Unable to Pay Dollar Bond Interest Promised by 23rd

Bond Yields Surge 15 Times in 2 Months Amid Evergrande Default Risk

WSJ: "Chinese Authorities Instruct to Prepare for Evergrande Default Fallout"

Speculation That Government Will Not Let Evergrande Bankruptcy Go Unchecked

[Asia Economy Reporter Kim Suhwan] Evergrande (恒大·Ebeogeulande), China’s second-largest real estate developer, which is on the brink of bankruptcy due to a debt pile worth around 350 trillion won, reportedly failed to properly pay the interest on its dollar bonds scheduled for the 23rd.

On the 24th, CNBC reported that Evergrande appeared to have failed to pay interest to investors holding its issued dollar bonds.

Evergrande was supposed to pay bondholders $83.5 million (approximately 99.3 billion won) in dollar bond interest and 232 million yuan (approximately 42.5 billion won) in yuan bond interest on the 23rd.

Amid concerns of default, Evergrande announced on the 22nd that it had "resolved" the issue of paying 232 million yuan in yuan bond interest.

Evergrande Hits 546% Bond Yield Amid Liquidity Crisis

However, U.S. media reported that Evergrande had not made any announcements regarding the payment of interest on its dollar bonds even by the morning when Asian stock markets opened.

As a result, investors holding Evergrande’s dollar bonds reportedly fell into a state of near "panic" over fears of default, CNBC reported.

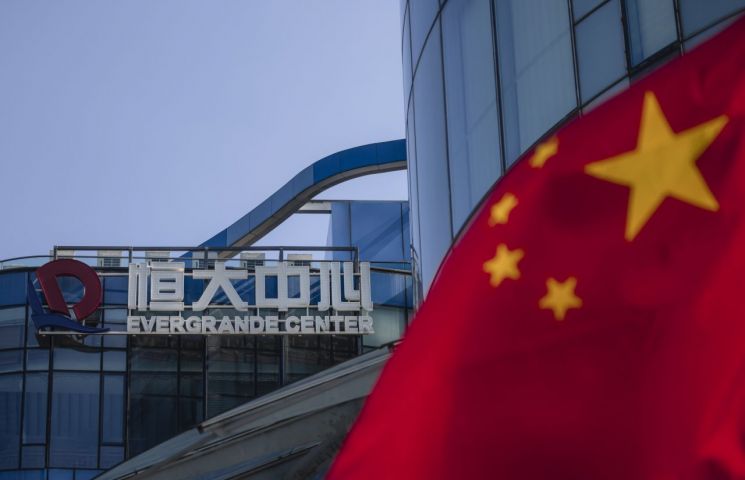

On the 13th, investors demanding Evergrande's bond interest payments gathered and protested at Evergrande's headquarters in Shenzhen, China. [Image source=Reuters Yonhap News]

On the 13th, investors demanding Evergrande's bond interest payments gathered and protested at Evergrande's headquarters in Shenzhen, China. [Image source=Reuters Yonhap News]

A portfolio manager told CNBC, "None of my clients have received interest payments."

As the possibility of Evergrande’s default has been raised, bond yields have soared. Typically, bond yields move inversely to bond prices.

According to market research firm Refinitiv, Evergrande’s 5-year bond yield hit 546% on this day, a 15-fold increase in two months since July 16 (36%).

30 Days Until Interest Payment Deadline... "Dollar Bond Market Will Be Hit First in Case of Default"

However, according to the dollar bond contract, interest payments can be made within 30 days from the scheduled date, so there is still time before an official default declaration.

Market observers point out that Evergrande has failed to resolve its fundamental liquidity crisis and is stalling for time during the remaining 30 days until the interest payment deadline.

In addition, Evergrande must pay $45 million (approximately 53 billion won) in interest on dollar bonds maturing in 2024 by the 29th.

CNBC reported, "Some analysts expect Evergrande to try to pay interest to yuan bond investors first," adding, "If the Evergrande default situation actually occurs, investors holding dollar bonds will be the first to suffer losses."

China Orders Preparations for Aftershocks from Evergrande Default

If debt restructuring led by Chinese authorities does not proceed, Evergrande may eventually declare default and enter bankruptcy proceedings.

On the same day, The Wall Street Journal (WSJ) reported, "Chinese authorities have asked local governments to prepare for the possibility of Evergrande’s default and the resulting 'aftershocks,'" calling it a sign that the government is reluctant to restructure Evergrande’s debt.

WSJ further reported, "Local governments and state-owned enterprises have been instructed to intervene only at the last minute if Evergrande fails to handle matters in an orderly manner."

China’s state-run Global Times also conveyed a message through expert comments that "too big to fail" is not necessarily impossible.

However, some market observers speculate that authorities are considering separating Evergrande’s core real estate business and turning it into a state-owned enterprise to control socio-economic fallout.

Oner Yuan, head of Asia emerging market bonds at Goldman Sachs, told major foreign media, "They (Chinese authorities) do not want an immediate default," adding, "Since there is a 30-day grace period, they may try to make a deal within the next 30 days."

There is also speculation that the Chinese government, recognizing the importance of the dollar bond market, will not allow a situation where interest payments on dollar bonds are left unpaid.

Hao Hong, director at Bank of Communications (BOCOM), said, "The U.S. dollar bond market has low interest rates, making it easier to attract funds," adding, "The dollar bond market is essential for Chinese companies. Ultimately, (Evergrande) will repay all the interest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)