Wall Street Expects $15 Billion Monthly Reduction... "Faster Than Expected"

Fed Officials Favor Rate Hikes Amid Inflation Concerns

Rate Hike Timing May Delay Following President Biden's Fed Appointments

[Asia Economy New York=Correspondent Baek Jong-min] The statement released by the U.S. Federal Reserve (Fed) after the Federal Open Market Committee (FOMC) regular meeting on the 22nd (local time) showed a clear view on tapering (asset purchase reduction) within this year. The phrase "over the coming months," which was included in the previous statement, has also disappeared. This is analyzed as a change signaling that tapering is imminent.

◇ Possibility of interest rate hikes with a time lag after tapering completion = Chairman Powell's remark that there is a consensus to complete tapering by mid-next year attracted particular attention. Wall Street investment banks (IBs) interpreted this as a forecast of reducing asset purchases by $15 billion per month.

This is considered a faster pace than initially expected. There is also a prospect that tapering could be announced and implemented simultaneously in November. In this case, tapering would be completed in about eight months. This contrasts with the Fed's tapering process from 2013 to 2014, which took 10 months. Regarding this, Chairman Powell added, "The current U.S. economy is much better than in 2013."

Completing tapering early is also linked to the timing of interest rate hikes. Once tapering is completed, a foundation is established to proceed with interest rate hikes with a slight time lag to mitigate market shocks. The issue of raising the government debt ceiling, which is currently stalled in the U.S. Congress, is considered a variable in the tapering decision.

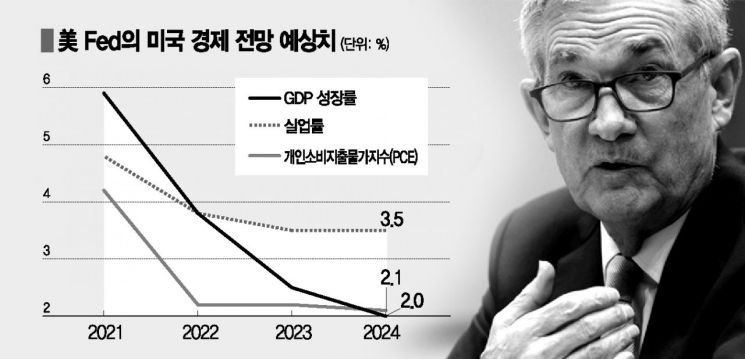

The variable in the path from tapering to interest rate hikes is inflation. The Fed revised its economic outlook on this day, lowering the U.S. economic growth rate for this year while raising the inflation rate and unemployment rate. It diagnosed that the economic flow is more negative than expected in the first half due to the spread of the Delta variant and global supply chain bottlenecks.

◇ Inflation outlook also raised = Especially notable is the Fed's change in perception of rising inflation. The Fed and Chairman Powell have claimed that inflation is temporary, but in this outlook, they presented the core Personal Consumption Expenditures (PCE) price index forecast for this year at 3.7%.

This is 0.7 percentage points higher than the 3% presented in June, rising within three months. The Fed revised this year's economic growth forecast from 7.0% to 5.9%, and the unemployment rate from 4.5% to 4.8%, recognizing increased uncertainty in the economy.

Professor Son Seong-won of Loyola Marymount University said that the Fed is lowering its economic growth outlook and is concerned about inflation, forecasting that "the future of the employment-focused monetary policy created by Chairman Powell depends on inflation and interest rate changes."

Chairman Powell again blocked attempts to link tapering and interest rate hikes this time. He emphasized, "Tapering is not a direct signal for interest rate hikes." Chairman Powell maintains the position that the dot plot is not directly linked to interest rate hikes and that the criteria for interest rate hikes are much stricter than for tapering.

Rich Tuazon, portfolio manager at Capital Group, mentioned, "The Fed is still dovish on interest rates." He interpreted that tapering is proceeding as the market expected, which led to a rise in the New York stock market and a decline in Treasury yields on this day.

It is also pointed out that an important variable remains regarding the timing of the Fed's interest rate hikes. The direction of monetary policy could change depending on next year's changes in FOMC voting rights of Fed members, Chairman Powell's reappointment, Vice Chairman Randal Quarles' resignation, and appointments to currently vacant Fed board seats.

Bank of America predicted, "If President Joe Biden appoints even more dovish members to the Fed board than currently, there could be changes in the dot plot." It is expected that President Biden has the potential to change the direction of interest rate hikes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)