Seoul Auction's Auction Sales from January to August This Year

Grew to 2.5 Times Last Year's Level

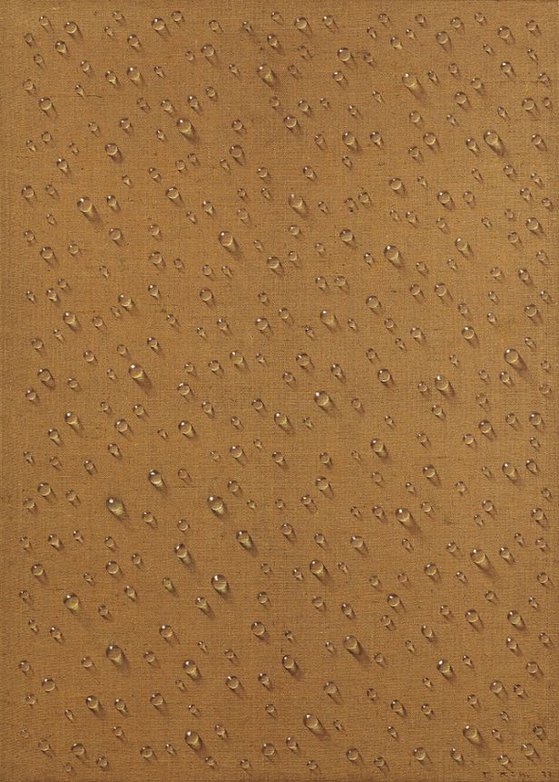

This February, Kim Chang-yeol's 1977 Work 'Water Drops'

Sold for 1.04 Billion KRW

MZ Generation Leading the Art Market Boom with New Investment Methods

Expecting Profits as Price per Piece and Market Value Rise

Annual Returns of 6-8% Possible When Leasing to Galleries

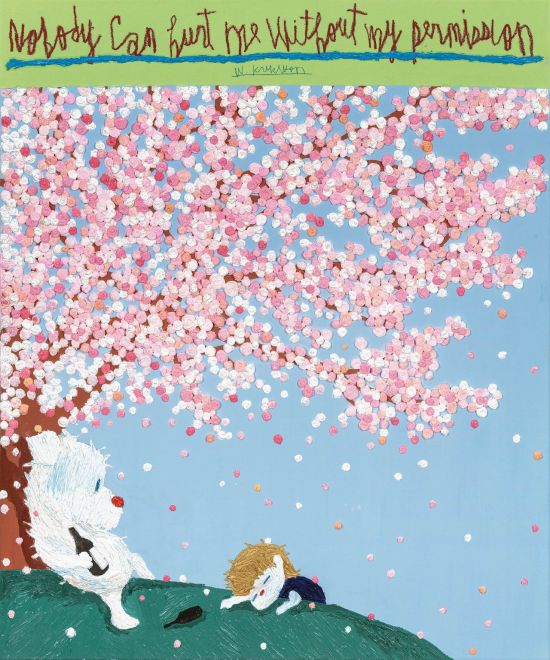

Ukookwon's 'Attitude'. At last month's K Auction major auction, it started at 5 million won and was sold for 95 million won, 19 times the starting price.

Ukookwon's 'Attitude'. At last month's K Auction major auction, it started at 5 million won and was sold for 95 million won, 19 times the starting price.

[Asia Economy Reporter Donghyun Choi] Office worker Park Junseok (42, pseudonym) purchased a work by an emerging artist for 5 million won through an art auction last year. Recently, he received a proposal from a gallery representative he met at a social gathering. The offer was to lend the artwork and guarantee a monthly rental income of 0.6% of twice the purchase price for two years. He was also promised that after the contract period, the artwork would be sold under favorable conditions. Park accepted the offer, gaining both short-term capital gains and an annual return of 7.2%.

The domestic art market is rapidly growing as a new investment destination following stocks, real estate, and cryptocurrencies. Especially among the MZ generation (Millennials + Generation Z), who are familiar with digital, IT technology, and platforms, an Art+Tech craze is expanding the base of the art market.

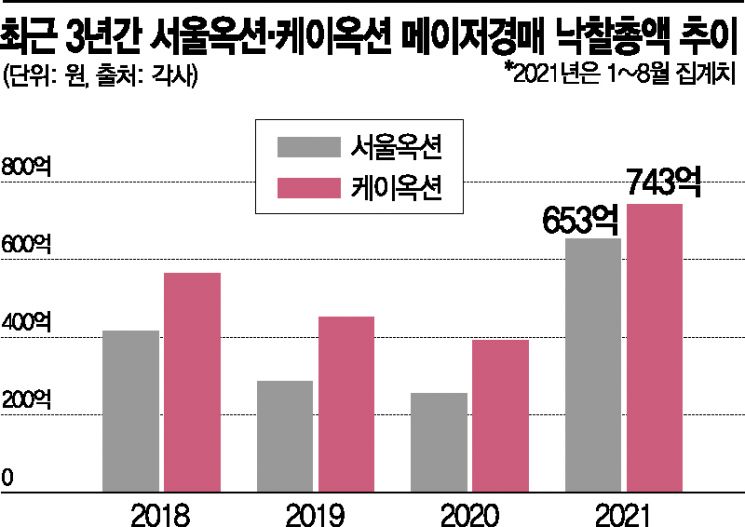

According to the art auction industry on the 1st, K Auction recorded a total major auction sales amount of 74.3 billion won from January to August this year. This is nearly double last year's total sales amount of 39.3 billion won. Compared to the annual results of the past three years, such as 56.6 billion won in 2018 and 45.2 billion won in 2019, this is the highest level. K Auction's major auctions were originally held every two months, but thanks to this year's exceptional boom, they have been held monthly since April. A K Auction official said, "Compared to the booming art market in 2005-2006, this year is the best performance ever," adding, "It is likely that the annual total sales will surpass 100 billion won for the first time by the end of the year."

Seoul Auction also recorded total sales of 65.3 billion won in major auctions held every two months from January to August this year. This is 2.5 times last year's sales amount of 25.7 billion won. Seoul Auction held auctions in Hong Kong and other places in 2018 and 2019 before the spread of COVID-19, but since last year, auctions have been held only in Seoul and other domestic regions. Nevertheless, auction results have exceeded previous years' levels.

The most notable artists in this year's art market are Lee Ufan, Kim Whanki, and Kim Changyeol. Especially early this year, the works of the late "Water Drop Painter" Kim Changyeol, who passed away in January, gained great popularity. In Seoul Auction's January to August auctions, 111 works by Kim Changyeol were sold, ranking first among all domestic and international artists. In a February Seoul Auction auction, Kim Changyeol's 1977 work "Water Drop" was sold for 1.04 billion won, setting a new record for the highest price for a domestic artist. Recently, works by young artists such as Woo Gukwon, Moon Hyungtae, and Kim Sunwoo have gained high popularity.

Industry insiders unanimously agree that the driving force behind this year's art market boom is the MZ generation. Their approach to art is more investment-oriented than aesthetic. They treat art as a financial asset like stocks or real estate. Sometimes, if they expect the value of blue-chip artists to rise, they pay deposits without even seeing the artwork. A representative from a domestic gallery said, "Works by famous celebrities with strong fandoms or artists frequently exposed in the media are bought without questions or hesitation," adding, "In the past, it was simply for collection, but recently, many aim for short-term capital gains."

Kim Chang-yeol's 1977 work 'Water Droplet'. It was sold for 1.04 billion KRW at the Seoul Auction Major Auction last February.

Kim Chang-yeol's 1977 work 'Water Droplet'. It was sold for 1.04 billion KRW at the Seoul Auction Major Auction last February.

How do people make money from art? There are two ways: capital gains and rental income. For paintings, the base price is set according to the price per "ho" (artwork number) determined by the Korea Fine Arts Association. This is similar to an official land price in real estate. The higher the artist's name value and the larger the painting, the more expensive it is. Based on this, premiums are added to form market prices. If the price per "ho" or market price rises, one can expect corresponding gains. In the domestic art market, emerging artists' prices per "ho" range from 70,000 to 100,000 won, while professors' works range from 300,000 to 1 million won. The price per "ho" for famous domestic artists like Kim Whanki and Lee Ufan exceeds tens of millions of won.

Rental income is earned by lending artworks to galleries. In the past, this market was a closed structure mainly for the wealthy, but recently, general public access has become easier through applications. Anyone can register their personal information and rent out artworks. Compared to the 1% level interest rates of commercial bank deposits, rental income is relatively high at 6-8% annually. Occasionally, if the gallery borrowing the artwork uses it for advertisements or exhibitions, additional income can be earned. A representative from the art rental industry explained, "The problem with art investment in the past was unstable prices and low liquidity," adding, "But nowadays, with frequent ownership changes through funding, equity investment, and online auctions, risks have decreased."

Experts expect the art market to continue its boom for the time being. However, there may be variables linked to domestic and international interest rate hikes. Son Icheon, director of K Auction, said, "The art market is greatly influenced by global economic trends and interest rate levels," adding, "I expect the current level to be maintained this year, but changes may occur depending on how the market reacts to domestic base rate hikes or the speed of US tapering (asset purchase reduction)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)