February Surrenders Refunds of Top 3 Life Insurers Up 17%

Non-life Insurers Also See Increased Refunds and Decreased New Subscriptions

[Asia Economy Reporter Oh Hyung-gil] Insurance planner Jeong Mi-ok (66, pseudonym) was devastated upon hearing recent news about a client who had signed up for indemnity health insurance and disease insurance through her.

Choi Yoon-soo (69, female), who ran a beauty salon, recently faced severe business difficulties as customers decreased due to the novel coronavirus infection (COVID-19). Ultimately, unable to bear the insurance premium burden, she decided to cancel her insurance. Jeong tried to persuade her to reduce the premium or defer payment for a certain period instead of canceling, but she could not change Choi’s mind.

The problem arose after the insurance was canceled. Choi, who visited a hospital with a sore throat, was diagnosed with thyroid cancer. Upon hearing that Choi, who had already canceled her insurance, was struggling with medical bills, Jeong said, "Recently, there have been cases where people cancel insurance due to family circumstances," adding, "People believe they are healthy, but incidents like Choi’s happen," expressing her regret.

Seventy-four-year-old grandmother Choi Soon-ok (74, female) was also diagnosed with lung cancer but could not receive insurance benefits because she had canceled her insurance. Her children encouraged her to sign up when senior cancer insurance was launched last year. Hesitant due to financial difficulties but persuaded by her children who mentioned family history, she underwent a medical checkup and signed a contract with the lowest premium.

However, Choi canceled her insurance in January, the 10th month after signing up, citing financial burdens. Last month, she visited a hospital for a regular checkup for the elderly due to the COVID-19 situation and was diagnosed with lung cancer. There were no issues in the medical checkup at the time of insurance enrollment, but the cancer developed within a year.

The insurance planner in charge of Choi said, "I tried to dissuade her from canceling, saying that even a few tens of thousands of won in premiums is not a small amount for the grandmother, but I eventually had to give up," adding, "It is a very unfortunate story how such things happen."

Due to the COVID-19 crisis, low-income people who are struggling to secure daily living or education expenses are increasingly canceling their insurance mid-term as a means of livelihood.

However, there are also cases where insurance benefits cannot be received due to sudden illnesses or accidents. When unexpected high medical expenses occur, household finances can be completely shaken. Experts recommend postponing insurance cancellation until the last moment and finding ways to maintain at least minimal coverage.

According to the industry on the 27th, the surrender refunds of the three major life insurance companies increased by 17% compared to the same period last year during the nationwide spread of COVID-19 last month. The surrender refunds for long-term insurance of the five major non-life insurance companies also increased by 22.7%.

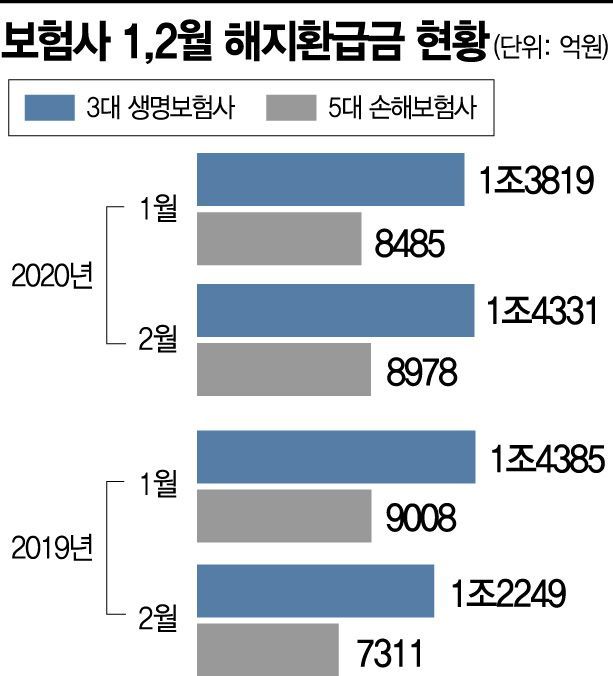

Looking at monthly figures, the surrender refunds of the three large life insurers were 1.3819 trillion won in January, down from 1.4385 trillion won in the same period last year, but expanded from 1.2249 trillion won to 1.4331 trillion won in February.

The surrender refunds of the five non-life insurers were 848.5 billion won in January and 897.8 billion won in February. Although January (900.8 billion won) was less than the previous year, February (731.1 billion won) saw a sharp increase.

It is analyzed that as debts increase or living expenses become burdensome, people are reluctantly canceling insurance contracts that require monthly payments.

The problem is that cases are occurring where diseases are discovered after cancellation, and insurance benefits cannot be received. An insurance planner said, "Since COVID-19, inquiries about insurance cancellations from subscribers suffering financial difficulties have greatly increased," adding, "I sometimes hear that elderly people who discovered diseases after canceling insurance are burdened with hospital bills."

COVID-19 is also affecting new subscriptions. The number of new long-term insurance contracts at A Non-Life Insurance Company decreased from about 58,000 in the first week of February to 55,000 in the second week. It dropped to 48,000 in the third week and sharply declined to 44,000 in the last week.

The insurance industry expects that whether the trend of insurance cancellations will continue long-term will be determined within this month. An industry official said, "Even this month, inquiries about insurance cancellations through planners or call centers are increasing," adding, "Insurance can cause losses if canceled mid-term, and it is advantageous to keep it as a last safety net in case of emergencies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)