In the Past, Cheap Labor Enabled Low-Cost Product Supply... Deflationary Export Assessment

Burden of Reduced Consumer Benefits Passed On... Price Inflation Triggered in Largest Trading Partner US

[Asia Economy Reporter Park Byung-hee] China, known as the world's manufacturing hub, was once regarded as a country that exported deflation. This was because it supplied products at low prices to the global market based on cheap labor. However, according to the Wall Street Journal (WSJ) on the 29th, with China's labor costs rising significantly compared to the past and raw material prices also increasing, it has now transformed into a country that raises inflationary pressures on the global economy.

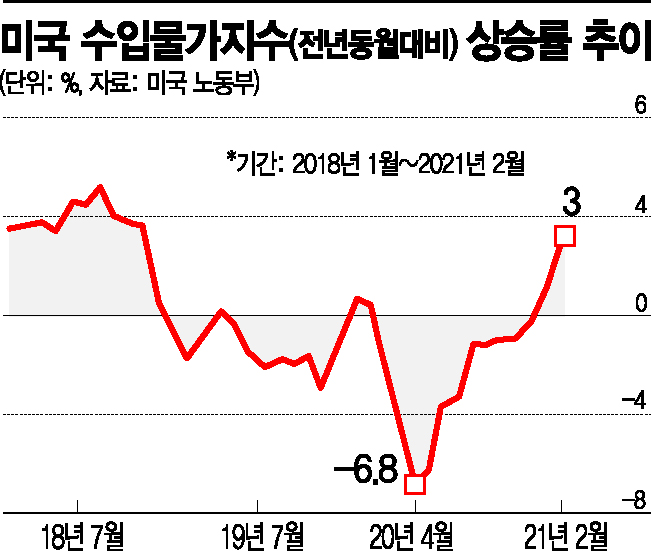

In fact, recent data shows that the rise in U.S. import prices has been significantly stimulating inflation. According to the U.S. Department of Labor, the import price index increase rate (year-over-year) in February recorded 3.0%, the highest since October 2018 (3.4%). In particular, the import price increase rate from China was 1.2% (year-over-year), the highest since 2012. The import price from China rose 0.9% over three months from December last year to February this year. This is the highest figure in 10 years since the 1.0% increase from September to November 2011.

◆ Chinese Companies Raise Prices of Manufactured Goods One After Another = Chinese companies, whose profits sharply declined last year due to the impact of COVID-19, have recently begun raising product prices one after another. As profit margins shrank due to rising raw material prices, they could no longer endure the pressure and started passing the burden onto consumers. WSJ diagnosed that, in addition to rising raw material prices, supply chain instability, and the U.S. Biden administration’s $1.9 trillion stimulus package, the price increases of Chinese export products are another factor increasing global inflationary pressures.

Regista, a furniture company in Foshan, Guangdong Province, China, plans to raise product prices by about 7% starting this summer. This is due to increases in the prices of chemical products and metals used in furniture manufacturing. Since June last year, air logistics costs have also risen by nearly 90%. Jian Huaerxin, a work boots manufacturer in Jiangxi Province, raised product prices by 5% from the end of February, reflecting a 20-30% increase in raw material costs. WSJ reported that many other Chinese manufacturers, including clothing companies and doll manufacturers, raised product prices by 10-15% starting in March.

China’s government carbon emission zero policy is also a cost-increasing factor for companies. The Chinese government is trying to reduce greenhouse gases by even ordering a reduction in iron ore production. Investment in eco-friendly technologies becomes a cost-increasing factor from the companies’ perspective. Speculation is also a factor causing price increases in Chinese products. Textile broker Chen Yang claimed that some suppliers stockpiled cotton ahead of the Lunar New Year holiday, anticipating price increases following the passage of the U.S. $1.9 trillion stimulus package. He added that the cotton price, which was $1,990 per ton in mid-February, rose to $2,600 per ton by early March.

◆ "Risk of Increasing Inflation from China" = Before the COVID-19 pandemic, Americans spent a higher proportion of their consumption expenditure on services such as dining out and travel rather than on product purchases. Spending on dining out and travel accounted for 60% of total consumption expenditure. However, with dining out and travel restricted due to COVID-19, the proportion of product purchases increased. This means that the impact of China’s export price increases on U.S. import prices has grown.

Nick Marro, an analyst at the Economist Intelligence Unit (EIU), said, "It is somewhat premature to expect rapid inflation at this point," but added, "There are clear risk factors for continued inflationary pressure increases, including unprecedented stimulus packages, global logistics crises, and price hikes by Chinese exporters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)