Reference Image

Reference Image

[Asia Economy Reporter Kim Hyo-jin] The government has declared the second half of this year as the "Special Eradication Period for Illegal Private Loans" and plans to launch a large-scale crackdown and punishment on illegal private financing. Depending on the case, the government intends to actively pursue arrest investigations by considering illegal lending businesses as acts of criminal organizations.

Additionally, the legal interest rate cap for unregistered lending businesses will be lowered from the current 24% to 6%. The amount that victims of illegal private financing can recover through unjust enrichment claims in lawsuits will also increase.

On the 23rd, the Financial Services Commission held a joint briefing at the Government Seoul Office in Jongno-gu, Seoul, together with the Ministry of Justice, National Police Agency, Korea Communications Commission, National Tax Service, and others, announcing the "Measures to Eradicate Illegal Private Financing in Response to the COVID-19 Crisis."

The government prepared these measures in response to the increase in illegal private financing targeting ordinary citizens struggling due to the novel coronavirus disease (COVID-19), often under the guise of official support. According to the Financial Services Commission, reports and tips related to illegal private financing increased by about 60% in April and May compared to the same period last year amid the spread of COVID-19.

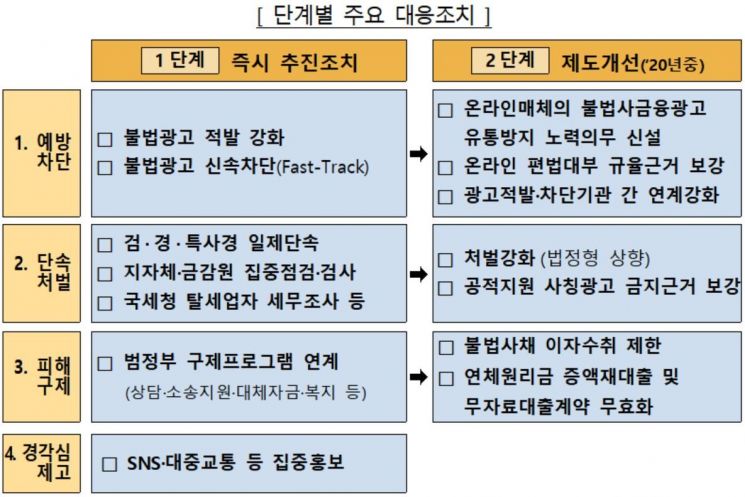

The government has declared the period from the 29th of this month until the end of the year as a government-wide special eradication period for illegal private financing. Accordingly, the government plans to form an inter-agency task force (TF) involving the Financial Services Commission and related agencies to achieve substantial results in eradicating illegal private financing crimes.

First, the government will conduct a comprehensive crackdown across ministries on illegal lending advertisements both online and offline, including new business methods, reports and tips received by the Financial Supervisory Service, and crime information recognized by investigative agencies. The police, Ministry of Justice, prosecution, local governments (special judicial police), National Tax Service, and Financial Supervisory Service will all be involved. The police will deploy 688 personnel specializing in intelligent crime investigations and 624 personnel from the metropolitan investigation units.

The government also plans to completely block all forms of illegal lending advertisements, including online illegal loan ads on SNS and internet bulletin boards, as well as offline ads in the form of text messages, business cards, and banners.

To this end, a dedicated team will be established within the Financial Supervisory Service, and if new illegal advertisements emerge or there is concern about an increase in damage, consumer alerts will be issued and warning messages sent. If illegal advertisements or communication means are detected, emergency blocking procedures by the Korea Communications Commission and others will be applied for immediate blocking.

The government plans to share reports and analysis information in real-time among enforcement agencies to focus on cracking down on new criminal methods and illegal debt collection targeting vulnerable groups. It also plans to actively identify and investigate illegal activities involving multiple loan brokers and behind-the-scenes intermediaries.

Organized illegal lending activities will be prosecuted under the Criminal Organization Act, and malicious illegal debt collection acts will be subject to the Act on the Punishment of Violent Crimes, with active applications for arrest warrants.

The legal interest rate cap for unregistered lending businesses will be lowered from the current 24% to 6%. This measure aims to address the problem where unregistered lenders, whose operations are illegal, can still charge the maximum interest rate (24%) allowed for legitimate financial businesses under the Loan Business Act.

Interest payments exceeding 6% will be applied to principal repayment, and any remaining amount after principal repayment can be reclaimed by borrowers through unjust enrichment claims and lawsuits. Consequently, the amount recoverable through litigation will increase accordingly.

The government also plans to actively apply for confiscation preservation of unjust enrichment from illegal private financing when necessary and to deprive tax evasion gains through tax investigations of evading businesses.

The government has prepared relief and recurrence prevention measures for victims of high-interest and illegal debt collection. The Financial Supervisory Service will oversee the first reception and counseling of illegal private financing victims and immediately connect them to the Korea Legal Aid Corporation and the Korea Inclusive Finance Agency to assess the demand for legal relief and financial support services.

The Korea Legal Aid Corporation provides customized legal counseling and free support from debtor representatives and litigation lawyers to protect victims' rights. The Korea Inclusive Finance Agency conducts comprehensive counseling to resolve the financial needs of victims directly received or referred, providing loan supply, debt adjustment, welfare, and employment support.

The government also plans to impose obligations on online media such as SNS and internet portals to prevent the distribution of illegal advertisements and strengthen the regulatory framework for indirect brokerage through online bulletin boards.

This policy considers the lack of minimum illegal verification obligations for advertisers when online media post loan advertisements for a fee, and the ambiguous legal grounds for regulation when online bulletin boards operate loan brokerage by charging board usage fees (membership fees) instead of brokerage commissions.

Additionally, the government will restrict interest collection from illegal private financing, strengthen the grounds for punishing illegal loan advertisements that impersonate government or government agency support, and increase the severity of penalties for illegal private financing.

Simultaneously, the government will link detection data from the Financial Supervisory Service, Korea Communications Standards Commission, and Korea Internet & Security Agency in real-time to accelerate blocking of online illegal advertisements and promote the development of illegal advertisement detection technologies using big data and artificial intelligence (AI) through research and development (R&D) support projects by the Ministry of Science and ICT and related ministries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)