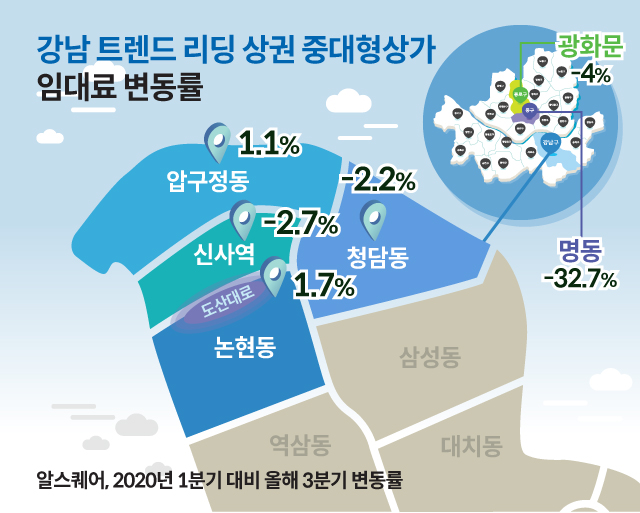

Rent for Medium to Large Commercial Spaces on Dosan-daero and Apgujeong Rises Over 1% Compared to Pre-COVID Levels

Contrasting Sharp Declines in Rents in Commercial Districts like Gwanghwamun and Myeongdong

"Rent Decline Mitigated by Continuous Store Openings of Trendsetting Brands"

[Asia Economy Reporter Kim Min-young] Despite the prolonged COVID-19 pandemic, rents in commercial districts located in Gangnam such as Dosan-daero, Apgujeong, and Cheongdam in Seoul have either increased or remained at levels similar to those before COVID-19. This contrasts sharply with the significant rent declines in traditional commercial areas like Myeongdong and Gwanghwamun. In Gangnam districts, tenant demand has been maintained as companies have continuously opened stores targeting the emerging consumer group, the MZ generation (Millennials + Generation Z, born 1981?2010).

On the 1st, RSquare, a total commercial real estate platform, surveyed rents and vacancy rates of medium to large and small commercial spaces in major Seoul commercial districts using data from the Korea Real Estate Board. The results showed that in the third quarter of this year, the rent for medium to large commercial spaces on Dosan-daero was 45,900 KRW per 1㎡, up 1.7% from the first quarter of 2020. Apgujeong also rose by 1.1% to 47,700 KRW, while Cheongdam and Sinsa saw only decreases in the 2% range, with rents at 57,900 KRW and 82,100 KRW respectively.

Rents for small-scale commercial spaces also increased despite the COVID-19 situation. During the same period, Apgujeong (42,000 KRW) rose 5%, Dosan-daero (45,800 KRW) increased by 3.2%, and Cheongdam (53,000 KRW) went up by 1%. The Korea Real Estate Board calculates rents based on the first floor, classifying spaces over 330㎡ in total floor area and above the third floor as medium to large commercial spaces, and those under 330㎡ and on the second floor or below as small-scale commercial spaces.

Vacancy rates in Gangnam commercial districts are also better than in other areas. In the third quarter, the vacancy rate for medium to large commercial spaces in Apgujeong was 7.4%, down 7.3 percentage points from the first quarter of 2020, and Dosan-daero also dropped by 0.8 percentage points to 10.9%. Although vacancy rates for small-scale commercial spaces in Dosan-daero and Apgujeong are relatively high at 14.7% and 17.1% respectively, many of these vacancies are due to store renovations or short-term vacancies following contract renewals, which may have caused the figures to appear somewhat elevated.

An RSquare official stated, "The reason why rents and vacancy rates in Gangnam’s trend-leading commercial districts were not severely impacted by COVID-19 is that consumer sentiment gradually revived with the easing of social distancing measures, concentrating on luxury goods and specific brands, which led to continuous store openings by companies."

On the other hand, rents in commercial spaces located in northern Seoul, such as Myeongdong, declined. The rent for medium to large commercial spaces in Myeongdong dropped sharply by 32.7% to 199,700 KRW per 1㎡, while Namdaemun (-7.9%), Gwanghwamun (-4%), and City Hall (-3.8%) also saw decreases. Small-scale commercial spaces showed similar trends. Myeongdong rents fell by 26.4%, and rents in Gwanghwamun (-5.8%), Euljiro (-2.7%), and City Hall (-1.4%) also declined.

Vacancy rates are also at critical levels. In Myeongdong, about half of all commercial spaces, regardless of size, are vacant, and in Gwanghwamun, vacancy rates for medium to large and small commercial spaces reached 23% and 19.3%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)