Major Export Countries Including US and Europe Locked Down, Manufacturing Industry Faces Biggest Crisis Since Financial Crisis

Coincident and Leading Indicators Both Decline... Kim Yong-beom "Current Situation Is Not Easy"

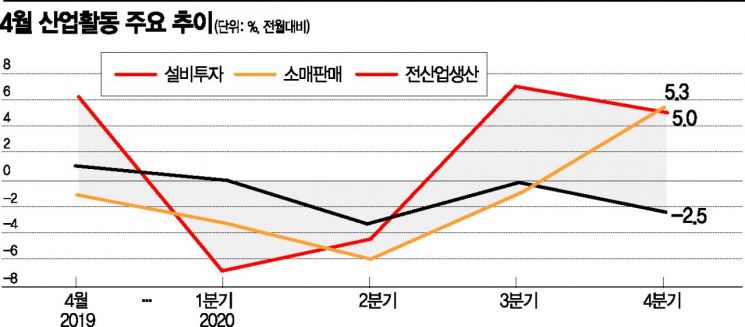

[Asia Economy Reporter Kwangho Lee] According to the 'April Industrial Activity Trends' released by Statistics Korea on the 29th, the crisis of the novel coronavirus infection (COVID-19) is analyzed to be spreading fully into the manufacturing industry. As the United States and Europe have successively imposed lockdown measures, domestic exports and manufacturing have taken a direct hit. On the same day, Kim Yong-beom, the 1st Vice Minister of Strategy and Finance, diagnosed, "The April industrial activity trends show the seriousness of the crisis we are facing," adding, "It shows that the crisis, which started in the service sector, is now spreading fully to manufacturing." The government expects that from May to June, the effects of policies will be reflected and indicators will improve. However, unless the spread of COVID-19 slows down in major countries, the domestic manufacturing industry is still expected to struggle.

Looking at the April industrial activity trends, mining and manufacturing production centered on manufacturing decreased by 6.0% compared to the previous month, marking the largest contraction since December 2008 (-10.5%) during the global financial crisis. This is because exports decreased as the economies of major export partners such as the U.S. and Europe were locked down due to the spread of COVID-19. Semiconductor production, including DRAM and other memory semiconductors, decreased by 15.6% due to the global economic slowdown. This is the largest decline since December 2008 (-16.9%). If COVID-19 continues, the semiconductor industry is inevitably expected to be hit hard in the second quarter.

Since the beginning of this year, the supply of semiconductors has been limited, causing fixed prices of memory semiconductors such as DRAM and NAND flash to rise, which has helped the semiconductor industry's performance. However, if the impact of COVID-19 continues, it is predicted that there will inevitably be damage in terms of prices as well. In fact, recently, the spot prices of semiconductors have fallen by more than 10% compared to the previous month, showing negative effects. A semiconductor industry official said, "Despite COVID-19, semiconductors are holding up relatively well compared to other industries such as aviation and shipping due to non-face-to-face (untact) demand, but if the situation continues, it will lead to consumption contraction, so damage is inevitable."

The automobile sector also fell by 13.4% due to the base effect from the previous month and production adjustments caused by shrinking overseas sales demand. As a result, manufacturing production decreased by 6.4% compared to the previous month, the largest drop since December 2008 (10.7%). The average operating rate of manufacturing, which indicates production performance relative to production capacity, recorded 68.6%, down 5.7 percentage points from the previous month. The decrease was the largest since December 2008 (7.2 percentage points), and the operating rate hit its lowest point in 11 years and 2 months since February 2009 (66.8%). Manufacturing shipments declined by 7.2% compared to the previous month as automobiles and semiconductors decreased. This is the largest decline in 11 years and 4 months since December 2008 (-7.5%). Manufacturing inventories decreased by 0.4% compared to the previous month as automobiles (6.7%) and primary metals (3.3%) increased, but semiconductors (-6.3%) and electronic components (-15.0%) decreased. The inventory-to-shipment ratio, which indicates inventory rate, rose by 8.1 percentage points from the previous month to 119.1%.

The economic indices that show the current and future economic trends also indicate a challenging situation. The coincident index of economic conditions, which shows the current economic situation, fell by 1.3 points from the previous month, the largest drop in 22 years and 1 month since March 1998 (2.0 points) during the International Monetary Fund (IMF) foreign exchange crisis. This means that our economy is currently severely contracted. The leading index of economic conditions, which predicts future economic trends, also fell by 0.5 points compared to the previous month, continuing a three-month consecutive decline. Vice Minister Kim mentioned the simultaneously declining coincident and leading indices, saying, "They indicate that the current and future economic trends are not easy," and emphasized, "Although it is clearly a difficult time, the government will make every effort to overcome the crisis."

An Hyung-jun, Director of Economic Statistics Trends at Statistics Korea, explained, "In May and June, the transition to daily quarantine and the effects of disaster relief funds are expected to be reflected in statistics for service production and retail sales," adding, "The impact on the manufacturing sector is currently highly uncertain, so we need to watch the overseas spread of COVID-19 and the lifting of economic lockdown measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.