As of August, 21,216 cases of third-party repayment in their 20s

Already 21.6% higher than last year's total repayments

20s account for 30%... highest among all age groups

Assemblyman Min Hyung-bae says, "We need to consider ways to reduce third-party repayment"

Experts also advise, "Reduce borrower burden"

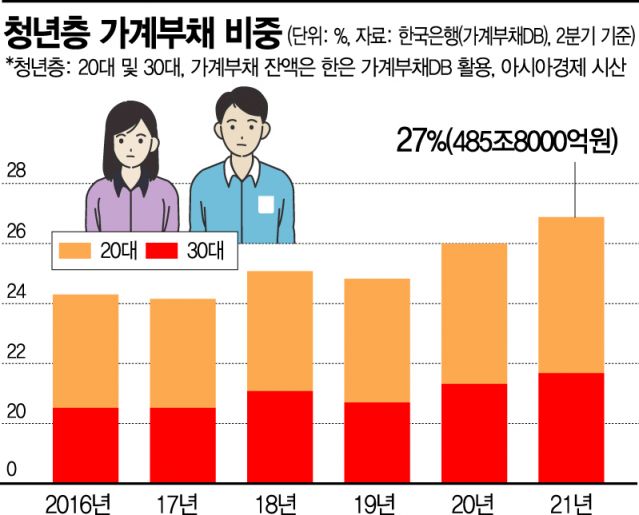

[Asia Economy Reporter Song Seung-seop] As the debt scale of the youth rapidly increases, negative repercussions are being observed one after another. The number of people in their 20s who have defaulted on even relatively low-interest policy financial loans and required state subrogation payments has significantly increased. This is interpreted as meaning that many young people are burdened by accumulated debt and are unable to find a breakthrough. Since the insolvency of the younger generation can seriously hinder future growth engines, there is an urgent need for proactive and aggressive countermeasures.

According to data submitted by Min Hyung-bae, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, received from the Korea Inclusive Finance Agency as of August, the number of subrogation payments for policy guarantee products (Worker’s Sunshine Loan, Sunshine Loan Youth, Sunshine Loan 15, Sunshine Loan 17) among people in their 20s reached 21,216 cases.

Subrogation payment refers to the act of a third party (Korea Inclusive Finance Agency) repaying the debt on behalf of the borrower. It usually occurs when the principal and interest are overdue or when undergoing credit recovery (workout), personal rehabilitation, or personal bankruptcy procedures. When subrogation payment is implemented, the Korea Inclusive Finance Agency may register credit management information or take measures such as securing claims, litigation, or compulsory execution. Unlike rehabilitation procedures that reduce debt if certain conditions are met, subrogation payment requires the agency to use its own funds.

The number of subrogation payments among people in their 20s is increasing faster than other age groups. Considering that the number of subrogation payments for people in their 20s was 17,436 cases in the past year, it has already surged by 21.6%. This contrasts with other age groups that have not yet reached last year’s numbers. Considering COVID-19 and the economic situation, subrogation payments among people in their 20s are expected to increase further.

Aftermath of Debt Investment and All-In Investment: "Measures Needed to Reduce Youth Debt Burden"

The proportion of the total cases (70,646) is also 30%, the highest among all age groups. This is the first year that people in their 20s have accounted for the largest number of subrogation payments. Last year, the largest share by generation was the 30s at 31.0%, followed by the 40s at 24.4%. People in their 20s were third at 24.1%. It had generally maintained a stable level since 22.5% in 2016 but sharply increased this year.

The main reasons why subrogation payments have sharply increased only among people in their 20s are soaring housing prices and consequent debt investment (borrowing to invest) and all-in investment (investing by gathering all resources, even to the soul). Since it has become impossible to buy a home with labor income alone, the younger generation is said to have recklessly taken out loans to build assets.

Assemblyman Min Hyung-bae pointed out, “A high number of subrogation payments means there are many financially vulnerable people without repayment ability,” adding, “It is important to prevent people in their 20s from reaching subrogation payment situations through customized counseling or debt adjustment.” He also mentioned, “We need to examine the reasons for default among people in their 20s and consider measures to reduce subrogation payments such as lowering interest rates, reducing principal, and extending repayment periods.”

Experts also advised that policy efforts are needed to reduce the debt burden on the youth. Since it is difficult to repay loans in a short period, they argue that activating low-interest refinancing loans and extending the principal installment repayment period are necessary.

Professor Seo Ji-yong of the Department of Business Administration at Sangmyung University said, “In a situation where the base interest rate hike is a foregone conclusion, refinancing loans should be activated to reduce borrowers’ burdens,” and advised, “Since refinancing loans do not increase the total loan volume, active policies such as providing incentives to the relevant institutions are necessary.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)