More Stable Than Real Estate Investments Competing With REITs

Expanding Investment in Intellectual Property (IP) Such as Films and Patent Rights

What can I do for my favorite singer? I can go to concerts in person or buy albums. But there is also a way to go beyond simply purchasing products and instead invest directly in song copyrights and share streaming revenue. Royal, a U.S. music investment platform, sold fractional interests in tracks by hip-hop artist Nas, who won the Best Rap Album at the 63rd Grammy Awards in 2021. Fans bought portions of the streaming royalty revenue from two of his songs and thus invested directly in his music. For each song, Royal issued tokens in different tiers (Gold, Platinum, Diamond) and structured the royalty shares and additional perks differently by tier. For example, when investing in one of Nas's songs, "Rare," it issued 700 Gold tokens, 400 Platinum tokens, and 10 Diamond tokens, priced at 99 dollars, 499 dollars, and 9,999 dollars, respectively. Purchasing a Diamond token gives the holder about a 2% royalty share, along with benefits such as VIP concert tickets.

Individuals can also invest directly in movies scheduled for release. In 2024, Japan's Phillip Securities raised production costs for the film "Treasure Island" through security tokens. Investors participated in the distribution of film revenues, including box office, distribution, and broadcasting, and received additional perks such as having their names shown in the ending credits. The film was actually released in September last year, and it also achieved commercial success, with its lead actor being nominated for Best Actor at the Japan Academy Film Prize.

The security token offering (STO) market is moving beyond its early, real estate-centered phase and rapidly expanding its asset classes into broader areas such as intellectual property (IP). As the government adopts IP security tokens as a policy agenda and the industry responds swiftly, the market's center of gravity is visibly shifting.

According to the digital asset industry on the 6th, the Presidential National Intellectual Property Committee (NIPC) held the "2026 1st IP Policy Forum" on January 29. The theme was "Connecting IP royalties with private capital through security tokens." Through this, the government expressed its intention to expand security tokens beyond fractional real estate investment into the high value-added domain of "IP finance." NIPC Chairperson Lee Kwanghyung stressed that intellectual property must evolve from a mere legal right into a financial asset, saying, "A security token model based on intellectual property royalties will serve as a primer that draws private capital into the field of technology and solidifies the era of KOSPI 5000." IP security tokens refer to securities-type tokens, issued on a blockchain, that fractionalize the economic rights arising from IP such as copyrights, patents, and trademarks.

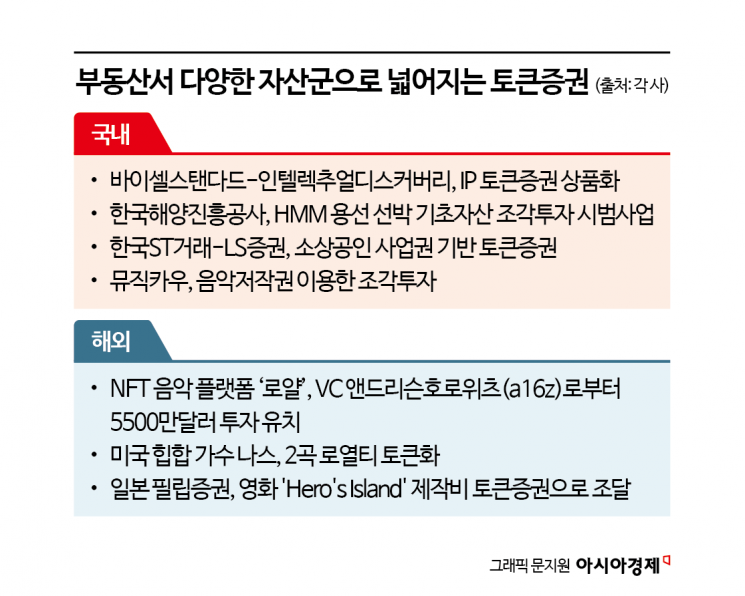

The private sector is also moving immediately toward commercialization. Intellectual Discovery, an IP-specialized company, and BuySellStandard, which operates the security token platform "Piece," have begun joint commercialization of security tokens based on patent IP. On January 28, when the Experics Group invested 3 billion won in BuySellStandard, the two companies formed this cooperative relationship on the premise of jointly developing IP security token products. Intellectual Discovery holds key domestic and overseas patents and generates revenue through licensing. BuySellStandard specializes in turning real assets, as well as non-standard assets such as artworks and vessels, into security tokens.

IP security tokens have many advantages over existing, standardized real estate security tokens. Real estate security tokens are structured around individual buildings, specific projects, or a single income right, so risks related to vacancy, rent levels, and falling asset values can be passed on to investors. By contrast, IP security tokens can provide stable cash flow through licensing income generated by the patent portfolio itself. BuySellStandard CEO Shin Beomjun explained, "Patents have a stable royalty revenue structure, so the predictability of cash flow is higher compared to real estate." There is also an assessment that real estate-centered fractional investments are at a disadvantage compared to similar products such as real estate investment trusts (REITs), since they merely securitize real estate income. Joh Jeonghyun, a researcher at IBK Investment & Securities, stated, "Unless real estate STOs at the individual asset level offer additional conditions that REITs cannot provide, investors will choose REITs, which offer greater liquidity and institutional stability."

The domestic security token market is rapidly expanding from early art and real estate-based security tokens into non-standard assets such as vessels and IP. Last year, the Korea Ocean Business Corporation launched a pilot fractional investment project using HMM chartered vessels as underlying assets, and the "Centennial Store" small business license-based security tokens issued by Korea ST Exchange and LS Securities were designated as an innovative financial service. CEO Shin said, "The security token market is moving beyond the real estate-centered 1.0 era and entering a 2.0 era in which non-standard assets such as IP, vessels, and content are combined," adding, "Now that legislation has been completed and the government has set IP security tokens as a policy agenda, whoever brings actual products to market first will determine who captures the initiative in the early market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.