Samsung Electronics Q2 Operating Profit 8.14 Trillion KRW, Largest Since Q4 2018

Semiconductor Operating Profit Soars 68% YoY to 5.43 Trillion KRW

Increased Semiconductor Demand Driven by COVID-19 Remote Work Expansion

[Asia Economy reporters Changhwan Lee and Jinju Han] Samsung Electronics announced a surprise Q2 performance that exceeded market expectations. Despite the spread of the novel coronavirus infection (COVID-19), all business divisions, including semiconductors, mobile, and consumer electronics, showed balanced performance improvements. However, analysis suggests that internal and external uncertainties surrounding the company, such as the COVID-19 threat, intensified global semiconductor market competition, and the US-China trade dispute, remain.

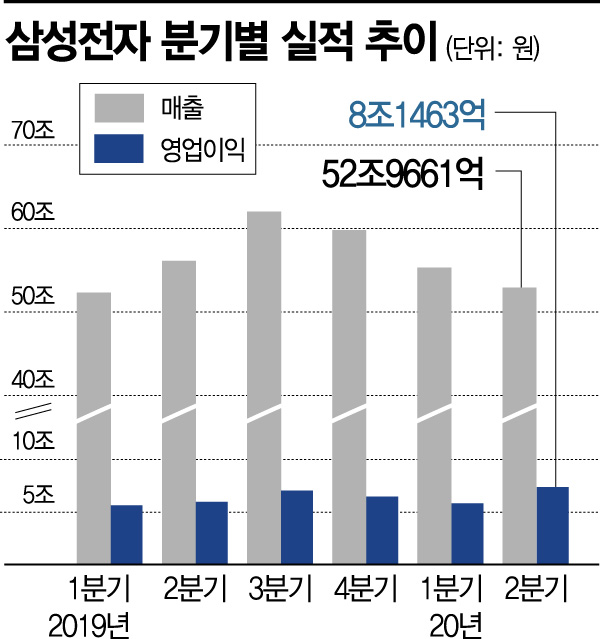

Samsung Electronics announced on the 30th that it recorded sales of KRW 52.9661 trillion and operating profit of KRW 8.1463 trillion in the second quarter of this year. Compared to the same period last year, sales decreased by 5.6%, but operating profit increased by 23.5%. In particular, the operating profit is the largest since the fourth quarter of 2018, when it recorded KRW 10.8 trillion. The operating profit margin, which is the ratio of operating profit to sales, was 15.4%, the highest since the fourth quarter of 2018 (24.2%).

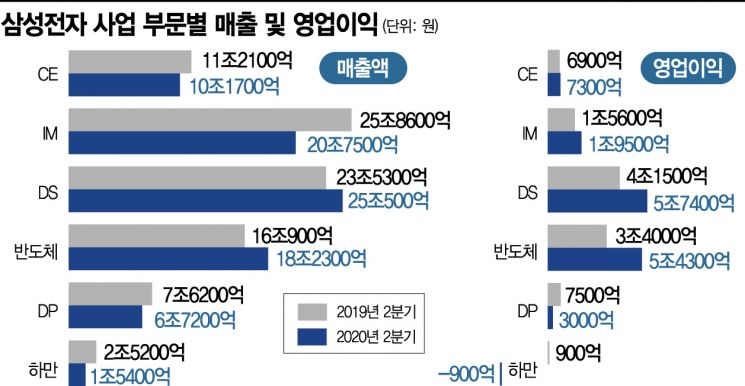

The semiconductor business led the performance improvement. The semiconductor division's Q2 operating profit surged 68% to KRW 5.43 trillion from KRW 3.4 trillion in the same period last year. The spread of COVID-19 led to a sharp increase in demand for data center servers and PCs due to remote work and online education, causing semiconductor prices to rise significantly.

According to market research firm DRAMeXchange, the fixed transaction price of DDR4 8Gb DRAM products mainly used in PCs steadily increased from $2.84 in January to $3.29 in April and $3.31 last month. NAND flash prices also rose from $4.42 at the end of last year to $4.68 at the end of last month based on 128Gb MLC (multi-level cell) used in solid-state drives (SSD) and USB drives, contributing to performance improvement.

A Samsung Electronics official explained, "In the second quarter, the memory semiconductor business showed improved performance as demand centered on data centers and PCs remained solid due to increased remote work and online education, although mobile demand was relatively weak amid the ongoing impact of COVID-19."

The set business also performed better than expected. The IT & Mobile (IM) division, responsible for smartphones, posted a Q2 operating profit of KRW 1.95 trillion, a 25% increase year-on-year. It is evaluated that the impact of COVID-19 was safely overcome through cost efficiency and expansion of the mid-to-low-end smartphone lineup.

A Samsung Electronics official said, "Although smartphone sales volume and revenue decreased compared to the previous quarter due to store closures caused by COVID-19, profitability remained solid," adding, "We will continue efforts to improve profitability through the launch of flagship new models such as Galaxy Note and Fold, expansion of mid-to-low-end model sales, and operational efficiency."

Kim Kyung-min, a researcher at Hana Financial Investment, analyzed, "Smartphone sales volume is expected to grow by about 24% in the third quarter, and sales of mid-to-low-end products will also be strengthened. Considering that profitability was maintained despite the mid-to-low-end focused sales strategy in the second quarter, although there is a possibility of increased costs, IM operating profit in the third quarter is also expected to increase by about 28%."

The Consumer Electronics (CE) division, responsible for home appliances, achieved a solid performance with a Q2 operating profit of KRW 730 billion, a 7.2% increase year-on-year. Although TV market demand declined due to the impact of COVID-19, performance improved by actively responding to short-term demand increases using global supply chain management (SCM) and cost efficiency. Home appliances also saw increased performance due to expanded sales of premium products such as Grande AI and Bespoke refrigerators and the seasonal peak of air conditioners.

The Display (DP) division recorded a Q2 operating profit of KRW 300 billion, successfully returning to profitability. Although overall panel demand decreased, performance greatly improved due to a compensation payment of about KRW 1 trillion from Apple for failing to meet contracted volumes with Samsung.

Although Samsung Electronics posted strong Q2 results, COVID-19 continues to rage, and there are many internal and external variables such as intensified semiconductor competition, the US-China trade dispute, and owner-related trials, so uncertainties remain in the second half of the year.

In the case of non-memory semiconductors, the fact that Taiwan's TSMC, a foundry (semiconductor contract manufacturing) competitor, is soaring with record-high performance is also a burden.

Lee Soon-hak, a researcher at Hanwha Investment & Securities, explained, "Although Samsung Electronics posted earnings surprise-level results that greatly exceeded expectations in the second quarter, uncertainties about the semiconductor market conditions in the second half still exist," adding, "Uncertainties will decrease only when it is proven that DRAM demand remains solid in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)