Territorial Battle Among Local Delivery Agencies... Severe 'Cutthroat Competition' Among Platforms

Thousands in Penalties for Switching Platforms... Proliferation of Unqualified Companies

Agencies with High Order Volumes Attracted with 'Loan' Premiums

[Asia Economy Reporter Kim Bo-kyung] As the COVID-19 pandemic has accelerated non-face-to-face transactions, the domestic delivery market is growing rapidly. The delivery agency industry has benefited from the increase in non-face-to-face and online transactions due to the COVID-19 situation. This can be felt just by looking at the number of motorcycles roaming the roads with delivery boxes attached. According to Statistics Korea, in the first quarter of this year, the transaction amount for food services ordered online through the internet and mobile platforms reached 5.9 trillion won, a 71.9% surge compared to the same period last year.

Corporate alliances and mergers for entering the delivery business are also becoming active. The delivery agency company ‘Barogo’ recently secured an investment of 80 billion won from 11st Street and CJ Group. Shinhan Bank signed a business agreement with Inseong Data, the parent company of Logiol which operates the delivery agency service ‘Saenggakdaero,’ and is investing 14 billion won in developing a food order delivery application. Kakao Mobility has recently started directly recruiting quick delivery riders, increasing the possibility of expanding its business to food delivery services. Baedal Minjok and Coupang Eats are fiercely competing in ‘single-order delivery,’ striving hard to attract the increasingly valuable delivery riders.

Riding the trend of fast delivery, services have expanded beyond food to include non-food items such as daily necessities, intensifying competition. When competition overheats, the market inevitably becomes chaotic. While consumers order food for safe and comfortable meals, companies are engaged in relentless battles to maintain dominance in the delivery market.

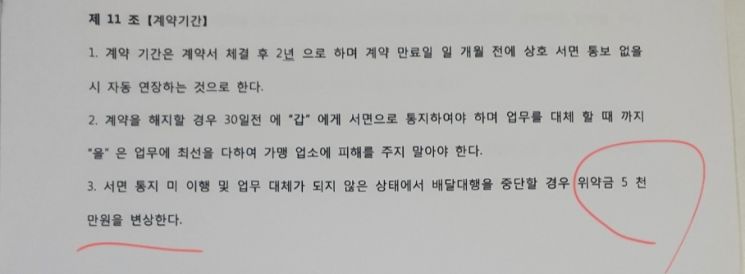

A delivery agency platform's contract with its branch. It states that if the delivery service is discontinued, a penalty of 50 million KRW must be compensated.

A delivery agency platform's contract with its branch. It states that if the delivery service is discontinued, a penalty of 50 million KRW must be compensated.

<1> Delivery Industry Plagued by Lawsuits and Penalties Worth Tens of Millions of Won

"Yesterday’s ally can become tomorrow’s enemy. That’s just how this industry is."

Park Nam-gyu (pseudonym), who ran a chicken restaurant before stepping into the delivery agency industry three years ago, is currently full of worries. This is because the delivery agency platform M company has demanded a penalty close to 100 million won from him. Park operates a local delivery agency in Gyeonggi Province using M company’s program. However, he recently terminated the contract and switched to another company, resulting in a large penalty fee. M company sent him a text message stating, "We have received information that you are switching to another company," and warned, "If the penalty is not paid, we will proceed with legal actions such as civil lawsuits."

A delivery agency platform refers to a company that develops and operates intermediary programs that assign food pickup and delivery tasks. When consumers order through applications like Baedal Minjok or Coupang Eats, restaurant owners use these programs to secure delivery riders and deliver food. The big three specializing in delivery agencies are ‘Saenggakdaero,’ ‘Barogo,’ and ‘Booroong.’ Nationwide, there are estimated to be about 40 delivery agency platforms of various sizes. These platform companies contract with over 2,000 local delivery agencies, each having offices in neighborhoods to manage delivery riders and support motorcycle lease costs.

Park has been visiting local restaurants one by one to persuade them to use his program and has even fulfilled orders that delivery riders refused. However, because he switched to another platform after only about a year, breaking the three-year contract period, he now faces a penalty. Park said, "I admit violating the contract was wrong, but the penalty amount beyond imagination is hard to accept." He also blamed M company for the switch, saying, "There were multiple server crashes during peak times like lunch hours, but the headquarters did not properly compensate for the damages." Park mentioned that due to program errors, he sometimes had to pay for food himself and even used KakaoTalk messenger as a temporary delivery method.

<2> Fierce Battle for Franchise Agencies, Billions in Loans and Kickbacks Exchanged

For platform companies, local delivery agencies are a stable source of income. Assuming a branch handling 1,000 orders a day is charged a commission of 50 won per order, that amounts to 50,000 won per day, 1.5 million won per month, and 18 million won per year. Because of this, platform companies inevitably engage in fierce battles to win over a single branch. Various tactics are used, including black propaganda, slander, and spreading defamatory information against competitors.

As competition intensifies, a loan system has emerged in the delivery agency industry. Large sums of money are lent to branch representatives to entice them to use a particular platform. The more orders processed daily and the more delivery riders a branch has, the higher its value, and thus the larger the loan amount. Sometimes, branches in downtown Seoul with high order volumes engage in ‘bloody competition’ by offering premiums to win over each other. An industry insider said, "Large corporations like Naver and distribution companies have high expectations for the future growth potential of delivery agencies and have made massive investments, further overheating the market."

It is unclear whether these loans go through proper accounting procedures or whether interest is properly charged and accounted for. Accounting data from a delivery agency platform obtained by this outlet showed no items that could be inferred as loans. An industry insider revealed, "Sometimes loans are given with untraceable funds, and interest is recovered by increasing commission fees."

<3> Franchise Owners Pocket Kickbacks While Switching Delivery Platforms

Where do the loans worth billions go? A local delivery agency representative said, "They are used for motorcycle lease fees and franchise promotion costs." The funds are spent on restaurant operations and management as well as recruiting delivery riders. However, there are known cases of abuse where loans are not repaid, platforms are switched, and new loans are taken again.

Branches that earn profits through per-order commissions sometimes collude on delivery fees, causing harm to self-employed restaurant owners. Kim Young-ik (pseudonym), a delivery agency representative, said, "Branches in the same neighborhood using different platforms agreed to simultaneously raise delivery fees from 3,200 won to 3,800 won to gain commission benefits." He added, "Restaurant owners complained about the sudden increase in delivery fees, but when branch managers said it was necessary to recruit delivery riders, there was nothing more they could do."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)