Due to the COVID-19 pandemic, people who could not travel abroad are flocking to domestic travel destinations. Domestic campsites have become one of the popular travel spots, making reservations difficult. Not only department stores and large marts but also major online shopping malls are enthusiastically holding 'camping special events' to sell camping supplies. Famous domestic outdoor brands are also increasing the supply of camping products and conducting various events to improve their performance.Helinox, known as the pride of domestic outdoor brands, is one of the brands consistently loved among camping enthusiasts. Gamseong Corporation launched a clothing brand last year based on the Snow Peak license. Asia Economy takes a closer look at the business structure and management status of Helinox and Gamseong Corporation and gauges their future growth potential.

[Asia Economy Reporter Jang Hyowon] Helinox, a global brand called a luxury in the outdoor industry, is soaring. As the number of campers increased due to COVID-19, it has become so popular that it caused a 'sold-out frenzy.' Because so many customers are looking for the products, they sometimes sell items by lottery after receiving purchase applications. Despite raising prices due to the flood of orders, demand has hardly decreased. As a result, Helinox's sales have surged sixfold compared to seven years ago.

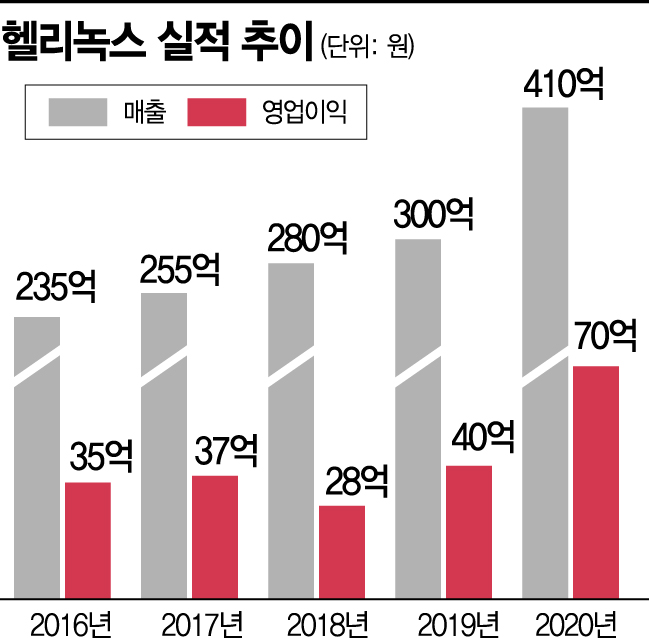

Sales Increased Sixfold, Operating Profit Up 11 Times in 7 Years

Helinox is an outdoor goods specialist company that sells camping furniture, tents, and more. It was launched as a brand by CEO Ra Jegun of Dong-A Aluminum (DAC) in 2011 and established as a corporation with capital of 50 million KRW in 2013. In 2015, CEO Ra resigned, and his son Ra Younghwan took over the company management.

Helinox's sales have grown annually by 7-9% since its inception, but last year, with the popularity of camping due to COVID-19, it showed rapid growth. Last year, Helinox's sales reached 41 billion KRW, a 26% increase from the previous year. Operating profit was 7 billion KRW, with a profit margin of 17% relative to sales. In 2014, sales and operating profit were only 6.2 billion KRW and 600 million KRW, respectively.

Helinox's main product is camping chairs, which account for about 70% of total sales. Helinox took a leap as a global outdoor brand by launching the ultra-lightweight camping chair 'Chair One' in early 2012. Chair One is made using high-strength ultra-light aluminum, weighing only 850g but capable of supporting up to 145kg.

Since then, Helinox has expanded its range by releasing various camping equipment such as tents, coats, and tables. It has also strengthened its design sector, winning the global design competition 'Red Dot Design Award' more than ten times. Additionally, it has built global recognition through collaborations with famous brands such as Nike, Supreme, Carhartt, and Porsche.

The core of Helinox products is Dong-A Aluminum's 'high-strength ultra-light aluminum.' Dong-A Aluminum developed aluminum that is lightweight yet strong and unbreakable through aluminum alloy R&D. Applying this to tent poles, Dong-A Aluminum holds the number one market share in the global tent pole market.

In fact, Helinox purchased products worth 14.6 billion KRW from Dong-A Aluminum last year. This accounts for 56.2% of the total cost of sales of 26 billion KRW. Helinox receives aluminum from Dong-A Aluminum and produces products through outsourced factories in Vietnam.

A Helinox official said, "Dong-A Aluminum's ultra-light high-strength aluminum takes nearly two months to manufacture, so even if product demand surges, it is difficult to produce items immediately," adding, "We also plan to invest in facilities to normalize supply in the future."

Preparing to Open Busan HCC... Restructuring Governance

With good performance and steady cash flow, Helinox's financial condition is sound. As of the end of last year, Helinox's debt ratio was 78.9%, which is stable. However, it rose somewhat from about 42% in 2019 due to an increase of approximately 17 billion KRW in long-term borrowings.

Helinox plans to use this borrowing to build a new headquarters in Incheon and open a sales store called Busan HCC (Helinox Creative Sensor). Although borrowings increased, the annual interest rate is low at 2.4-2.9%, and operating cash flow is about 8 billion KRW, so the burden is expected to be minimal.

The largest shareholder of Helinox is CEO Ra Younghwan, who holds 66.67% of the shares. Originally, CEO Ra held 100% of the shares, but his stake decreased after receiving a 30 billion KRW convertible preferred stock investment from the domestic private equity fund SkyLake Investment in 2019.

Helinox is also the second-largest shareholder of Dong-A Aluminum, holding 25.14% of shares, which is controlled by Ra Jegun, Ra Younghwan's father. Helinox, which was launched as a spin-off from Dong-A Aluminum, has come to control Dong-A Aluminum.

Dong-A Aluminum's shares were 72.86% owned by related parties including CEO Ra Jegun and Ra Younghwan, but as of the end of June 2019, Helinox purchased some of Ra Younghwan's shares for 9.2 billion KRW, becoming the second-largest shareholder.

At that time, Helinox sold a building located in Incheon to Dong-A Aluminum for 7 billion KRW and combined that money with cash on hand to buy Ra Younghwan's shares. CEO Ra thus maintained control over Dong-A Aluminum through Helinox while securing cash.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.