Consumer Insight Survey on Domestic Traveler Accommodation Trends

Hotels Ranked No. 1 Accommodation Choice Last Year

Share Rose 1.8 Times Compared to 2017

Increase in Mid- and Low-Priced Three-Star Hotels Drives Growth in Hotel Stays

Hotels are solidifying their position as the primary accommodation option for domestic travel in Korea. With clean facilities and high convenience, the proportion of not only individual travelers but also families opting for hotel vacations-so-called "hocance" (hotel + vacance)-is on the rise.

A comparison of the types of accommodations used and reasons for choice by domestic travelers over nine years before and after COVID-19 (2017-2025) shows that hotels ranked first as the preferred lodging place last year. Getty Images

A comparison of the types of accommodations used and reasons for choice by domestic travelers over nine years before and after COVID-19 (2017-2025) shows that hotels ranked first as the preferred lodging place last year. Getty Images

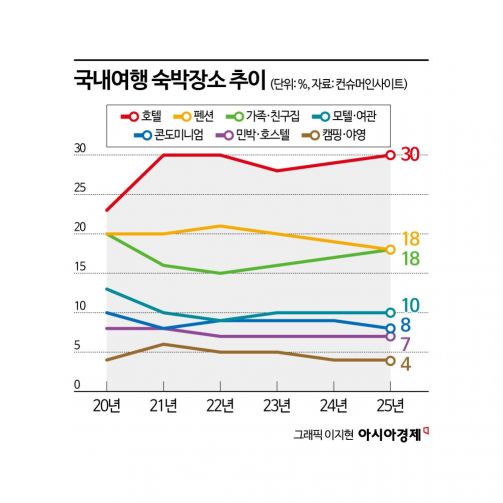

According to Consumer Insight, a travel research institute, which compared the types of accommodations used and the reasons for selection among domestic travelers over the nine years before and after COVID-19 (2017-2025) based on an annual sample of 26,000 people, hotels ranked first as the preferred lodging place last year. The survey found that 3 out of 10 domestic travelers (30%) stayed at hotels. This figure has increased by 1.8 times over eight years, up from 17% in 2017.

In the Travel Corona Index (TCI), which sets 2019-the year before COVID-19-as 100 and tracks changes over time, hotels recorded a score of 126 last year, marking a 26% increase compared to six years ago. In contrast, pensions and condominiums, which were previously popular as family or group travel accommodations, saw their TCI drop to 83 and 74, respectively, reflecting a 17-26% decline from 2019. Motels and inns (87), as well as cost-saving options such as staying at the homes of family or friends (99), and guesthouses or hostels (95), also showed slight decreases.

When choosing accommodations, domestic travelers cited "cost" (22%) as the most important factor. The TCI for cost was 135, representing not only the only increase among the surveyed factors compared to before COVID-19, but also the largest jump. This is interpreted as a result of ultra-frugal travel becoming inevitable due to high inflation and economic downturn. Next in importance were "distance and transportation" (21%), "accommodation and room environment" (17%), and "surrounding environment and scenery" (14%), but for most of these, the significance either declined or stagnated compared to the past. Notably, the importance of distance and transportation, room environment, and surrounding scenery-which were previously the top factors in accommodation selection-has dropped significantly.

Based on the survey results, the increase in preference for hotels-which are relatively more expensive-and the prioritization of cost when traveling may seem contradictory. Regarding this, Consumer Insight explained, "Recently, the number of mid- to low-priced hotels with clean facilities at reasonable rates has increased, and more people are using them for general accommodation purposes."

In fact, the proportion of travelers who experienced hotels rated four to five stars or higher versus those rated three stars or lower shifted from an even split in 2017 (12% vs. 12%) to 14% vs. 16% last year, with the share of three-star-or-lower hotels continuing to rise. This trend is also influenced by the normalization of small-group trips with two or fewer people, and the growing popularity of culinary travel, where travelers prefer exploring local restaurants outside the hotel rather than dining in.

A representative from Consumer Insight stated, "Hotels surpassing pensions to become the leading accommodation option signifies a structural change in domestic travel, rather than just a passing trend," adding, "With the rise of rational consumption and ultra-frugal travel, seeking accommodations that are hygienic, convenient, and not overly expensive is becoming the new normal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)