Allowance for Appointment of Loss Adjuster When Claiming Insurance Last Year

"Must Actively Establish Consumer Protection System"

[Asia Economy Reporter Oh Hyung-gil] Although the right of insurance policyholders to appoint loss adjusters has been activated to prevent disadvantages when claiming insurance benefits, the actual number of claims remains extremely low.

In particular, there have been cases where insurance companies refused appointments despite consumer requests, raising calls for financial authorities and insurers to take a more proactive approach in establishing consumer protection systems.

According to the insurance industry on the 5th, insurance companies established the "Model Guidelines on Outsourcing Loss Adjustment Work and Appointment of Loss Adjusters" in 2019 and have applied it to indemnity insurance since last year. According to the guidelines, if an indemnity insurance policyholder requests the appointment of a loss adjuster, the insurer must accept it.

If an insurer refuses the loss adjuster appointed by the indemnity insurance policyholder, it must explain the reason to the policyholder. This improvement was introduced to prevent criticism that insurers appoint loss adjusters who calculate damages and compensation in a way that is exploited to reduce or deny insurance payments in the event of accidents or disasters.

When the insurance policyholder agrees to appoint a loss adjuster, the insurer bears the cost of the loss adjuster, allowing the customer to objectively assess their own damages without bearing any costs.

However, the number of requests for loss adjuster appointments was extremely rare compared to the number of claims.

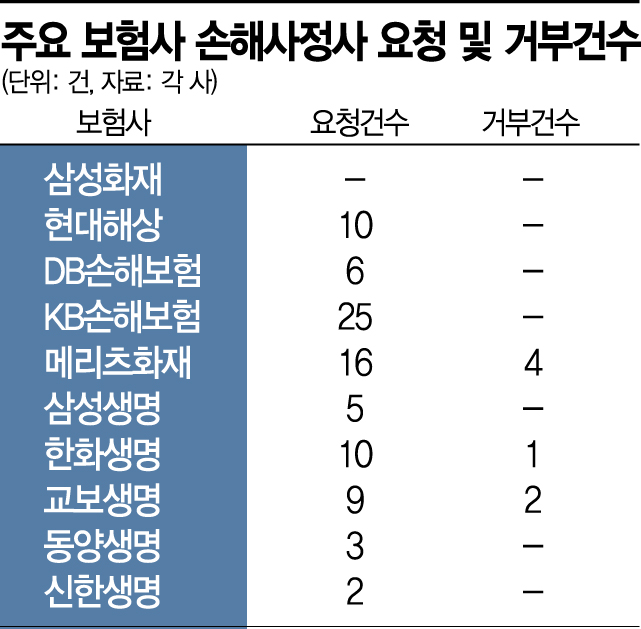

Among the top five life insurers (Samsung, Hanwha, Kyobo, Dongyang, Shinhan Life) and non-life insurers (Samsung Fire & Marine, Hyundai Marine & Fire, DB Insurance, KB Insurance, Meritz Fire & Marine), the number of loss adjuster appointment requests received from customers last year was only 86. Considering that the number of indemnity insurance claims for life and non-life insurance last year was about 105 million, the utilization rate is extremely low.

By insurer, KB Insurance had the highest number with 25 cases. Meritz Fire & Marine and Hyundai Marine & Fire had 16 and 10 cases respectively, and DB Insurance had 6 cases. Samsung Fire & Marine, the top non-life insurer, had none. Among life insurers, Hanwha Life had 10 cases, Kyobo Life 9 cases, and Samsung Life 5 cases.

There were also cases where requests to appoint loss adjusters were refused. Meritz Fire & Marine had 4 cases, Kyobo Life 2 cases, and Hanwha Life 1 case.

A Meritz Fire & Marine official explained, "In the refusal cases, reasons included loss adjusters not agreeing to the fee standards, failure to disclose key management information, or not completing loss adjustment-related fee training," adding, "It was judged that minimum stability was not secured, such as consumer protection or personal information protection."

Insurers can refuse appointment requests based on qualifications of loss adjusters or standards such as improper business practices. According to the model guidelines, appointments cannot be agreed upon if the loss adjuster is unregistered, has conflicts of interest with the policyholder, or has a history of complaints within one year due to unfriendliness, delays, or unethical conduct.

It is pointed out that stakeholders need to actively utilize the loss adjuster system for it to be well established.

Baek Young-hwa, a research fellow at the Korea Insurance Research Institute, said, "Consumers should actively exercise their right to appoint loss adjusters, and insurers should review appointment requests based on objective criteria," adding, "If the right to appoint loss adjusters is fully guaranteed, it is expected to reduce disputes and complaints between consumers and insurers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)