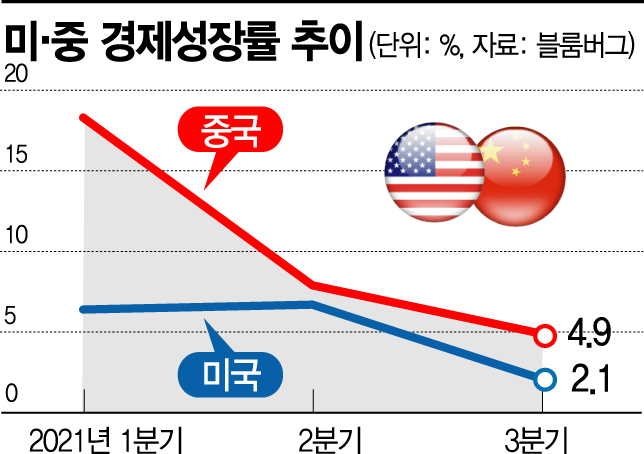

[Asia Economy New York=Correspondent Baek Jong-min] Concerns over inflation and the spread of the Omicron variant have emerged as red flags for global economic growth. As major central banks simultaneously adopt tightening measures to counter inflation, the rapid spread of Omicron is becoming a significant burden on the world economy. Worries that China's economic growth rate will sharply slow due to inflation and a downturn in the real estate market are also holding back the global economy. Meanwhile, the social infrastructure investment bill (BBB) promoted by U.S. President Joe Biden is facing the risk of collapse, raising concerns about a future contraction in green investments.

According to U.S. media on the 21st (local time), Goldman Sachs forecasted the U.S. real Gross Domestic Product (GDP) growth rates for 2022 at 2% for Q1, 3% for Q2, and 2.75% for Q3. These figures represent downward revisions of 1 percentage point, 0.5 percentage points, and 0.25 percentage points respectively from previous forecasts.

Economic growth forecasts are also being revised downward in Europe, where the Omicron variant is spreading rapidly. The Bank of France lowered its growth forecast for next year by 0.1 percentage points. Germany's central bank, the Bundesbank, also revised its growth forecast down by 1 percentage point to 4.2%.

China's situation has also become a burden on the global economy. The day before, the People's Bank of China unexpectedly cut the benchmark Loan Prime Rate (LPR) by 0.05 percentage points to 3.8%. The possibility of restricted economic growth in China is seen as triggering a global slowdown in growth.

The potential collapse of the BBB promoted by President Biden amid the Omicron situation is also negative. Concerns are growing over a slowdown in U.S. economic growth forecasts next year due to the failure of government stimulus measures. As the green policies included in the BBB face collapse, worries have increased that the Biden administration's plans to expand green investments will be derailed.

On this day, the New York stock market's S&P 500 index closed at 4568.02, plunging 1.14% compared to the previous trading day. The Dow and Nasdaq indices also fell sharply by 1.23% and 1.24%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)