[Asia Economy Reporter Joselgina] "The real 5G competition begins."

On the 3rd of next month, marking the first anniversary of 5G commercialization, the three domestic mobile carriers will officially enter into service competition. They will focus on discovering new 5G business models by designating 2020 as the inaugural year for business-to-business (B2B) transactions, as well as accelerating the development of 5G content. There are also numerous challenges to address before the popularization of 5G services, such as controversies over call quality and the lack of killer content. This year, the second year of commercialization, will also see the first public release of 5G quality evaluations.

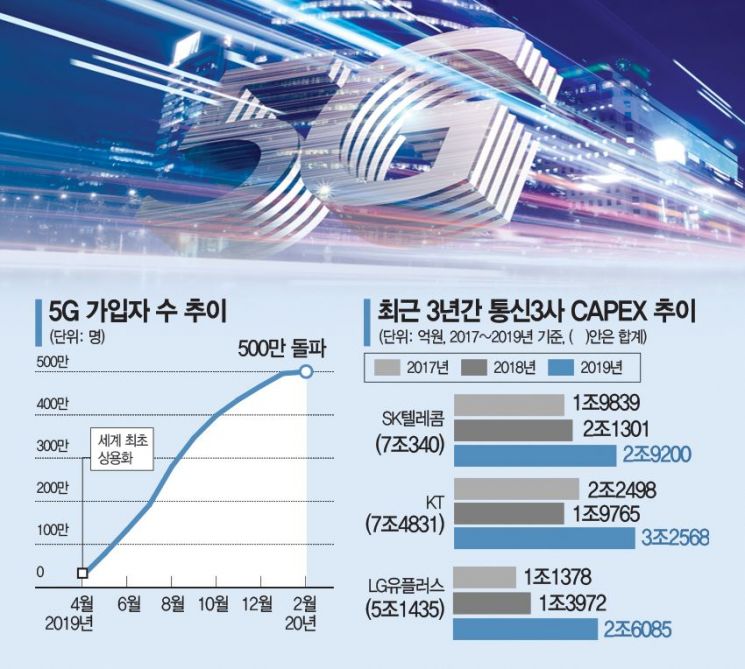

◆ 5 million subscribers in one year... 15 million expected this year = According to the Ministry of Science and ICT as of the end of February this year, the number of domestic 5G subscribers has surpassed 5 million, but the growth rate has clearly slowed. This is due to ongoing controversies over call quality and the reduction of subsidies from mobile carriers aimed at attracting subscribers. Recently, the impact of the novel coronavirus (COVID-19) has further frozen consumer sentiment, putting the goal of reaching 15 million 5G subscribers this year to the test.

For 5G to become widespread, it must first shed the stigma of being "5G that works worse than LTE (4G)." The three carriers have invested a staggering 19.6609 trillion KRW in network construction and other capital expenditures (CAPEX) over the past three years (2017?2019). More than 8 trillion KRW was invested in the first year of commercialization alone last year. However, most 5G base stations remain concentrated in the metropolitan area, and 5G service still drops in subways and buildings, indicating that there is still a long way to go before a nationwide network era is realized.

There are also criticisms that relying solely on private companies for 5G investment has its limits. To maintain Korea’s 5G leadership, having been the first in the world to commercialize, the government must actively participate in building infrastructure to realize "ultra-fast, ultra-low latency, and ultra-connectivity." The lack of 5G-specialized killer content remains a challenge. An industry insider said, "Although we hold the title of 'world’s first,' we are not free from consumer criticism that it is '5G in name only' and 'there is nothing to see,'" adding, "Support measures such as tax credits to attract investment are necessary."

◆ Turning eyes overseas instead of cutthroat competition... Content war = However, Korea’s early establishment of 5G infrastructure has clearly yielded market preemption effects. The 5G leadership demonstrated by SK Telecom, KT, and LG Uplus has led to new business ventures with renowned global companies such as Microsoft (MS), and there have been trickle-down effects like increased market shares for domestic smartphone and telecommunications equipment companies.

On the first anniversary of commercialization, the three carriers plan to shift from exhausting competition limited to the domestic market to accelerating the discovery of business models with global companies.

SK Telecom declared a "challenge to become the world’s best 5G through ultra-collaboration with leading domestic and international companies." The cloud gaming service currently being prepared jointly by SK Telecom and MS is attracting attention as a "game changer" that will disrupt the existing industry landscape. KT is also focusing on expanding content, aiming to officially launch its "5G streaming game," currently in open beta, within the first half of the year.

LG Uplus aims to actively expand exports of 5G content to Europe and Southeast Asia. To this end, it will invest 2.6 trillion KRW over five years in content and technology development. It is developing AR content that uses augmented reality (AR) technology to display internet search results as immersive images in collaboration with Google, and is also expanding its 3D AR English fairy tale service.

◆ The 'blue ocean' B2B market is being laid out = The industry views the true battleground for 5G as the B2B market. Significant innovation is expected as 5G infrastructure is applied across various industries such as smart factories, smart hospitals, and autonomous vehicles.

Declaring 2020 as the inaugural year for B2B, SK Telecom plans to lead the cloud industry revolution by establishing 5G mobile edge computing (MEC) hubs in 12 locations nationwide. KT plans to transform all industries with 5G, focusing on seven key areas including smart factories, connected cars, and immersive media. As of the end of last year, it has discovered 150 B2B application cases and secured 53 corporate-exclusive 5G customers. LG Uplus is also accelerating new business opportunities by advancing 5G autonomous driving technology and integrating communication networks for drone businesses. Yoo Sang-young, head of SK Telecom’s MNO business division, said, "We are confident that the 5G business models to be launched in earnest this year will drive the next decade."

However, there are criticisms that neither operators nor the government are fully prepared to expand the B2B market. It is explained that there is a need to review the entire regulatory system, including reporting and approval systems, to respond to market changes.

The three carriers will continue investing in 5G networks this year. It is expected that the 28 GHz band, which offers ten times the bandwidth of the existing 3.5 GHz frequency band, will be opened within the year, and 5G standalone mode (SA) will be established. The Ministry of Science and ICT will publicly release the results of the 5G communication service quality evaluation by the three carriers for the first time in July.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)