CATL Maintains 1st Place with 31.2% Market Share

LG Energy Solution at 23.8%... Slight Increase from Previous Year

5th SK Ino at 5.4%... 6th Samsung SDI at 4.6%

[Asia Economy Reporter Hwang Yoon-joo] As China's CATL continues to dominate the global electric vehicle market, the three major domestic battery companies are also maintaining their market shares, defending against the offensive from Chinese firms.

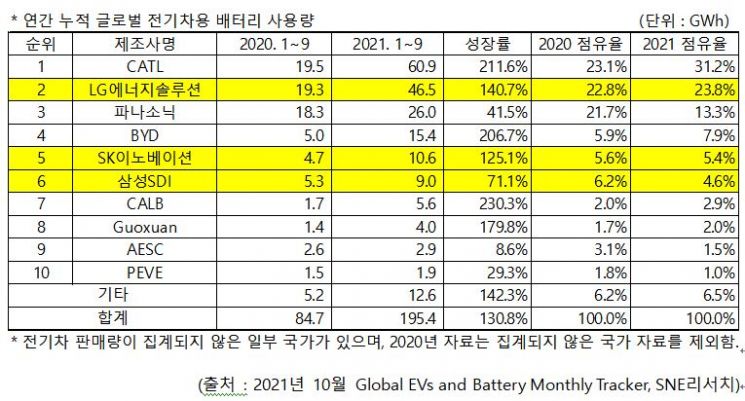

According to SNE Research on the 28th, the total battery energy capacity for electric vehicles from January to September this year reached 195.4 GWh, a 2.3-fold increase compared to the same period last year. The recovery in electric vehicle sales, which began in the third quarter of 2020, appears to be ongoing, and the upward trend is expected to continue at least until the end of the year.

By company, CATL ranked first with 60.9 GWh, nearly tripling compared to the same period last year. LG Energy Solution maintained its second place with 46.5 GWh, a 2.4-fold increase year-on-year. Panasonic showed the lowest growth among the top companies with 26 GWh, while BYD tripled to 15.4 GWh. SK Innovation increased by 125.1%, rising one rank compared to the same period last year. As of this year, it has firmly held the fifth position it has occupied since the first half. Samsung SDI recorded a 71.1% increase to 9.0 GWh but dropped two ranks to sixth place.

As of the cumulative market share in September, CATL led with 31.2%. This was followed by LG Energy Solution (23.8%), Panasonic (13.3%), BYD (7.9%), SK Innovation (5.4%), Samsung SDI (4.6%), and CALB (2.9%).

A significant number of Chinese companies registered vehicles worldwide led the battery market growth, spearheaded by the two major firms CATL and BYD. Chinese companies including CATL, BYD, and CALB all recorded growth rates in the 200% range compared to the same period last year.

Japanese companies such as Panasonic showed growth rates far below the market average, resulting in a decline in most of their market shares. The three domestic companies showed mixed trends in growth rates compared to the market average, but overall their market shares slightly declined.

The growth of the three domestic companies was driven by increased sales of models equipped with their batteries. LG Energy Solution experienced rapid growth mainly due to strong sales of Tesla Model Y (China-made), Volkswagen ID.4, and Ford Mustang Mach-E. SK Innovation's surge was fueled by increased sales of Hyundai Ioniq 5, Kia Niro EV, and Mercedes-Benz GLE PHEV. Samsung SDI showed growth supported by increased sales of Fiat 500, Audi E-tron EV, and Jeep Wrangler PHEV, but the sharp decline in Volkswagen e-Golf sales significantly offset the overall growth.

Meanwhile, global electric vehicle battery usage in September 2021 reached 32.9 GWh, a 94.0% increase compared to the same month last year. The electric vehicle battery market has shown a continuous increase for 15 consecutive months, recovering from the impact of the COVID-19 pandemic. Major markets including China, the United States, and Europe all experienced growth, with many Chinese companies leading the overall market expansion by company.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)