3D, AI, Machine Learning, and Other IT-Integrated Personalized Services Gain Popularity

Urbanbase's '3D Simulation' Establishes Presence in Japanese Interior Market

Customer Service Culture Online with 'ChannelTalk', Referral Hiring with 'WantedLab'

COVID-19 Accelerates Digital Transformation in Japan, Opportunities for K-Startups

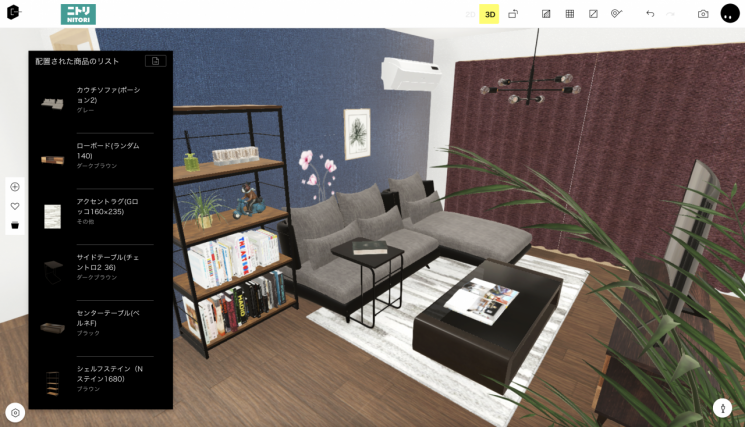

Urbanbase, screen capture of space consulting service from Japan's Nitori Corporation.

Urbanbase, screen capture of space consulting service from Japan's Nitori Corporation. [Photo by Urbanbase]

[Asia Economy Reporter Kim Jong-hwa] K-startups are capturing the Japanese market. Domestic startups that have targeted the niche of Japan’s digital market, which has a slow digital transformation speed due to its unique analog business culture, are achieving results and dreaming of becoming the second 'Naver Line.'

Domestic startups are standing out in various fields such as interior design, content, and communication by leveraging ‘personalized customized services’ combined with information technology (IT) like 3D, artificial intelligence (AI), and machine learning.

The startup leading the establishment of the Japanese market is ‘Urbanbase.’ Urbanbase has settled in the Japanese interior market with its ‘3D interior simulation.’ Japan’s high-density urban residential culture features many ultra-compact and narrow houses, making compact furniture arrangement and customized space composition very important. Therefore, space consulting is common, but most companies still conduct consulting using drawing or sticker methods.

Urbanbase, which established its Japanese corporation in August last year, signed a contract with Japan’s top furniture company ‘Nitori’ and supplied its '3D interior solution' as a cloud-based subscription service (SaaS). Japanese consumers praised the Urbanbase Live Sketch feature, which allows users to draw and modify floor plans directly and convert them into 3D spaces, in addition to the basic simulation function of placing furniture and interior accessories in a virtual space.

Nitori’s space consulting service, which applies 3D interior technology, has been sequentially implemented in over 500 Nitori offline stores in Japan and is planned to expand to Nitori stores worldwide based on customer satisfaction.

‘Channel Corporation,’ which dominates the Japanese B2B communication market with its business messenger ‘Channel Talk,’ is also a notable startup. Japan has a developed hospitality culture called 'Omotenashi (お持て成し),' which means sincerely welcoming and caring for customers. As face-to-face contact with customers became impossible due to COVID-19 and most services and work styles rapidly shifted to non-face-to-face online formats, Channel Talk’s features began to stand out.

Channel Corporation operates the business messenger Channel Talk in 22 countries worldwide, including Japan. Channel Talk users can communicate with businesses in real time by simply clicking the round chat button at the bottom of the mobile app or web service. It is highly regarded for best implementing Japan’s hospitality culture online by providing automated functions that allow users to quickly and easily resolve inquiries through multiple-choice chatbots as well as direct conversations with consultants.

‘Wanted Lab’ is targeting the Japanese recruiting market with its acquaintance referral hiring platform. Most Japanese companies hire experienced workers through headhunters and pay headhunting firms about 30-100% of the successful candidate’s annual salary once the hire is confirmed. Wanted Lab reduces this cost burden for companies.

Wanted Lab applies the domestic system where acquaintances or former colleagues recommend candidates to companies to help job seekers make the most of their careers, and the referrer receives a reward when the job seeker is hired.

‘Watcha’ has established itself in the Japanese video content market as a personalized recommendation ‘online video service (OTT).’ The Japanese OTT market is fiercely competitive with global players like Netflix, Amazon Prime Video, U-NEXT, dTV, and local platforms. Japanese consumers tend to be enthusiasts who consume content based on their favorite movies or shows rather than trends, making personalized recommendation services that accurately understand preferences highly competitive.

The OTT platform Watcha officially launched its service in Japan last year. It offers the same 100% monthly subscription-based video on demand (SVOD) service as in Korea. Currently, Watcha has a total of 90,000 video contents, with more Japanese dramas and movies than Netflix. It is expanding the market aiming for investment attraction and an initial public offering (IPO) in Japan.

Hajinwoo, CEO of Urbanbase, said, "Japan is historically an adversary of Korea, but with a GDP of $5.817 trillion, it is the world’s third-largest economy after the US and China, and a land of opportunity with 2.4 times our population." He added, "Digital transformation is accelerating in Japan due to COVID-19, creating opportunities for domestic startups."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)