Due to the impact of the COVID-19 pandemic, consumption through online channels is increasing. The number of customers using delivery services and the frequency of use per customer have risen, and as contactless culture spreads, the social commerce market has also grown. The middle-aged and older generation, who had relatively avoided online consumption compared to the MZ generation (Millennials + Generation Z), are now embracing the convenience of online shopping.

According to Hana Financial Management Research Institute, the scale of Hana Card payments made online last year increased by 45% compared to 2019. The proportion of those aged 40 and above in online credit and check card payments was 51%, up 4 percentage points from 47% the previous year. On online shopping malls such as Coupang, Gmarket, and 11st, the payment amount growth rate of middle-aged customers aged 40 and above was higher than that of younger customers under 30. The share of simple payment amounts among those aged 50 and above increased from 11% in 2019 to 17% in 2020.

The spread of consumption culture through online channels has led to the growth of electronic payment gateway (PG) companies that handle payment services online. Fintech companies providing payment platforms are also expected to have many growth opportunities. Asia Economy takes a closer look at the business structure and growth strategies of PG company NHN Korea Cyber Payment and fintech company SettleBank to gauge their future growth potential.

[Asia Economy Reporter Park Hyungsoo] As social commerce, home shopping, and delivery service markets grow, the sales of NHN Korea Cyber Payment, the No. 1 electronic payment gateway (PG) company in Korea, are also increasing. Last year, due to the COVID-19 impact, the time spent at home increased, leading to a rise in online orders and naturally expanding payment volumes. NHN Korea Cyber Payment has been steadily growing by increasing not only domestic but also overseas merchants.

NHN Korea Cyber Payment operates online payment business, offline payment business, and online-offline linked (O2O) business. The online payment business is divided into PG business and online card payment network (VAN) business.

The PG business connects financial transactions between payment providers such as credit card companies, banks, and electronic money, and merchants such as internet shopping malls and game companies through various payment methods online. It receives payment amounts from payment providers and pays merchants while collecting a certain fee. The VAN business is a communication service that intermediates transaction approvals and additional information between credit card companies and merchants using a dedicated network. It provides online VAN services for e-commerce payments on online shopping malls. The online VAN business transmits credit card information and payment information generated from online shopping mall customers to credit card companies through a secure network. NHN Korea Cyber Payment is estimated to hold about 50% of the entire online VAN market.

When a customer pays by credit card at an online shopping mall, the PG company receives a commission of about 2% of the payment amount from the merchant. The 2% fee includes credit card fees, PG fees, hosting fees, and others. The PG company takes about 0.2~0.5% as its commission. The online VAN fee is about 25~30 KRW per transaction.

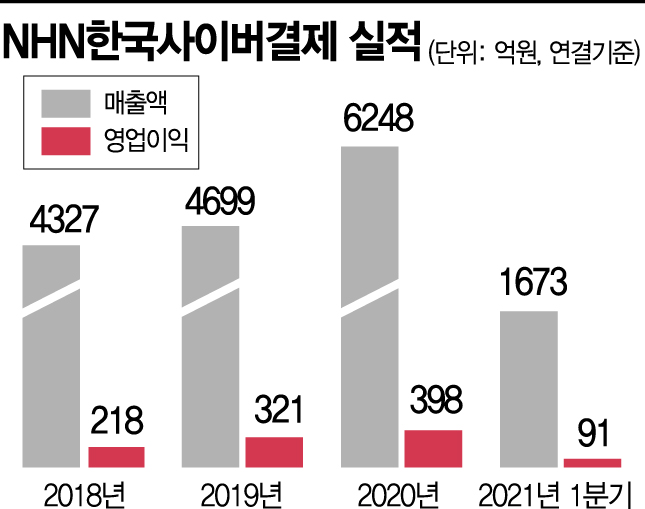

With the explosive growth of the mobile payment market based on simple payments, the usage rate of electronic payment services in Korea has steadily increased. As contactless payments become more active, the PG market and online VAN market are growing together. Online transactions largely consist of transactions through online shopping malls. Recently, as the digital content market including webtoons and web novels has expanded, NHN Korea Cyber Payment has maintained stable growth. Last year, it achieved revenue of 624.8 billion KRW, operating profit of 39.8 billion KRW, and net profit of 29.9 billion KRW. Compared to the previous year, sales increased by 33%, operating profit by about 24%, and net profit by about 22%.

Transactions with overseas merchants amounted to 2.5 trillion KRW, accounting for 9% of total transaction volume. This year, overseas merchant transaction volume is expected to increase to 4.7 trillion KRW, raising the share to 15%. NHN Korea Cyber Payment formed a strategic partnership with Cybersource, the world's No. 1 PG company, in 2012, and in 2018, agreed to cooperate with Adyen, the No. 2 PG company. Through these strategic partnerships, it provides payment systems necessary for domestic merchants to expand overseas and for foreign companies to enter the domestic market. In August 2019, Apple App Store selected NHN Korea Cyber Payment as a PG company, allowing payments from domestic card companies. In October last year, it signed a contract to provide payment services with Google Play. In 2019, the domestic market size of Google Play Market and Apple App Store was 6 trillion KRW and 2.3 trillion KRW, respectively. The commission rate for overseas merchants is higher than that for domestic clients. When building payment systems for overseas merchants, it is necessary to link with the overseas headquarters' settlement system. Because it requires high technical skills and security levels, performance with large overseas merchants is important. As the sales proportion of overseas merchants increases, profit margin improvement can also be expected. With higher vaccination rates, recovery in travel and airline demand is also anticipated. If transaction volumes from travel and airline merchants such as Hotels.com and Expedia increase, NHN Korea Cyber Payment's sales will also rise.

NHN Korea Cyber Payment also operates O2O services utilizing existing business resources. The mobile smart order payment business is conducted jointly with NHN Payco under the service brand "Payco Order." As of the end of Q1 this year, it has contracted with about 71,000 merchants. The business targets franchises aiming to increase profitability through various methods such as establishing unmanned stores, small stores focused on takeout in office districts, and operating their own delivery channels. By linking with point-of-sale (POS) systems, it provides one-stop customized services for merchants, enhancing convenience.

Aside from NHN Korea Cyber Payment's external growth, the trend toward large-scale online platforms may act as a factor deteriorating profitability. As mergers and acquisitions (M&A) increase in the fashion, electronics, and social commerce markets, concentration toward some large companies is occurring. The higher the sales contribution from large merchants with relatively low commission rates, the worse the profitability becomes. In Q1 this year, sales increased by 17.7%, and operating profit rose by 14.3%.

As of the end of March, NHN Korea Cyber Payment's debt ratio was 142.6%. This reflects total borrowings of 15 billion KRW and accounts payable and other liabilities of 203.3 billion KRW. It holds cash and cash equivalents of 187.2 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)