KTB Investment & Securities Report

RP Regulations Expected to Increase Costs for Both Overnight and Term Transactions

Funds Shift from Government Bonds to Credit Bonds, Highlighting AA+ Investment Appeal

[Asia Economy Reporter Minji Lee] RP regulations will be gradually implemented starting next month. RP sellers who raise funds in the RP market will be required to hold a certain proportion of their raised amount in cash-equivalent assets. Accordingly, funds are expected to shift from a market focused on government bonds to credit products.

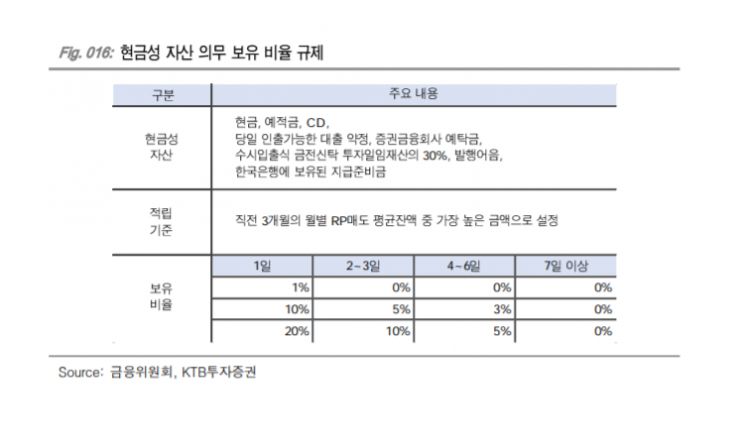

According to the financial investment industry on the 28th, the authorities plan to have a grace period starting next month and apply these enforcement rules from April next year. The purpose of this regulation is to reorganize the repo market, which is currently centered on 1-day repos, into a market focused on term repos (2 days or more). The authorities consider that next-day repo transactions carry a high rollover risk and encourage holding a certain proportion of the amount raised through repos in cash-equivalent assets.

From the perspective of fundraisers through RP sales, there is a burden. When raising funds with next-day repos, there is a loss of profit opportunities due to the expansion of cash-equivalent assets, and when raising funds with 7-day repos, the funding cost increases by about 13 basis points compared to next-day repos. Seokhyun Park, a researcher at KTB Investment & Securities, said, “With the implementation of the regulation, securities firms are attempting to reduce the size of their RP books, but since the absolute proportion is large, it will be difficult to significantly reduce the RP book,” adding, “Currently, securities firms rely on the RP market for 30% of their funding.”

Since costs increase whether it is next-day or term repos, some funds are expected to move from the existing government bond-dominated market to credit. Researcher Park explained, “Considering that during the period when the economy hit bottom and rebounded, the rise in stock prices and interest rates was the steepest, it is burdensome to buy bonds from a capital gains perspective,” and added, “Funds are expected to move due to carry demand, preferring credit purchases over government bonds.”

In the government bond market, RP fund inflows are expected in the 4-5 year remaining maturity segment. The segment over 7 years is directly exposed to the burden of deficit bond issuance, and the segment under 3 years is expected to show rates inverted or similar to the 7-day RP rate.

In the credit market, AA+ rated corporate bonds are expected to have higher investment value. This is because the gap with repo rates is relatively large and there is still room for interest rate declines. For bank bonds, issuance volume is expected to increase in the second half of the year due to the impact of base rate cuts. Researcher Park said, “Despite the issuance burden, the interest rate gap is small, making investment difficult,” and added, “In the case of card bonds, there is issuer risk due to possible rating downgrades.”

In the corporate bond market, both AAA and AA+ rated bonds have a gap of more than 50 basis points with repo rates, making them attractive from a carry perspective. Among them, AA+ rated bonds can simultaneously pursue capital gains. Researcher Park forecasted, “If purchases of AA+ rated corporate bonds begin due to government support policies and the execution of surplus funds, interest rates may decline somewhat.” Among cash-equivalent assets, purchases are expected to focus on CDs and commercial papers. This is because among the cash-equivalent assets listed by the authorities, these have low transaction costs and relatively active secondary markets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)