Savings Banks with Dividend Payout Ratios Exceeding 20% Flood In Again This Year

Contrary to Market Banks' Stance Despite Regulatory Restraint Recommendations

[Asia Economy Reporter Song Seung-seop] Savings banks are facing controversy as they consecutively decide on high dividends. This behavior contrasts with financial holding companies, which recorded record profits and have been reducing their dividend payout ratios (cash dividends relative to net income) following financial authorities' recommendations to refrain from dividends across the financial sector in response to the COVID-19 situation.

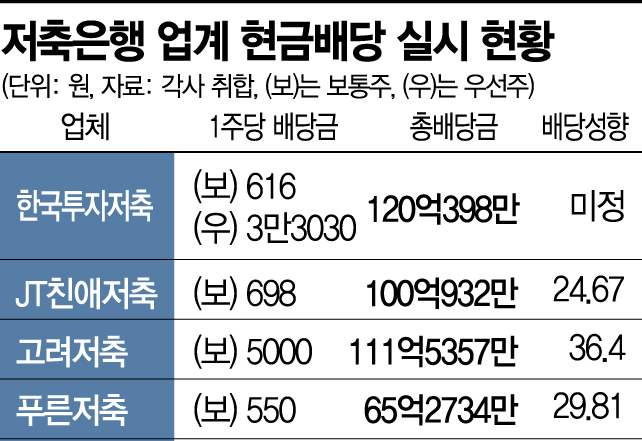

According to the financial sector on the 17th, JT Chin-Ae Savings Bank recently held a board meeting and resolved to pay a year-end dividend of 698 KRW per common share. The total dividend amount is 10.0932 billion KRW, and it plans to pay after the shareholders' meeting on the 24th, with payment scheduled for the 25th. Compared to net income of 40.9 billion KRW, the dividend payout ratio reaches 24.67%.

JT Chin-Ae Savings Bank conducted an interim dividend of 18.2118 billion KRW (1,270 KRW per common share) in May last year, the first since entering the domestic market. At that time, it was stated that the purpose was to facilitate ongoing business in Indonesia, but this dividend is being made as a shareholder return after the major shareholder changed to Japan's "Nexus Bank." Considering that Japanese financial companies have refrained from dividends to avoid emotional backlash and controversies over national wealth outflow, this is regarded as unusual.

Koryo Savings Bank also recently announced it would pay dividends of 5,000 KRW per common share, totaling 11.15357 billion KRW. Koryo Savings Bank recorded total assets of 1.0727 trillion KRW and net income of 30.6 billion KRW, resulting in a dividend payout ratio of 36.4%. The owner family, including former Taekwang Group Chairman Lee Ho-jin and his nephew Lee Won-jun, is expected to receive dividends amounting to tens of billions of KRW.

In the case of Koryo Savings Bank, it has maintained a dividend payout ratio close to 40%, paying dividends of about 11 billion KRW annually regardless of net income. Since 2016, Koryo Savings Bank's net income has steadily declined from 36.2 billion KRW. Although there were many concerns about increased risks due to COVID-19 from last year, operating profit, which had fallen to 26.4 billion KRW in 2019, improved significantly, allowing dividends of a similar scale to be paid.

Pureun Savings Bank is known for having high dividend payout ratios and market dividend yields (dividends relative to stock price on the dividend record date) among savings banks that pay dividends. This year's total dividend amount is 6.52734 billion KRW (550 KRW per common share), with a market dividend yield of 6.14%. Considering that market dividend yields of commercial banks are usually around 5%, this is a high level. Net income was 21.9 billion KRW, with a dividend payout ratio of 29.81% and a cash dividend rate of 55% relative to the par value.

Major Companies Also Join High Dividend Trend... Opposite to Authorities and Commercial Banks' Recommendations

Major savings banks have also joined the high dividend trend. Among the five major savings banks (SBI, OK, Pepper, Korea Investment, and Welcome), Korea Investment Savings Bank paid dividends of 616 KRW per common share and 33,030 KRW per preferred share, totaling 12.0398 billion KRW. Based on 2019 net income (58.5 billion KRW), the dividend payout ratio is about 20.5%.

There is strong negative public opinion regarding the high dividend payout trend in the savings bank industry. Many savings banks are operated by foreign entities or owners, so high dividends can lead to controversies over capital outflow or owners filling their coffers, leading most to refrain from such payouts.

This is especially in direct conflict with the movements of financial authorities and commercial banks. The Financial Services Commission at the beginning of this year passed a capital management recommendation for financial holding companies to maintain dividend payout ratios within 20% by the end of June. This was intended to reduce dividends as banks' soundness could be impaired due to increased economic uncertainty amid the COVID-19 crisis.

Although no specific dividend guidelines have been presented for the secondary financial sector, the stance is that dividend decisions should be made cautiously. On the 3rd of last month, Kwon Dae-young, Director of the Financial Industry Bureau at the Financial Services Commission, stated during a work plan announcement that the secondary financial sector should also decide dividends carefully. At that time, Director Kwon said, "The secondary financial sector is mostly indirectly restricted by holding companies, so there was no special recommendation to reduce dividends for cards or mutual finance," but emphasized, "The secondary financial sector must consider the COVID-19 situation, and the government expects CEOs and shareholders to make appropriate dividend decisions considering these factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)