Top-tier non-life insurers stick with shareholder returns

Industry remains cautious amid earnings pressure

Auto premium hike impact not expected until the second half

Major non-life insurers in Korea are accelerating shareholder returns by increasing dividends despite a decline in net profit. However, as rising loss ratios and a slowdown in the Contractual Service Margin (CSM) are adding to earnings pressure across the industry, there is a view that dividend expansion will be limited for insurers outside the top tier. The impact of auto insurance premium hikes and system improvements, introduced amid a worsening auto insurance loss ratio, is expected to become visible after the second half of this year.

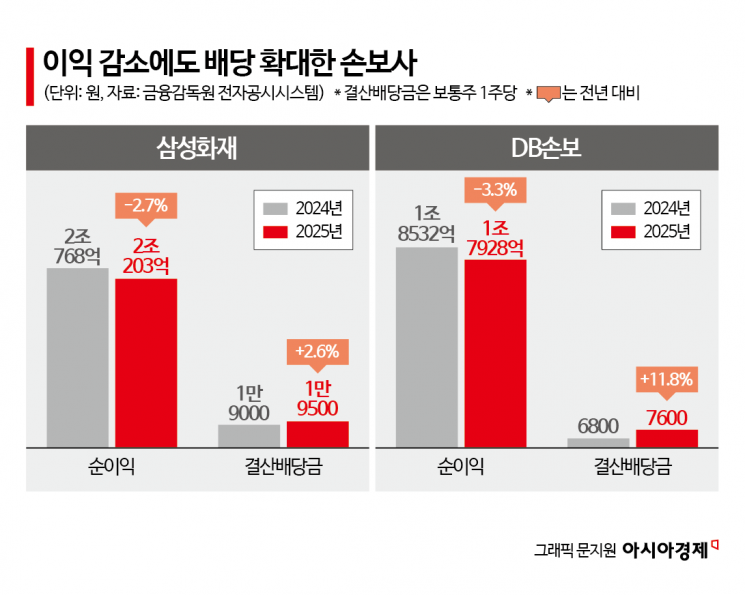

According to the financial sector on February 6, some large non-life insurers are maintaining their shareholder-return stance even though last year’s results were weaker than the previous year. Samsung Fire & Marine Insurance posted a provisional net profit of 2.0203 trillion won last year, down 2.7% year-on-year, but decided on a year-end dividend of 19,500 won per common share, increasing the total dividend amount by 2.6% from a year earlier. DB Insurance also recorded a provisional net profit of 1.7928 trillion won, down 3.3% from the previous year, but set its dividend at 7,600 won per share, up 11.8% year-on-year.

While these large non-life insurers are signaling a strong will to expand dividends and speeding up shareholder returns, industry observers expect that it will be difficult to anticipate similar dividend increases from companies other than Samsung Fire & Marine Insurance and DB Insurance, which rank first and second in the non-life insurance sector. This is because there is a growing possibility that the sector’s overall earnings will fall short of market expectations. As the cost burden from loss-making contracts increases, insurance sales are also expected to decline, and the rising share of special promotional driver insurance products with low conversion multiples is likely to push down new business CSM. In addition, existing in-force CSM is also projected to decrease, due to factors such as only limited premium rate hikes for first- and second-generation indemnity health insurance products and the reflection of higher education tax.

Insurers move to raise auto insurance premiums... but impact will take time

In particular, the auto insurance loss ratio is being pointed to as a key factor weighing on earnings. By the end of last year, the auto insurance loss ratio of the four major players - Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, and KB Insurance - reached 96.1%. It was the first time since 2020 that the monthly loss ratio had been in the 96% range. Seasonal year-end factors that increased vehicle traffic, along with four consecutive years of premium cuts and higher property damage payouts such as parts costs, drove a sharp rise in the loss ratio.

In response, the non-life insurance industry has decided to raise auto insurance premiums for the first time in five years, after having reduced them in the name of inclusive finance. Samsung Fire & Marine Insurance will raise auto insurance premiums by 1.4% starting on the 11th. DB Insurance and Hyundai Marine & Fire Insurance will each apply premium hikes of 1.3% and 1.4%, respectively, from the 16th. KB Insurance will raise premiums by 1.3% from the 18th, and Meritz Fire & Marine Insurance will also implement a 1.3% increase starting on the 21st.

Some non-life insurers had earlier argued that a hike of around 2.5% was necessary, but it is understood that the increase was adjusted to the 1%-range through consultations with financial authorities. On this, Jung Taejoon, an analyst at Mirae Asset Securities, commented, "A 1%-range increase in auto insurance premiums is not high enough to fully offset the impact of the premium cuts that have been in place since 2022," adding, "Because the effect of premium hikes is only fully reflected about 12 months after implementation, it will be difficult to expect a quick improvement in earnings."

The environment for a rebound in non-life insurers’ earnings is expected to be in place after the second half of this year. Kang Seunggun, an analyst at KB Securities, said, "If auto insurance premium hikes and system improvements for patients with minor injuries move forward, there is a possibility that we will see the start of a loss-ratio improvement cycle by the fourth quarter of this year at the latest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.