[Asia Economy Reporter Park Ji-hwan] Hanwha Investment & Securities emphasized on the 3rd that attention should be paid to Samsung Engineering's overseas order market recovery movement and its enriched order pipeline.

Song Yu-rim, a researcher at Hanwha Investment & Securities, stated, "Samsung Engineering's consolidated sales for the second quarter are estimated at 1.8 trillion KRW, a 6.0% increase compared to the same period last year, and operating profit is estimated at 105 billion KRW, a 22.4% increase. This figure is 6.1% higher than the market consensus operating profit of 99 billion KRW."

Researcher Song explained, "It is understood that the sales growth in the petrochemical sector, which appeared from the fourth quarter of last year, continued due to the sales contribution of the large project Dos Bocas in Mexico (3.2 trillion KRW). In the first quarter, there was a sales disruption in the non-petrochemical sector due to delays in settlement of affiliate projects, but this is expected to be reflected in the sales increase in the second quarter."

Researcher Song analyzed, "The recent stock price rise accompanied the increase in oil prices, but considering the order backlog increased compared to before COVID-19, the replenished order pipeline, and the upward revision of multiples of peer companies, it is hard to see it as very burdensome." He explained that even without reaching the rapid order growth period of 2018, additional multiple expansion is possible considering that it traded at a P/B ratio of 2.2 to 2.3 times just before COVID-19.

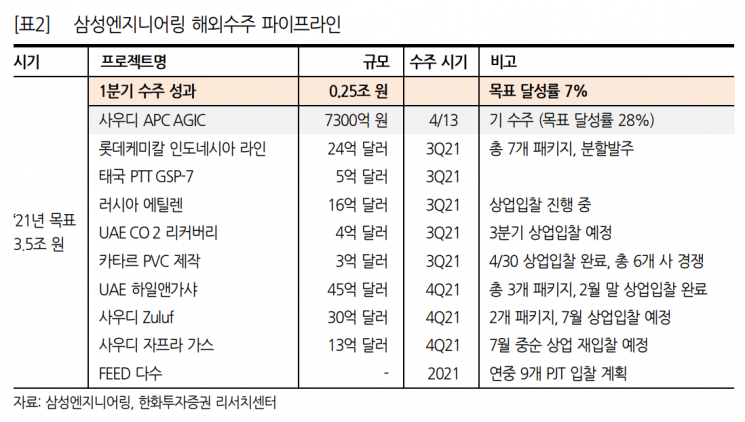

Researcher Song added, "Especially from the second half of the year, major project orders such as Lotte Chemical Indonesia line (2.4 billion USD), Saudi Zuluf (3 billion USD), Saudi Jafra (1.3 billion USD), and UAE Hail & Ghasha (4.5 billion USD) are scheduled, so attention should be paid to the results."

He emphasized, "Based on the rise in oil prices, not only domestic construction companies but also overseas competitors' stock prices have become sensitive to new order news. This is why the overseas order pipeline concentrated in the second half of the year draws more attention."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)