Authorities Tackle Household Loans, Banks Focus on Reducing Maru Tong

52,812 Accounts Opened in June...Stronger Regulations Expected in Second Half

[Asia Economy Reporter Kwangho Lee] Last month, the number of newly opened bank overdraft accounts (known as "matong") dropped by half compared to the beginning of the year. This is because financial authorities have strengthened household loan management, leading commercial banks to tighten overdraft accounts, which are more likely to be used as a means of raising funds for stock and real estate investments rather than for actual demand funds. Banks that have already halved the maximum overdraft limit and raised interest rates are expected to impose even stricter restrictions in the second half of the year, making it more difficult to obtain overdraft accounts.

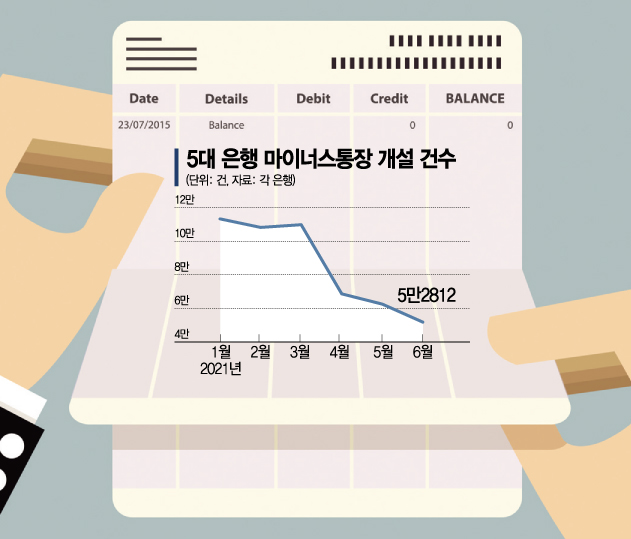

According to the financial sector on the 5th, the number of overdraft accounts opened in June at the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?was 52,812, a sharp decrease of 53.4% compared to January (113,363). It also fell 15.5% compared to the previous month (62,571).

By bank, KB Kookmin Bank saw a noticeable decline in overdraft account openings. Compared to the previous month, KB Kookmin Bank decreased by 21.9%, while Shinhan Bank and Woori Bank also shrank by 16.5% and 6.3%, respectively.

This trend is due to financial authorities focusing on managing overdraft loans. At the beginning of this year, financial authorities instructed banks to keep the household loan growth rate at around 5%. Next year, they plan to lower it to the pre-COVID-19 level of around 4%.

A financial authority official said, "We have set the monthly increase in unsecured loans at around 2 trillion won and are focusing on managing the total volume of unsecured loans across the banking sector. Overdraft accounts are being closely monitored because they are more likely to be used as a means of raising funds for stock and real estate investments rather than for actual demand funds."

Heads of financial authorities have also repeatedly called for management of household loans. On the 1st, Eun Sung-soo, Chairman of the Financial Services Commission, met with bank presidents and requested, "Please minimize the handling of unnecessary household loans." On the following day, June 2nd, Kim Geun-ik, Acting Governor of the Financial Supervisory Service, visited financial institutions' business sites and said, "Household loans, which surged since the second half of last year, have stabilized. Please manage them thoroughly to prepare for future changes in the financial situation."

Accordingly, banks have actively reduced limits and raised interest rates on overdraft accounts, which are an effective tool for controlling growth rates.

Shinhan Bank has been reducing the overdraft limit by up to 20% when extending overdraft accounts with limits exceeding 30 million won if the usage rate is below 10% three months before maturity since May. In February, it lowered the maximum overdraft limit for convenient credit loans for office workers and public officials from 100 million won to 50 million won. It also requires head office review if the debt service ratio (DSR) exceeds 40%.

Woori Bank also reduced the maximum overdraft limit for major unsecured loans such as Woori Main Transaction Office Worker Loan to 50 million won. Since April, if less than 10% of an overdraft account exceeding 20 million won is used, the limit is reduced by 10% upon extension or renewal. If less than 5% is used, the limit is reduced by 20%.

KB Kookmin Bank reduced the limit by 20% for overdraft accounts exceeding 20 million won in the second half of last year if the average loan limit utilization rate three months before maturity was 10% or less. Hana Bank notified customers that for its non-face-to-face credit loan product, Hana OneQ Credit Loan, the overdraft limit can be reduced by up to 50% if the usage performance is low.

A bank official said, "Due to the financial authorities' total volume management of household loans, it will be difficult to obtain unsecured loans, including overdraft accounts, throughout this year. We plan to closely monitor the household loan growth trend and continuously review additional measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)