Samsung Electronics and SK Hynix 2x Leveraged ETFs

Top Ranks in Custody and Net Purchases on Hong Kong Exchange

Domestic Asset Managers: "Greater Product Variety Expected"

As early as the first half of this year, single-stock leveraged exchange-traded funds (ETFs) targeting leading domestic stocks such as Samsung Electronics and SK Hynix are expected to be launched in Korea. Given their proven popularity in the Hong Kong stock market, where they rank among the top performers, there is keen interest in whether the introduction of single-stock leveraged ETFs in the domestic market will attract demand that previously flowed to overseas markets.

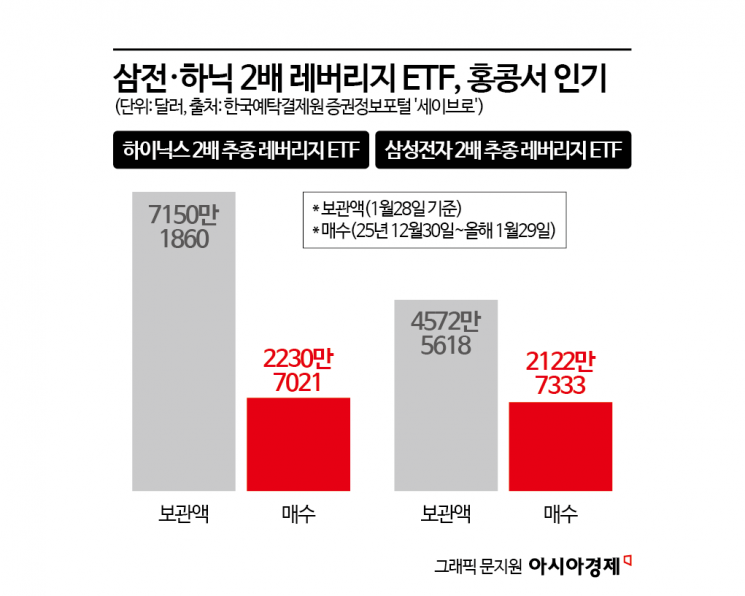

According to the Korea Securities Depository’s securities information portal, SEIBro, on February 2, Hong Kong asset management company CSOP’s “Samsung Electronics 2x Leveraged ETF” and “SK Hynix 2x Leveraged ETF,” both launched last year, ranked among the top 50 stocks by custody value on the Hong Kong Stock Exchange as of January 28. The combined custody value of these two ETFs reached 117.23 million dollars. The SK Hynix 2x Leveraged ETF had a custody value of 71.50 million dollars, ranking 10th, while the Samsung Electronics 2x Leveraged ETF had a custody value of 45.72 million dollars, ranking 14th on the Hong Kong Stock Exchange.

During the one-month period ending January 29, the SK Hynix 2x Leveraged ETF saw purchases totaling 22.31 million dollars, and the Samsung Electronics 2x Leveraged ETF recorded purchases of 21.23 million dollars. In particular, the Samsung Electronics 2x Leveraged ETF achieved net purchases of 6.89 million dollars, ranking third on the Hong Kong Stock Exchange over the same period.

Until now, single-stock leveraged ETFs have not been available in Korea. Due to financial regulatory restrictions, the proportion of any single stock in an ETF was limited to 30%, and at least 10 stocks were required to be included. On January 30, the Financial Services Commission announced a draft amendment to the enforcement decree that would allow the listing of “single-stock 2x leveraged ETFs” in Korea. The Commission stated that it plans to revise the enforcement decree and related regulations in the second quarter of this year, and to complete follow-up measures such as system development. After reviews by the Financial Supervisory Service and the Korea Exchange, the products will be able to launch.

Domestic asset management companies are preparing to develop products such as single-stock leveraged ETFs. Nam Yongsoo, Head of ETF Management at Korea Investment Management, said, “We believe there is sufficient demand, as many domestic investors are already investing in single-stock leveraged and covered call ETFs listed overseas.” Another asset management company official stated, “With the lifting of the 30% single-stock limit, we expect a greater diversity of products to be offered.”

Once single-stock leveraged ETFs are fully launched on the domestic stock market, it is expected that investors who previously had no other choice but to buy ETFs listed on overseas exchanges will be drawn back. Lee Eogwon, Vice Chairman of the Financial Services Commission, stated at a press conference on January 28, “There has been an issue where various ETF investment demands could not be met due to the asymmetric regulation that allowed launches overseas but not domestically. We will swiftly improve the regulations to enhance the attractiveness of the domestic capital market.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)