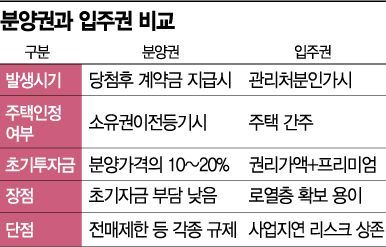

[Asia Economy Reporter Ryu Taemin] Both move-in rights and pre-sale rights serve as guarantees to move into a new apartment. However, since there are differences in registration status, initial investment costs, and taxation between move-in rights and pre-sale rights, it is important to understand these differences accurately.

Move-in rights are the rights granted to members of reconstruction or redevelopment project associations to move into new homes. In redevelopment projects, owning either land or a house qualifies one as an association member and secures move-in rights, but in reconstruction projects, one must own both the land and the building to be granted move-in rights. Move-in rights are finalized once the management disposition approval is completed.

On the other hand, pre-sale rights are rights obtained by winning an apartment subscription lottery. Apart from the quota allocated to association members, the remaining units are sold through contracts between the general public and the project developer. However, holding pre-sale rights does not immediately confer ownership of the property. Only after paying the intermediate and final payments and completing the ownership transfer registration does it become a fully owned home.

Both move-in rights and pre-sale rights are counted as housing units. Pre-sale rights acquired before January 1 of this year are not included in the housing count, but those acquired afterward are included, which changes the tax imposition criteria. For example, if a person owns one house and also holds pre-sale rights, they are considered a one-household two-home owner and are subject to higher tax rates.

Generally, the general sale price is set higher than the association member sale price. This is because all costs arising from project delays or surging project expenses must be borne by the association members. If the general sale fails and unsold units remain, the risk of additional charges falls on the association members, so they receive proportionally greater benefits.

However, there is a difference in initial investment costs between pre-sale rights and move-in rights. Pre-sale rights require paying a deposit of 10-20% of the sale price, making the initial cost relatively low. In contrast, move-in rights granted to association members are priced based on the evaluation value of the existing building plus settlement payments, resulting in relatively higher initial investment costs.

Since pre-sale rights and move-in rights are essentially ‘rights,’ caution is necessary when purchasing them. Because these rights pertain to homes not yet completed, there is always a risk of sudden project delays. In the case of move-in rights, since the project process is still ongoing, additional charges may arise, and when paying the intermediate and final payments for pre-sale rights, these amounts should be considered as part of the purchase price.

Resale restrictions must also be noted. For pre-sale rights, there are complexes where legal trading restrictions apply from at least six months after the winner announcement until the move-in date. Trading during the resale restriction period can invalidate the contract, so it is essential to check carefully in advance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)