[Post-Corona, Global Corporate Survival Strategy ⑤ Sharing, Merging, Adding: New Distribution]

Finding New Solutions in Crisis Era Through Alliances in the Distribution Industry

Fulfillment Services Increasingly Important in E-commerce Shopping Market

[Asia Economy Reporters Hyesun Lim and Minyoung Cha] Domestic distribution companies are undergoing a period of upheaval due to the novel coronavirus disease (COVID-19), with 'alliances and mergers' in full swing. They are expanding their scale by merging within the same industry and breaking down industry boundaries through combinations across different sectors. Their common goal is to provide consumers with a 'seamless experience.'

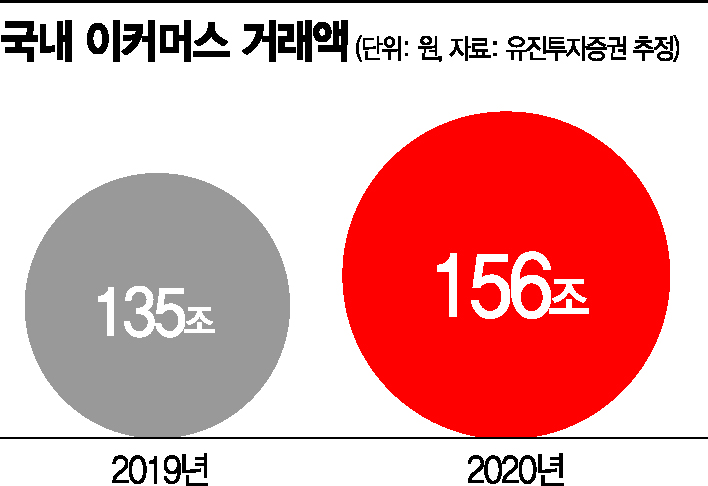

In particular, this year, the Korean e-commerce market is expected to rank third in the global e-commerce market, following China and the United States, and is anticipated to engage in fierce competition with global giants. According to estimates from the securities industry, last year's domestic e-commerce transaction volume reached 156 trillion won, a 15% increase from the previous year. Double-digit growth is also expected this year.

Joining Hands Despite Differences

Since the amendment of the Distribution Industry Development Act regulating offline distribution in 2012, large supermarkets have declined over the past eight years, while online platforms have shown remarkable growth. Coupang, for example, expanded its fulfillment business and launched the 'Rocket Delivery' service, achieving sales of 7 trillion won in 2019. The outbreak of COVID-19 in January last year is also regarded as a strategic turning point that ignited the trend of contactless shopping.

Amazon, the global leader, has partnered with SK to officially enter the Korean market. The domestic open market site 11st is expected to benefit from synergy effects under the leadership of its parent company SK Telecom.

GS Group, represented by GS Retail, has also mobilized group capabilities to strengthen online-offline integration. GS Retail announced the birth of a mega-commerce company with assets of 9 trillion won and an annual transaction volume of 15 trillion won through its merger with GS Home Shopping in November last year. It also unveiled a vision to grow into an 'online-offline commerce tech leader' with a transaction volume of 25 trillion won by 2025.

GS Retail is particularly focusing on logistics efficiency. In fact, the first move after the merger of GS Retail and GS Home Shopping was to share the unmanned parcel network at convenience stores. GS Retail, together with its logistics affiliate GS Networks, has made the BOX25 contactless parcel locker service available to GS Shop customers since the end of last year. GS Networks currently operates over 20 cold chain facilities and 28 automation centers, and plans to strengthen logistics agency services by integrating GS Home Shopping's IT with its 3PL services.

Choi Ji-hye, a research fellow at Seoul National University's Consumer Trend Analysis Center, said, "There is very active change where content companies enter distribution, and distribution companies expand into content fields. Eventually, companies that fully integrate these three elements, including the simple payment system called 'Pay,' are expected to dominate the market."

Giants Focusing on Logistics

The biggest challenge for platform companies seeking to secure delivery competitiveness is logistics. Naver has adopted a strategy of building a logistics ecosystem through partnerships with fulfillment and courier companies without investing in its own logistics. Last year, Naver invested in fulfillment logistics companies Wekeep, Dooson Company, and GSS. It also exchanged shares with CJ Group. Naver and CJ Group formed a comprehensive business alliance that includes cooperation in K-content and digital video platform businesses and joint promotion of e-fulfillment business for e-commerce innovation, exchanging stocks worth 600 billion won. Fulfillment refers to the entire process of picking, packing, and delivering products from a logistics center according to customer orders.

Currently, Emart is converting inefficient spaces within its 114 stores into PP centers to respond to same-day delivery. SSG.com Neo Center handles dawn delivery, while PP centers handle same-day delivery. Additionally, Emart opened its first store-type logistics center, 'EOS (Emart Online Store)' Cheonggyecheon branch, last year. This store delivers products ordered online by consumers within a maximum distance of 20 km within two hours. To achieve this, it has established automated product sorting and delivery systems. Of Emart's planned investment of 5 trillion won over the next three years, 26% is concentrated on SSG.com, mostly expected to be used to establish Neo.

Lotte is expanding 'Semi-Dark Stores' and 'Smart Stores' at its large supermarket locations nationwide, actively establishing store-based delivery hubs. The 'Semi-Dark Stores' located in four stores nationwide have converted part of the store space into dedicated areas with automated facilities to improve online product packing efficiency. Lotte Mart plans to expand the number of Semi-Dark Stores to 29 this year, increasing online order processing capacity more than fivefold. It also plans to apply 'Smart Stores,' equipped with automated picking and packing facilities, to 12 stores.

A senior executive in the distribution industry said, "In the past, regardless of industry, large corporations focused solely on owning all businesses to create synergy among affiliates. While it is impossible to predict the future in the coming years, such rational changes are expected to elevate the competitiveness of our distribution industry to a new level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)