Chinese games are gradually encroaching on the Korean game market. This is a complete reversal from the past when Korean games dominated the Chinese market.

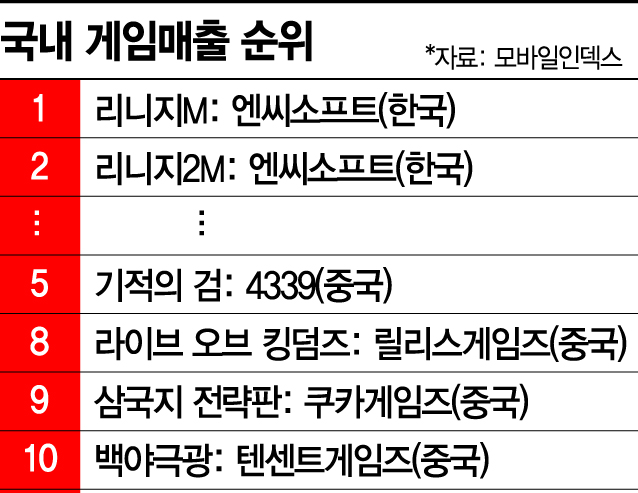

According to Mobile Index by data analytics company IGAWorks on the 5th, Chinese games accounted for 35% (7 titles) of the top 20 domestic mobile game revenue rankings in the third week of last month. Chinese game company 4399's "Miracle Sword" ranked 5th, Lilith Games' "Rise of Kingdoms" ranked 8th, and Kuka Games' "Three Kingdoms Strategy Edition" ranked 9th, occupying top positions.

Chinese games, once criticized as knockoffs of Korean games, have intensified their offensive backed by financial power. Voices from the Korean game industry say, "Unlike in the past, Chinese game companies have technologically advanced, increasing the threat." According to the "2020 China Game Industry" report, last year China's overseas game revenue reached about 17.5 trillion KRW. Among this, Korea ranked 3rd (8.8%) in China's total overseas revenue, estimated to have earned about 1.5 trillion KRW from the Korean game market.

While China is encroaching on the market like this, Korean games have not been able to properly target the Chinese market due to the "Chinese government risk." China has maintained the Hallyu ban policy in response to the deployment of the Terminal High Altitude Area Defense (THAAD) system. Although Pearl Abyss's "Black Desert Mobile" received a game service license (panho) on the 29th of last month, since March 2017, China has issued only three panhos for Korean games. Previously, domestic indie game "Rooms: The Unsolvable Puzzle" and Com2uS's "Summoners War: Sky Arena" received panhos.

Nexon's Dungeon & Fighter (DNF) Mobile has had its Chinese service delayed for nearly a year. DNF is Nexon's representative PC online game released in 2005. It was especially popular in China, generating annual revenue of about 1 trillion KRW. However, with the release delayed for nearly a year, speculation arises that it is not simply a system issue. Notably, DNF has already been granted a panho. An industry insider said, "There are rumors that the Chinese government is trying to curb DNF, which has about 60 million pre-registrations."

Because of this, there are complaints of "reverse discrimination" in the Korean game industry. A game industry official lamented, "Chinese game companies are rapidly encroaching on the Korean market, but the path to export to China remains unclear," adding, "It is also unfair that the entire game industry is criticized whenever Chinese game companies' poor management becomes controversial."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)