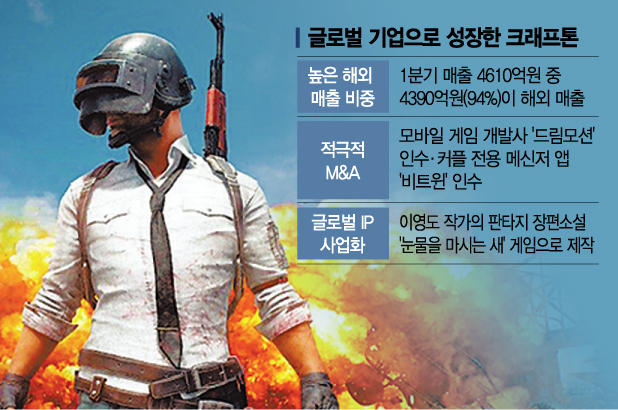

[Asia Economy Reporter Kang Nahum] Krafton, which is preparing for its IPO, has begun actively increasing its valuation by solidifying its position as a global company through aggressive mergers and acquisitions (M&A) and intellectual property (IP) development. Attention is focused on whether it will surpass the valuations of NCSoft and Netmarble, which are leading the gaming industry, upon its listing.

◆ Overseas sales account for 94%... Strengthening market penetration through M&A = According to industry sources on the 15th, Krafton is expanding its scope to establish itself as a global company. Since overseas markets have accounted for most of Krafton's performance so far, the strategy is interpreted as continuously creating growth engines in overseas markets. Krafton's revenue in the first quarter of this year was 461 billion KRW, of which overseas sales accounted for 439 billion KRW, or 94%.

The source of this revenue is Krafton's flagship IP, "Battlegrounds." Battlegrounds Mobile, now in its third year since its global launch, continues steady growth as the user base expands through content diversification and business model advancement. Domestic sales, where Krafton provides direct service, also increased by 13% compared to the same period last year, establishing itself as a popular game.

Krafton is also actively pursuing M&A to target the global market. Recently, it acquired the mobile game developer "Dream Motion." Dream Motion, established in July 2016, has developed and released three mobile games to the market. Among them, "Ronin: The Last Samurai," an action roguelike genre game released earlier this year, has gained great popularity in Korea, Japan, and other countries.

Once the acquisition process is complete, Dream Motion will become one of Krafton's independent studios. Krafton currently consists of independent studios such as PUBG Studio, Bluehole Studio, Rising Wings, and Striking Distance Studio. Krafton plans to further strengthen its global market penetration together with these independent studios.

Last month, Krafton also acquired the messenger app "Between." Between is a couple-exclusive messenger app developed by VCNC, a subsidiary of Socar, which recorded 1 million daily users and 26 million global downloads as of 2018. It is expected that research will be conducted to enhance the company's deep learning technology through data exchanged by Between users.

In addition, Krafton is steadily investing in technology and securing talent in deep learning and artificial intelligence (AI) fields, including collaboration with AI startup VoyagerX.

◆ Domestic creations also go overseas = Krafton has also started global IP commercialization of domestic creations. A representative example is the fantasy novel "The Bird That Drinks Tears" by author Lee Youngdo. Visual R&D work is underway to produce this novel into a game.

This work is being carried out jointly by Krafton's "Project Windless" team and Hollywood concept artist Ian McCaig. McCaig is a renowned concept artist who has participated in early character visualization for blockbuster films such as the Star Wars series, Harry Potter, Avengers, and Terminator. In particular, the IP of The Bird That Drinks Tears is planned to be introduced to the global market in various forms of secondary content production, including video content and publications, beyond just games.

Krafton's initial public offering (IPO) is also accelerating. The Korea Exchange approved Krafton's preliminary listing review on the 11th. The lead underwriter for the listing is Mirae Asset Securities, with joint underwriters including NH Investment & Securities, Credit Suisse, Citigroup Global Markets Securities, and JP Morgan. Krafton's over-the-counter market capitalization is approximately 24 trillion KRW, and securities firms predict that its corporate value could soar up to 30 trillion KRW after listing.

If this happens, it will surpass the market capitalization of NCSoft and Netmarble, which compete for the top position in the domestic gaming industry. This suggests a high possibility of a new structure reshaping the domestic gaming industry, which has long been dominated by the "3N" (NCSoft, Netmarble, Nexon). An industry insider said, "The 3N system is already shaking and the trend is shifting, as Krafton has surpassed Netmarble in operating profit. If Krafton secures funding along with its current capabilities, the industry landscape will change significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)