[Asia Economy Reporter Joesulgina] "We watch online video services (OTT) instead of paid broadcasting."

The domestic IPTV industry has started to "catch up with OTT." As the OTT market, including Netflix, rapidly expands, the "Cord-Never" phenomenon, where mainly young people do not watch existing paid broadcasting platforms, has become full-fledged.

They are building tablet IPTV services that can be used anytime and anywhere like OTT, while also investing in original content. The strategy is to evolve from a simple "hundreds of channels + VOD replay" service into a media platform that provides everything from short-form content to customer participation content.

◇"Catch OTT" IPTV Industry Busy

According to the related industry on the 6th, the recent moves of the three domestic IPTV companies KT, SK Broadband, and LG Uplus are similar to the main strategies of OTT.

First, the tablet IPTV, which these three companies have promoted as a new growth engine this year, is representative. They increased accessibility through tablet PCs so that users can use the service anytime and anywhere like OTT, breaking away from the limitations of existing IPTV fixed in the living room or bedroom. Following LG Uplus, KT and SK Broadband also launched ‘Olleh tv Tab (May)’ and ‘Btv Air (July)’ this year, establishing a competitive service structure among the three domestic IPTV companies.

They have also actively invested in original content like OTT. SK Broadband plans to provide new variety shows as original content every quarter starting this year. After introducing 'Zombie Detective,' Btv's first original content last year, they announced a cooperation plan with entertainment company SM C&C, which includes Kang Ho-dong and Shin Dong-yup, earlier this year. The company is also releasing live musical performances as original content on IPTV this year.

Short-form content targeting the MZ generation (Millennials + Generation Z) and customer participation content aimed at stay-at-home demand are also notable. This production method has been used by YouTube and OTT, considering the characteristics of the MZ generation. SK Broadband has introduced a 10-minute program called ‘Short Pick’ in collaboration with famous domestic YouTubers this year. LG Uplus provides short-form Q&A content produced by Seoul National University Hospital professors and fitness experts through its recently launched IPTV-exclusive home training service ‘U+HomeTrainNow.’ It plans to evolve into a platform where customers can directly participate and communicate, such as sharing personal exercise tips and real-time interactive classes.

◇"20 Million Subscribers May Leave"

This move is interpreted as an attempt by the IPTV service, which has been in operation for 13 years, to present the ‘next level’ beyond simply providing hundreds of channels and VOD replay as before.

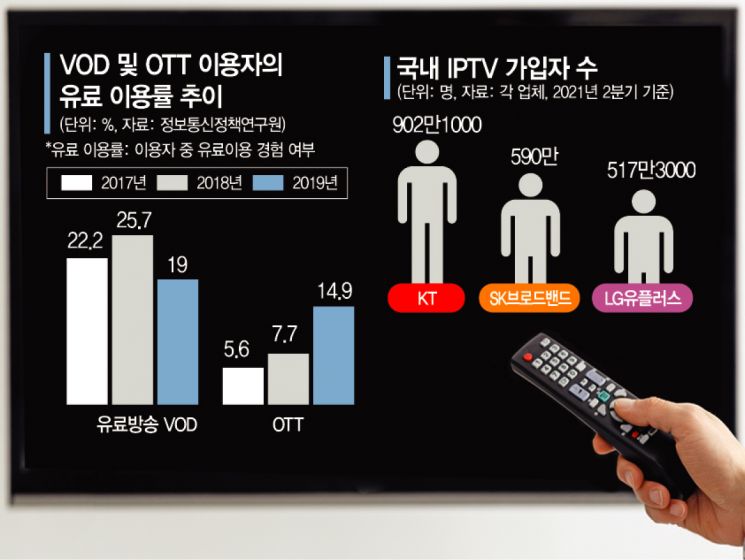

Looking at the media performance of the three telecommunications companies, growth centered on IPTV is still clear. As of the second quarter of this year, the number of IPTV subscribers for each company reached 9.021 million for KT, 5.9 million for SK Broadband, and 5.173 million for LG Uplus.

However, inside and outside the industry, there is a diagnosis that the global trends of cord-cutting (cancellation of paid broadcasting) and cord-shaving (switching to cheaper paid broadcasting subscription products) are becoming full-fledged in domestic IPTV as well. In particular, it is evaluated that the cord-never phenomenon, where young new households and single-person households do not subscribe to existing paid broadcasting platforms, is appearing.

An industry official said, "Domestic IPTV, which has a low average revenue per user (ARPU), is in a cord-shaving state rather than cord-cutting," adding, "In addition, young people are showing cord-never by choosing smart TVs and OTT." If this continues, IPTV will inevitably be pushed aside by OTT soon, just like cable TV, which is clearly declining in subscribers.

There is also an analysis that as OTT paid subscribers increase, VOD sales provided by paid broadcasting are already decreasing. According to a recent survey on broadcasting media usage behavior by the Korea Information Society Development Institute (KISDI), OTT usage rate soared from 36.1% in 2017 to 52% in 2019. Paid usage rate rose sharply from 5.6% to 14.9%. On the other hand, the paid usage rate of paid broadcasting VOD dropped from 25.7% in 2018 to 19% in 2019.

Meanwhile, LG Uplus and KT are in the final stages of negotiations to partner with OTT Disney Plus (Disney+), which is scheduled to launch its service in Korea in November. In the industry, the partnership between LG Uplus and Disney+ is considered a foregone conclusion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)