KOSPI Fluctuates Amid US Treasury Yield Rise and Concerns Over China's Tightening Policy

Box Range Trapped Below 3200 Ceiling... Rise Expected After Confirming Fundamental Recovery

[Asia Economy Reporter Lee Seon-ae] The domestic stock market, which has reached extreme volatility due to rising U.S. Treasury yields and concerns over China's tightening policies, continues to be influenced by external factors this week. The market is fluctuating by around 100 points in a single day, creating a truly 'dizzying' trading environment. Although Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), made remarks about quantitative easing, the market remains anxious that the upward trend in U.S. Treasury yields will continue. Investors are focusing on the upcoming Chinese Two Sessions (Lianghui: the National People's Congress and the Chinese People's Political Consultative Conference), which opens on the 4th, to confirm the direction of China's economic policies.

According to the Korea Exchange on the 3rd, the KOSPI opened at 3,041.20, down 0.09% (2.67 points). By 9:13 a.m., it had turned positive, rising 0.01% (0.34 points) to 3,044.21. Within just 30 minutes, the index switched between gains and losses six times. The previous day, it closed at 3,043.87, up 1.03% (30.92 points) from the prior trading day. Although the closing price showed an increase, investors experienced volatility throughout the day. Early in the session, the KOSPI surged 2.77% (3,096.50), eyeing a return above the 3,100 level. This was driven by the stabilization of U.S. Treasury yields and the simultaneous 1-3% gains across the three major New York stock indices, which raised hopes for a recovery in investor sentiment. With the easing of the U.S. rate shock that had been suppressing the domestic market, a further expansion of gains was expected, but the situation reversed sharply. In the afternoon, the index fell to 3,020.74 (+0.26%), giving back its earlier gains. This was a reaction to signals of liquidity tightening emerging from China. Guo Shuqing, Chairman of the China Banking and Insurance Regulatory Commission, indicated at a press conference that "since the COVID-19 pandemic, both developed and developing countries have used aggressive fiscal policies and extremely loose monetary policies, leading to increasing side effects," and warned that "the bubble in overseas financial assets could burst one day," suggesting that an 'exit strategy' is imminent. The market interpreted the remarks from a key economic policymaker as increasing the likelihood of a moderate monetary policy and tightening. Consequently, the Shanghai Composite, Hong Kong Hang Seng, and Japan's Nikkei 225 indices all closed down by around 1%. Essentially, the domestic market experienced volatility by absorbing the effects of U.S. stimulus and Chinese tightening in the morning and afternoon sessions, respectively.

Last month, out of 18 trading days, the KOSPI fluctuated by more than 50 points intraday on 11 days. Especially since the surge in U.S. Treasury yields on the 19th of last month, the average daily volatility over seven trading days was about 80 points, with price changes reaching 2-3%. On the 24th of last month, the index plunged 2.45%, only to rebound 3.5% the next day, repeatedly jumping 2-3%. This dizzying market condition is expected to continue.

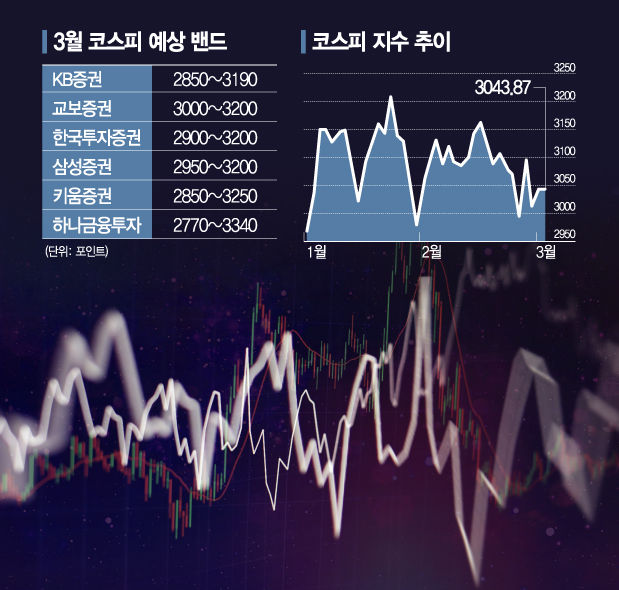

Brokerages have set the upper bound of the KOSPI forecast band for March at around 3,200, anticipating continued extreme volatility. Most securities firms, including Korea Investment & Securities (2,900?3,200), Samsung Securities (2,950?3,200), and Kyobo Securities (3,000?3,200), expect it to be difficult for the KOSPI to rise above 3,200. Hana Financial Investment, which projected the highest upper limit, expects the index to remain between 2,770 and 3,340, while Kiwoom Securities forecasts a slightly lower range of 2,850 to 3,250.

Although Powell's remarks have somewhat eased concerns about early U.S. monetary tightening, investors' anxiety remains. Kim Young-hwan, a researcher at NH Investment & Securities, stated, "The biggest source of uncertainty in the stock market is the rise in U.S. Treasury yields," adding, "If inflation intensifies due to U.S. stimulus measures, there is persistent concern that the Fed will reverse course, and rising yields increase the discount rate burden on the stock market, acting as a negative factor."

Moreover, with the risk of rising U.S. Treasury yields still present, any signals of liquidity contraction from China inevitably trigger KOSPI volatility. Accordingly, market attention has turned to the Chinese Two Sessions. Ahead of these meetings, China announced a stimulus package worth 25 trillion yuan (approximately 4,300 trillion won). However, this stimulus focuses on infrastructure investment to revitalize the economy rather than fiscal or monetary policies such as tax cuts. Han Dae-hoon, a researcher at SK Securities, said, "If the stimulus package is approved at the Chinese Two Sessions and specific guidelines are issued, commodities, cyclical sectors, and reflationary trends could continue to strengthen." However, he cautioned against excessive expectations, noting, "Since it is not yet determined over how many years China's stimulus will be implemented, a lack of clear guidelines could lead to disappointment selling." An So-eun, a researcher at IBK Investment & Securities, commented, "One of the factors influencing short-term KOSPI fluctuations is China's liquidity," but added, "The Chinese economy is not overheated to the extent that aggressive tightening is necessary."

Experts agree that the only way for the KOSPI to escape this volatile phase is through a fundamental recovery that can alleviate overheating concerns. Lee Kyung-min, a researcher at Daishin Securities, explained, "For the KOSPI to stabilize, it must either reduce overheating pressures or regain confidence in a self-sustaining economic recovery. Until then, the KOSPI and global stock markets are expected to continue reacting and adapting to variables such as inflation and interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)