Ruling Bloc and Opposition Both Weigh Deregulation

Will Dawn Delivery Finally Open Up for Hypermarkets?

Sunday Mandatory Closure Rules Still in Place

A "Half Measure" for Declining Hypermarkets

The Only Segment in Reverse Growth... Sluggish Outlook for Q4

While the hypermarket sector has been suffering from a prolonged downturn, there are signs that the business regulation banning dawn deliveries, which has been in place for 14 years, may be eased. If hypermarkets start dawn delivery services by utilizing their offline stores nationwide, they may gain some breathing room by recapturing demand that has shifted to the online market. However, there are also concerns, as the burden of labor costs and other expenses associated with late-night work is considerable.

According to the retail industry on the 5th, the Democratic Party of Korea, the government, and the presidential office held a working-level meeting the previous day at the Export-Import Bank of Korea headquarters in Yeouido, Seoul, to discuss adding an exception clause to Article 12-2, "Restrictions on Business Hours of Large-Scale Stores, etc.," of the current Distribution Industry Development Act.

Under the current Distribution Industry Development Act, large retailers are required to close twice a month on public holidays and are restricted from operating between midnight and 10 a.m. It is reported that officials discussed a plan under which the late-night business hour restrictions would not apply to online ordering and delivery.

The opposition bloc has also introduced a bill to ease regulations on hypermarkets' online operations. Kim Sungwon, a lawmaker from the People Power Party, proposed an amendment to the Distribution Industry Development Act that would exempt hypermarkets from business hour limits and mandatory closure rules when they are engaging in online order delivery. The bill also stipulates that corporate supermarkets (SSMs) operated by franchise owners be excluded from the scope of business regulations.

Homeplus Faces Liquidation Risk, Hypermarkets at a Crossroads of Survival... Gap Widens with Online Players Like Coupang

The shift in political sentiment comes as criticism has mounted that business regulations on hypermarkets have created an "unlevel playing field" in the retail market, especially after Coupang's personal data leak incident. Since the COVID-19 pandemic, the center of consumption has moved to the online market, enabling Coupang, which led with dawn delivery, to grow rapidly. In contrast, hypermarkets that rely on offline stores have been shackled by business regulations and have continued to post negative growth.

In particular, the current law, which restricts operations from midnight to 10 a.m. and mandates compulsory closures, has fundamentally blocked hypermarkets from using their stores as urban logistics hubs. As a result, some point out that it has been nearly impossible for them to compete with e-commerce platforms that emphasize fast delivery.

In fact, hypermarkets were the only segment in the entire retail industry to see a decline in sales last year. According to the "2025 Retail Sales Trend" report from the Ministry of Trade, Industry and Energy, hypermarket sales fell 4.2 percent year-on-year, while department store sales rose 4.3 percent and online retail grew 11.8 percent over the same period.

Their presence in the retail market is also weakening rapidly. Last year, hypermarkets accounted for 9.8 percent of total retail sales, falling below 10 percent for the first time. Their share, which was 15.1 percent in 2021, has dropped by more than 5 percentage points in just four years. Over the same period, the online retail share expanded from 52.1 percent to 59 percent.

By contrast, Coupang's sales jumped from 31.8298 trillion won in 2023 to 41.2901 trillion won in 2024, an increase of nearly 10 trillion won in just one year. Meanwhile, the combined sales of the three major hypermarket chains - Emart, Lotte Mart, and Homeplus - have stagnated in the 28 trillion won range from 2022 to 2024. The number of their stores also fell to 368 last year, down 26 from 2020.

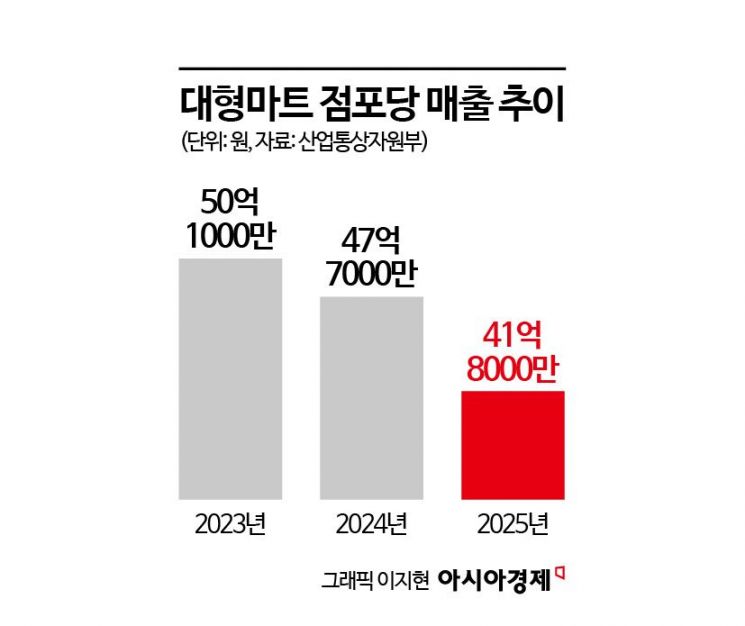

As of December last year, sales per hypermarket store stood at 4.18 billion won, down 7.1 percent from the same month a year earlier. Excluding months that include Lunar New Year and Chuseok, negative growth was repeated in most months of the year. While securities firms expect Emart and Lotte Shopping to post improved results in the fourth quarter of last year compared with a year earlier, they also project that weakness in the discount store segment will make it difficult for them to significantly exceed market expectations.

"At This Rate, Survival Is at Risk"... Mandatory Closures Also Need to Be Abolished

Industry players welcome the discussion on easing regulations, but many argue that it may end up being only a "half measure." They point out that if dawn delivery is allowed, labor costs will increase further, and if the rule requiring two mandatory closure days per month remains in place, it will be difficult to fully capture weekend and holiday demand.

Expected benefits also differ by company. Emart is considered the biggest potential beneficiary of expanded dawn delivery, based on its nationwide store network and logistics infrastructure. It can strengthen store-based quick commerce through integration with SSG.com. Lotte Mart is looking for synergies with Lotte On, but as it is simultaneously working to streamline its store network, it is cautious about aggressive expansion. As for Homeplus, given its relatively heavy financial burden, some predict that the tangible impact of deregulation will be limited.

An industry insider said, "Current regulations, contrary to the stated goal of protecting traditional markets, are structured in a way that only strengthens large platforms," adding, "Without a fundamental review of the system, including mandatory closures, it will be difficult to stop hypermarkets from continuing to decline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.