Nest did not obtain Airport Corporation approval for 46 billion won convertible bond issuance

Airport Corporation "Ignoring corrective measures, contract terminated due to Nest's fault"

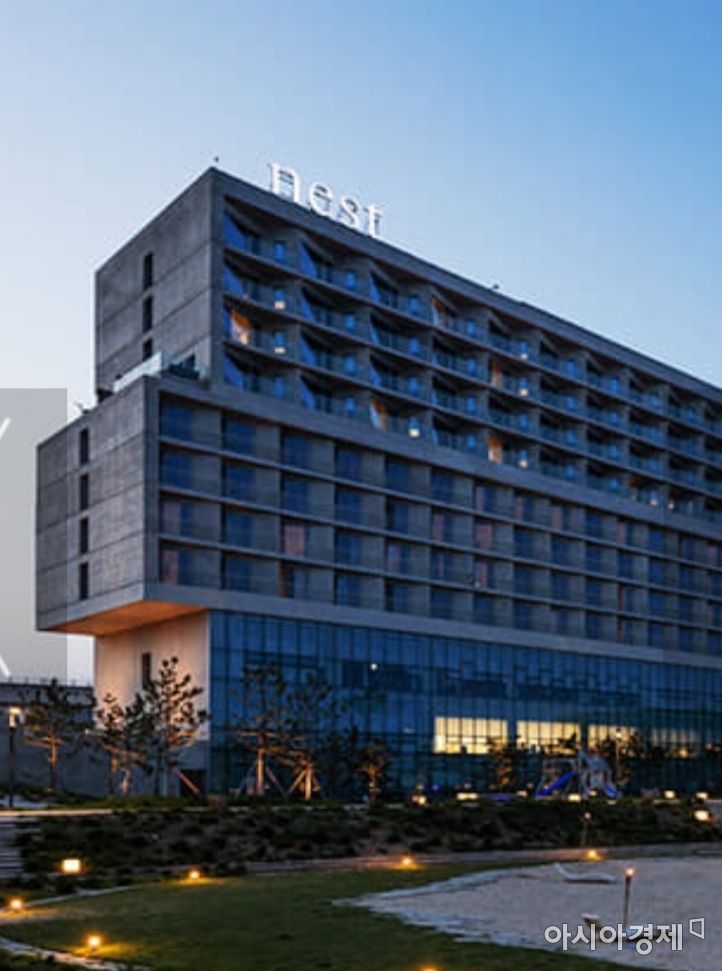

[Asia Economy Reporter Park Hyesook] Incheon International Airport Corporation has notified Nest Hotel, which operates 370 rooms on land leased from the corporation, of the termination of the 'Implementation Agreement.' This means the land must be restored to its original state, effectively forcing the hotel to close. The CEO of this hotel, Kim Youngjae, also serves as the CEO of Sky72 Golf Course, which is embroiled in controversy over 'illegal occupation.'

The airport corporation announced on the 13th that it had notified Nest Co., Ltd. of the early termination of the 'Incheon International Airport South Retention Basin Phase 2 Development Project Implementation Agreement,' signed in December 2011 for hotel development and operation.

The termination of the implementation agreement was due to Nest issuing convertible bonds (CB) worth 46 billion KRW twice in January and March last year without obtaining approval from Incheon International Airport Corporation.

The implementation agreement stipulates that if there is a change of 5% or more in shareholding, consultation or approval from the corporation is required. This is because a change of 5% or more in the shares of the project implementer or major investor constitutes a significant change related to the execution of the implementation agreement.

At that time, Nest Hotel's capital was 7 billion KRW, with the first-priority beneficiaries registered in the trust register being Korea Development Bank (maximum bond amount 44.29 billion KRW), Gwangju Bank (10.3 billion KRW), and Hana Bank (6 billion KRW).

However, the corporation stated that Nest issued convertible bonds amounting to 7.7 times its capital to investment purpose companies without any notification.

Upon confirming this fact in November last year, the corporation repeatedly demanded correction of the breach of the implementation agreement until the end of last month, but only received a general reply from Nest stating that 'no change in shareholding has occurred yet.'

Convertible bonds are bonds that can be converted into the issuing company's shares at the request of the holder after a certain period. Since there is no room for intervention by the issuer or third parties during this process, the airport corporation judges that once convertible bonds are issued, shareholding changes can occur regardless of the corporation's approval.

A corporation official said, "Nest failed to comply with the agreement regarding shareholding ratios despite multiple correction requests, which corresponds to Article 52 of the implementation agreement on 'early termination due to the project implementer's fault.'"

Accordingly, the corporation plans to proceed with related procedures following the termination, including restoring the Nest Hotel site to its original condition.

In principle, Nest must demolish the facilities at its own expense within six months, but the project implementer or creditors may select a new operator to take over and run the hotel. Even in such cases, approval from the airport corporation is required.

Nest Hotel has been operating since September 2014 on land owned by Incheon International Airport Corporation (19,011㎡) under a 50-year lease agreement until September 2064.

Meanwhile, a significant portion of the funds raised through the convertible bonds issued by Nest is known to have been used to acquire shares in Sky72 Golf Course. It is estimated that Nest's largest shareholder purchased 67.6% of the golf course's shares through convertible bonds and other means ahead of the termination of Sky72 Golf Course's implementation agreement at the end of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)