[Asia Economy Reporter Kwangho Lee] Due to the impact of the novel coronavirus infection (COVID-19), the consumer price inflation rate fell to the 0% range last month, and the core inflation rate (excluding food and energy index) dropped to its lowest level in 20 years, raising concerns about deflation. Deflation refers to a phenomenon where prices continuously decline and economic activity stagnates. This is what Japan experienced during its "Lost 20 Years."

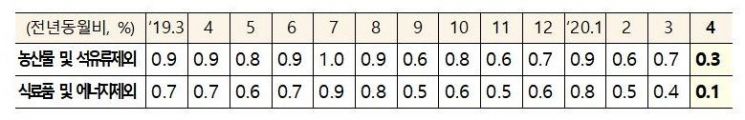

According to Statistics Korea on the 4th, the core inflation rate (excluding food and energy index) based on the Organization for Economic Cooperation and Development (OECD) standard rose by only 0.1% compared to the same period last year. This is the lowest level in 20 years and 4 months since December 1999 (0.1%), near the end of the International Monetary Fund (IMF) foreign exchange crisis.

Statistics Korea explained that the low core inflation rate resulted from policy effects such as free high school education and the reduction of the individual consumption tax on automobiles. Ahn Hyung-jun, Director of Economic Trend Statistics at Statistics Korea, said, "Policy effects such as free high school education, free school meals, and the reduction of the individual consumption tax on automobiles had an impact," adding, "The slowdown in the rise of dining-out prices due to COVID-19 also pulled down the OECD-based core inflation."

However, the fact that the core inflation rate remains at its lowest level since the foreign exchange crisis can be interpreted as a serious underlying low-price condition not only due to government policy effects but also from the demand side. Although the country will shift to a daily quarantine system from the 6th and provide emergency disaster relief funds within this month, it is uncertain whether consumer sentiment will rebound due to concerns about the resurgence of COVID-19.

Professor So-young Kim of the Department of Economics at Seoul National University said, "The current economic recession is more complicated than previous recessions," and expressed concern, saying, "Government consumption stimulation measures such as emergency disaster relief funds may slow down the decline in the inflation rate, but it is questionable whether they can cause a rebound."

Professor Tae-yoon Sung of the Department of Economics at Yonsei University stated, "This should be regarded as deflation. Even before the outbreak of COVID-19, prices were in deflation," explaining, "Because the GDP deflator is showing a negative value." He added, "Economic downturn caused by exports will continue, and if the economic downturn persists, it will further pull prices down into deflation."

On the same day, the Bank of Korea analyzed, "Comparing recent price trends in Korea and major countries, it appears that differences in the extent of COVID-19 spread and corresponding lockdown measures, in addition to global common factors such as the decline in international oil prices and global economic slowdown, are influencing the situation," adding, "In Korea, where full lockdown measures have not been implemented, supply chain disruptions are not as severe as in major countries, and there has been no hoarding of daily necessities, so factors driving commodity price increases are minimal. Meanwhile, government policies such as free high school education and reduction of individual consumption tax acted as additional downward pressure on prices."

In its monetary policy direction in April, the Bank of Korea forecasted that the core inflation rate would fall due to the expanded impact of the decline in international oil prices and weakening demand-side pressures. On the 20th of last month, former Monetary Policy Committee member Cho Dong-chul, who left the committee, said, "I hope that our economy, which the Bank of Korea leads, will not experience sudden stops or rapid accelerations, nor become a slow train heading toward deflation as some fear." This was a warning that if the Bank of Korea does not actively engage in monetary policy, the economy could fall into deflation.

Meanwhile, if the core inflation rate remains in the 0% range this year, it will be the third time in history and the first time ever to record a 0% range inflation rate for two consecutive years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)