Many in the 2030 Generation Suffered from the Merge Point Scandal

The Background is the 'Jjantech' Craze Popular Among 2030s

Minimizing Daily Expenses by Collecting Discount Coupons, Coupons, and Gifticons

Large Payments Due to Merge Point's Shocking Up to 20% Discount Coupons

Experts Say "There is No Free Lunch in This World... Consumers Should Also Be Careful"

On the afternoon of the 13th, subscribers demanding refunds gathered at the Merge Point headquarters located in Yeongdeungpo-gu, Seoul. / Photo by Yonhap News

On the afternoon of the 13th, subscribers demanding refunds gathered at the Merge Point headquarters located in Yeongdeungpo-gu, Seoul. / Photo by Yonhap News

[Asia Economy Reporter Lim Juhyung] "I made a big decision to live frugally and paid, but now I’m about to lose hundreds of thousands of won," "What if I can’t get a refund like this?"

The background of the 'Merge Point' mobile payment platform incident, which attracted attention with bold discount events but suddenly reduced services and triggered a refund chaos, involved so-called 'Jjantech.' Jjantech is a compound word of 'Jjandoli' (stingy person) and 'Jaetech' (financial technology), referring to a lifestyle that minimizes everyday expenses to save up a lump sum needed for savings and investment. Recently, among the 2030 generation struggling with hardships caused by the COVID-19 pandemic, Jjantech has become a hot topic.

Merge Point, which offered a shocking condition of up to 20% discount, attracted the attention of the 2030 Jjantech crowd, but as the company suddenly stopped selling points and drastically reduced usage locations, consumers’ anxiety is growing. This is why criticism arises that it left deep wounds in the hearts of young people who tried to overcome the recession by saving even small amounts of money.

◆Sudden reduction of usage locations... Merge Point refund chaos

The controversial Merge Point is a point payment platform. When you purchase Merge Points with cash, you can use the points to buy products at large marts, convenience stores, cafes, etc., partnered with the company. At this time, they launched an event giving up to 20% prepaid discount coupons, attracting consumers’ attention.

Merge Point became especially popular on social networking services (SNS) and online communities. Some consumers exchanged tens of thousands of won or more into Merge Points to receive discount coupons and attempted bulk purchases. At one point, the Merge Point app reportedly had 1 million cumulative users and issued points totaling 100 billion won.

Some consumers reportedly paid tens of thousands of won in lump sums aiming for Merzi Point discount benefits. / Photo by Yonhap News

Some consumers reportedly paid tens of thousands of won in lump sums aiming for Merzi Point discount benefits. / Photo by Yonhap News

However, on the 11th, Merge Plus, the operator of Merge Point, posted a notice that it would temporarily reduce the number of places where points could be used, sparking controversy. As the number of companies accepting points sharply decreased, consumers fearing damage began demanding refunds en masse.

The refund process started on the 13th. Some customers reportedly received refunds up to 90% of the payment amount, but there are also claims that deposits have not yet been made, increasing consumers’ anxiety.

◆2030 generation trying 'Jjantech' ends up losing money

Among the victims of the Merge Point refund incident, there are quite a few young people in their 20s and 30s. They expressed frustration, saying they tried to do 'Jjantech' with Merge Point discount coupons but ended up losing money.

A man in his 20s, A, who has experience using the Merge Point service, said, "I only used it once, but some friends around me paid tens of thousands of won," adding, "Even if we get a refund, it’s only 90%, so we’re going to lose several tens of thousands of won. Everyone made a big decision to save even small amounts, but now we’re losing money, so how unfair is that?"

On online communities and SNS, netizens who paid large sums for Merge Point continued to vent. A netizen who identified herself as a housewife said, "I paid over 2 million won trying to save on living expenses, but I still haven’t received a refund. I’m worried it might end up worthless like toilet paper," expressing anxiety.

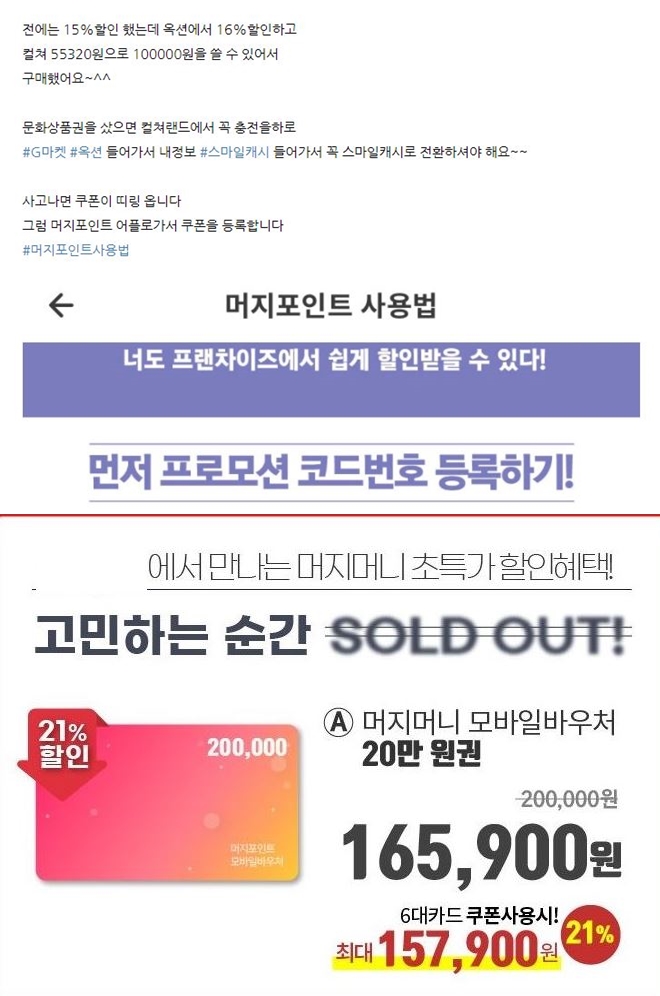

A detailed blog post explaining how to use Merge Point (above) and the Merge Point mobile discount coupon promotion / Photo by Blog, Internet homepage capture

A detailed blog post explaining how to use Merge Point (above) and the Merge Point mobile discount coupon promotion / Photo by Blog, Internet homepage capture

Jjantech people, who try to minimize everyday expenses such as meals or coffee, are very interested in collecting discount events or coupons. They download coupons distributed by platform companies for promotional purposes or leave lengthy review posts on blogs to reduce restaurant and food prices. On online communities popular among the 2030 generation, posts sharing information about new gifticons or discount events are easy to find.

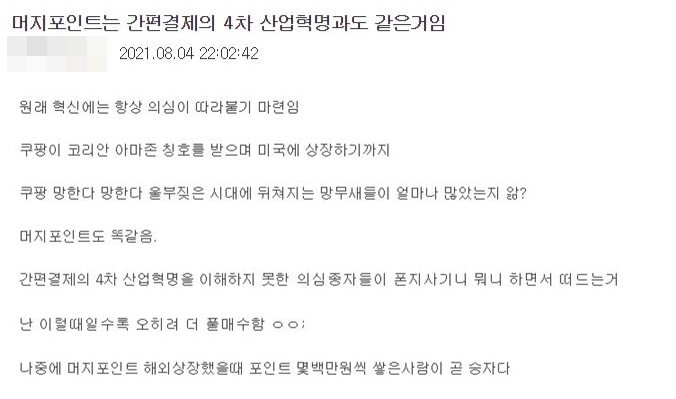

One netizen praised Merge Point as "the 4th Industrial Revolution of simple payment." / Photo by Internet Community Capture

One netizen praised Merge Point as "the 4th Industrial Revolution of simple payment." / Photo by Internet Community Capture

The 20% discount coupon of Merge Point was also a marketing tool targeting such Jjantech people. Until recently, blog posts explaining in detail how to obtain Merge Point discount coupons were popular on the internet. Some netizens called Merge Point 'Apptech (app + financial technology)' and praised it as a "revolution in easy payment."

According to a 'Jjantech' interest survey conducted by market research firm Embrain Trend Monitor in May on 1,000 office workers nationwide, people in their 30s showed the highest interest at 74.2%, followed by those in their 20s at 56.8%. The most commonly used Jjantech methods were 'receiving reward points (77.9%)', 'actively using coupons, gifticons, and other vouchers (65.5%)', and 'accumulating points through attendance checks and events (60.8%)'.

The reason young people became interested in Jjantech was anxiety about the future. Among respondents, 76.3% answered, "I want to live frugally from now on for a stable life in the future."

In other words, young people who chose 'frugal purchasing' to endure the recession ended up wasting money.

◆Expert: "As financial digitalization increases new services... Authorities must properly supervise"

An expert pointed out that although the financial industry is becoming digitalized, regulatory authorities are failing to keep up with changes, resulting in increasing cases of consumer damage.

Professor Kim Taegi of Dankook University’s Department of Economics said, "Merge Point can be seen as a new concept digital financial service using a mobile app," adding, "Such services are increasing, but the Financial Supervisory Service is not properly performing its supervisory role, causing greater consumer damage."

However, Professor Kim also urged consumers using new financial services to be cautious. He emphasized, "You must remember that nothing in this world is free," and said, "Merge Point attracted attention by offering very shocking discount benefits from the consumer’s perspective, but if there is a financial service with too good conditions, consumers should develop a skeptical mindset rather than using it blindly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)