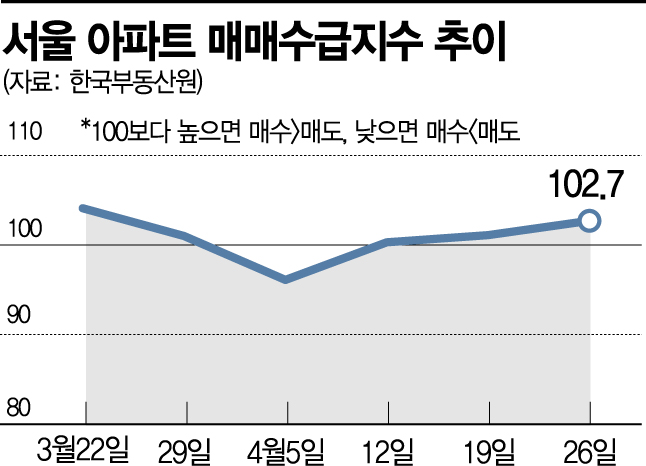

Surpassing the Baseline for 3 Consecutive Weeks

After the announcement of the 2·4 housing supply measures, which had caused a slowdown, the apartment buying sentiment in Seoul is stirring again due to expectations for reconstruction.

According to the Korea Real Estate Board on the 30th, the apartment sales and demand-supply index in Seoul this week (based on the survey on the 26th) recorded 102.7. This is an increase of 1.6 points from last week (101.1) and marks the third consecutive week the index has exceeded the baseline (100), showing an upward trend.

The sales and demand-supply index is calculated by analyzing surveys from member real estate agencies of the Real Estate Board and the number of online listings, quantifying the balance between demand and supply. The closer the index is to ‘0’, the more supply exceeds demand; the closer to ‘200’, the more demand exceeds supply. An index above 100 indicates that buying sentiment is heating up.

Buying sentiment had calmed down due to fatigue from soaring housing prices and the announcement of the 2·4 measures, which included additional supply plans for new towns in the metropolitan area, but it revived following the Seoul mayoral election.

This week, the sales and demand-supply index was highest in the southeastern area, which includes Gangnam, Seocho, Songpa, and Gangdong districts, at 104.2. It rose 2.4 points from the previous week, marking the largest increase. According to the Real Estate Board’s survey, apartment prices in Gangnam district rose mainly around reconstruction projects in Apgujeong and Gaepo-dong; in Songpa district, mainly around reconstruction in Bangi and Jamsil-dong; and in Seocho district, mainly in subway station areas such as Seocho and Jamwon-dong.

As the market showed signs of overheating, Seoul Mayor Oh Se-hoon declared a slowdown in the speed of his flagship pledge, the ‘Speed Housing Supply.’ This appears to reflect his awareness that if housing prices continue to rise due to redevelopment expectations, the private-sector-led supply measures he proposed could be shaken, and he could face a backlash from public sentiment on real estate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)