Major Retailers and Platforms Expand Customer Engagement with Real-Time, Interactive Broadcasting

Encouraging Participation of Mobile-Savvy MZ Generation... Market Size Expected to Reach 10 Trillion Won in 2023

Regulatory Blind Spots in Exaggerated and Misleading Advertising... Consumer Protection Measures Needed

[Asia Economy Reporter Jo In-kyung] Since the COVID-19 pandemic, the mobile shopping market has rapidly grown, with major retailers, e-commerce platforms, and delivery services all rushing to strengthen their live commerce businesses. Considering the rapid shift of shopping channels from offline to online and then to mobile, there is a sense of urgency that falling behind even once in the live commerce market, which is just entering its growth phase, could make it difficult to catch up again. As the number of participants explodes and the variety of products handled increases, voices calling for protective measures and related regulations to prevent consumer harm are also growing louder.

Content Over Shopping... Increase in Contactless Consumption Culture

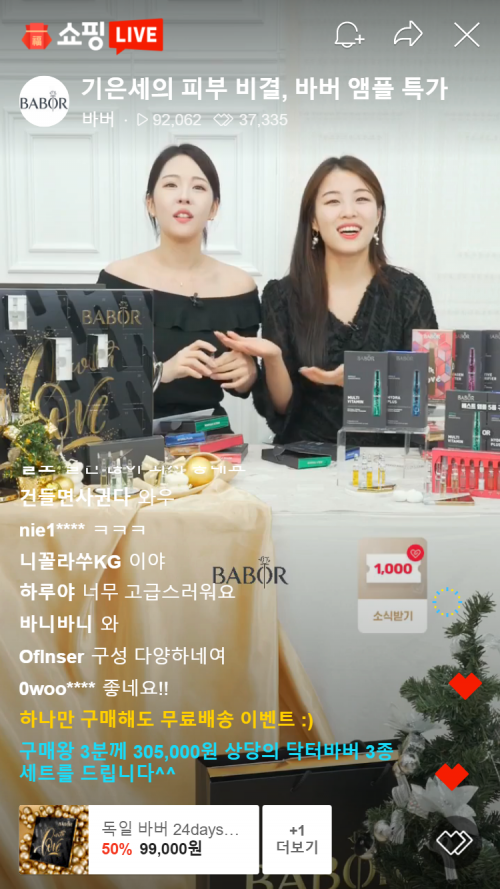

Live commerce is a method of introducing and selling products through real-time video streaming on smartphones. Similar to TV home shopping that sells products via live broadcasts, it is also called 'Labang' (live commerce broadcast). With contactless shopping becoming mainstream due to COVID-19, various products from fresh food to clothing, cosmetics, daily necessities, and electronic devices can now be sold and purchased through Labang.

First, major portal companies like Naver and Kakao are leading the live commerce market based on their large-scale platforms and infrastructure. Naver officially launched its business by rebranding the influencer marketing platform 'Selective' to 'Shopping Live' in July last year. By the end of March this year, Shopping Live had accumulated 170 million views.

Two months earlier, Kakao also officially started broadcasting under the name 'Kakao Shopping Live.' Its cumulative views have surpassed 30 million. Coupang, classified as an e-commerce company, launched 'Coupang Live' earlier this year. TMON also opened 'TMON Select' last year, allowing sellers to conduct live commerce in the form of personal broadcasts.

11st has been producing its own content under the name 'Live11' since last year and plans to expand and reorganize it from the second half of this year to allow general sellers to participate.

Retail Industry Betting on Labang to Not Miss 'Growth Opportunity'

Existing retailers have also rushed into the live commerce market. Lotte Department Store is diversifying content by promoting its own live broadcast channel '100LIVE' starting this year. They plan to add entertainment elements and emphasize experiences in content preferred by the MZ generation in their 20s and 30s to increase fun, and also expand the number of broadcasts by more than 40% compared to last year.

Emart opened a 105㎡ (about 32 pyeong) multi-purpose studio called 'Studio e' on the 6th floor of its headquarters in Seongsu-dong, Seoul, for live broadcasts. The studio is equipped with a system optimized for live broadcasting, including real-time insertion of images and text on the broadcast screen and a control room that allows communication with the presenter during filming. SSG.com's own live commerce, 'SSG Live,' is also filmed here.

Especially, the home shopping industry is more active in the live commerce business by leveraging its long broadcasting experience. Although the scale is still small compared to the existing home shopping market, considering the rapid shift of shopping channels from TV to mobile, they believe they cannot miss the live commerce market, which is just entering its growth phase.

CJ OnStyle, CJ O Shopping's new integrated brand, broadcasts mobile live commerce for 10 hours daily from Monday to Friday, totaling 50 hours per week. GS Home Shopping has revamped its mobile-only live commerce under the name 'Shoppy Live' and plans to increase broadcasts to more than four times daily. SK Stoa, a T-commerce company, started selling products through its own live commerce platform 'SK Stoa Shopping Live' from the 19th.

Following Food and Fashion, Dining Businesses Also Engage in 'Labang' Marketing

Consumer goods companies without their own platforms have also started selling through their own live broadcasts. Food and dining companies, as well as fashion, cosmetics, and luxury brands, are showcasing live commerce broadcasts through their websites, mobile apps, or other live commerce platforms.

Delivery app company Baedal Minjok launched 'Baemin Shopping Live' in March, promoting food live commerce. Products are introduced via video and can be ordered directly through the app. They also commercialize and sell popular traditional market rice cake shops or famous restaurants' signature menus as meal kits or ready-to-eat meals, which have become hot topics on social media.

Platforms that started as live commerce specialists, such as 'Grip' and 'Jam Live,' gather various sellers in one place and even feature celebrities and influencers to directly introduce and sell products to consumers.

The reason why not only retailers but also platform companies are rushing to expand live commerce is primarily due to the concentrated interest of consumers. The sales method, which introduces products through one-on-one communication mainly with the MZ generation familiar with the mobile environment and allows consumers to visually confirm products, is receiving great responses. Additionally, real-time chats with sellers encourage direct participation.

Accordingly, the securities industry expects the live commerce market, which was about 3 trillion won last year, to expand to 9 to 10 trillion won by 2023. There is also a forecast that the live commerce market could eventually replace existing TV home shopping in the long term.

Live Commerce in Regulatory Blind Spots

The problem is that live commerce is still a nascent platform, so there are no legal sanctions or consumer protection measures in place to regulate it. Although it is similar to home shopping in that products are introduced and sold via real-time video, unlike TV home shopping, it is free from regulations by the Korea Communications Standards Commission, prior review, and consumer protection obligations. Also, since it is not broadcast in the traditional sense, there are no burdens such as transmission fees or broadcasting development funds.

In particular, if there is a problem with a product, TV home shopping, as a 'telecommunication sales business operator,' is responsible for cancellations, refunds, and compensation. However, live commerce broadcasters, as 'telecommunication sales intermediaries,' do not bear such responsibilities. Earlier this year, the Korea Consumer Agency detected consumer damage caused by false or exaggerated advertising in live commerce broadcasts and pointed out that platform operators should strengthen management and supervision of sellers. However, there has been no discussion yet on establishing specific legal standards or sanctions.

Therefore, there are calls for the government, related ministries, or the industry itself to implement a certain level of regulation and self-purification efforts for the rapidly growing live commerce market.

A retail industry official said, "Many companies have already entered the live commerce business, attracting consumers with their differentiated content, but expertise in real-time broadcasting and management capabilities for sellers vary greatly. There is a need to promptly establish related regulations or legal standards to prevent consumer harm caused by indiscriminate advertising or competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.