Medical Advisory System Controversy

Rep. Kim Byung-wook Points Out at National Audit

Insurance Industry "Highlighting Some Cases"

[Asia Economy Reporter Oh Hyung-gil] The medical advisory system introduced by insurance companies to fairly pay insurance claims has become embroiled in controversy over its inadequacy. Criticism has arisen that insurance companies collude with doctors and exploit the system to deny claims to policyholders who lack medical knowledge.

Insurance companies recently expressed frustration, stating that while the rate of non-payment after medical advisory has been improving, only a very small number of unpaid cases are being highlighted.

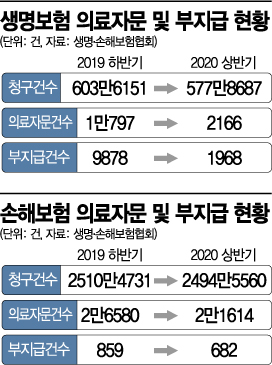

According to the insurance industry on the 6th, the total number of medical advisory cases conducted by life insurance companies in the first half of this year was 9,878.

This is a decrease of 919 cases (8.5%) compared to the previous quarter. The proportion of medical advisory cases out of the total 5,778,687 insurance claims was only 0.17%.

The number of cases where insurance claims were not paid after medical advisory was 1,968, and cases where partial payment was made were 3,821. Compared to the total scale of insurance claims, these represent only 0.03% and 0.06%, respectively.

For non-life insurance companies, as of the first half of the year, medical advisory was conducted on 21,614 cases (0.08%) out of a total of 24,945,560 insurance claims, which is an 18.6% decrease from 26,580 cases in the second half of the previous year. Among the claims that received medical advisory, only 682 cases were denied insurance payments.

Currently, when a policyholder files an insurance claim, the insurance company can conduct a medical advisory after accident investigation to seek medical judgment.

However, recent criticism has been raised that insurance companies are abusing the medical advisory system. Assemblyman Kim Byung-wook of the Democratic Party pointed out at the National Assembly audit held last month that the non-payment rate through the medical advisory system has reached up to 79% in the past three years.

A consumer organization claimed that insurance companies conduct more than 30,000 medical advisories annually, of which 38% result in non-payment or reduced payment of insurance claims. Recently, even independent loss assessment firms have appeared, claiming that insurance company medical advisories can be abused and using this for their own business purposes.

On the other hand, the insurance industry argues that the system is being misinterpreted by exaggerating some cases or distorting statistics, insisting that these are unavoidable and lawful procedures.

An insurance company official rebutted, "The low proportion of medical advisory cases among total insurance claims means that medical advisory is selectively conducted. Cases where doctors are consulted correspond to suspected overdiagnosis or insurance fraud, so the non-payment rate is inevitably high."

Measures to enhance the fairness of medical advisory system institutionally are also expanding. Since last year, the Life Insurance Association has signed business agreements with the Korean Academy of Manual Medicine (March) and the Korean Orthopedic Association (October), introducing procedures to receive medical advisory through fairly selected specialists.

The Financial Supervisory Service also plans to implement measures to mandate guidance on appeal and other relief procedures so that consumers can raise objections to the results of medical advisory conducted by insurance companies.

A Life Insurance Association official said, "Since it is not easy to detect fraudulent cases where medical institutions collude to claim insurance without verification, the medical advisory system is inevitable from the perspective of consumer protection," adding, "We will strive to enhance fairness by building a rich pool of advisors through specialist medical associations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)