[Asia Economy Reporter Jeong Hyunjin] As major countries including the United States compete for semiconductor self-reliance, voices calling for substantial government support for the Korean semiconductor industry are growing louder. In particular, there are ongoing calls to invest in and build an ecosystem for system semiconductors, where Korea's position is still weak, based on the country's strength in memory semiconductor know-how, as well as to nurture talent.

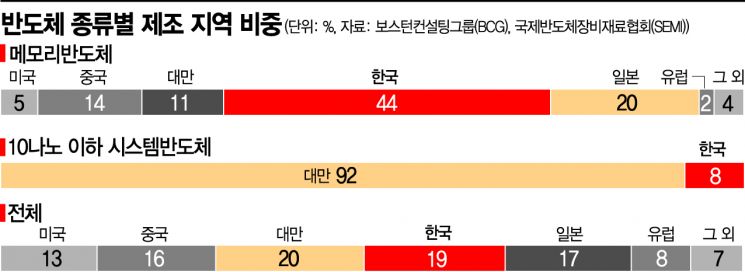

According to an analysis by the Semiconductor Industry Association (SIA) and Boston Consulting Group (BCG) on June 1 (local time), based on data from the Semiconductor Equipment and Materials International (SEMI), Korea accounted for 19% of total semiconductor production in 2019, ranking second after Taiwan (20%). Korea holds an overwhelming 44% market share in memory semiconductors, ranking first, but its position is weak in the non-memory semiconductor sector, known as system semiconductors, where it lags behind Taiwan, the United States, Europe, China, and Japan. Although Samsung Electronics Vice Chairman Lee Jae-yong has set a goal of becoming the world’s number one in system semiconductors by 2030, there remains a significant gap to be closed to achieve this.

In the case of advanced fine processes for system semiconductors below 10 nm (one billionth of a meter), only Taiwan and Korea are capable of production, but Taiwan dominates with a 92% share. Supported by the Taiwanese government, TSMC is leading the system semiconductor sector and focusing on widening the gap.

The system semiconductor market is larger than the memory semiconductor market and is a core component for artificial intelligence (AI), the Internet of Things (IoT), autonomous vehicles, and more, making its importance increasingly significant. As demand for semiconductors produced with advanced fine processes grows, the U.S. government is also expected to increase investment in this area. The SIA and BCG report also suggested that to meet domestic demand for semiconductors below 10 nm, the U.S. must build two to three state-of-the-art factories by 2030, requiring government incentives worth $20 billion to $50 billion.

Domestic experts point out that, given the surge in investments worldwide, active government support for system semiconductors is necessary in Korea as well. Experts believe that for the overall industry to build an ecosystem and grow, companies across various fields?including foundries led by Samsung Electronics, as well as fabless design and back-end processes (packaging), which are other pillars of system semiconductors?must all develop competitiveness evenly.

An Ki-hyun, Executive Director of the Korea Semiconductor Industry Association, said, "The public and private sectors must cooperate to expand the role of system semiconductors in the electronics industry supply chain." He added, "Particularly, investment in fabless companies designing system semiconductors, where Korea is weak, is necessary, and since a large number of new high-level talents are required for this, a talent development system must be established."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)