Industrial Activity Trends for December 2025 and the Year

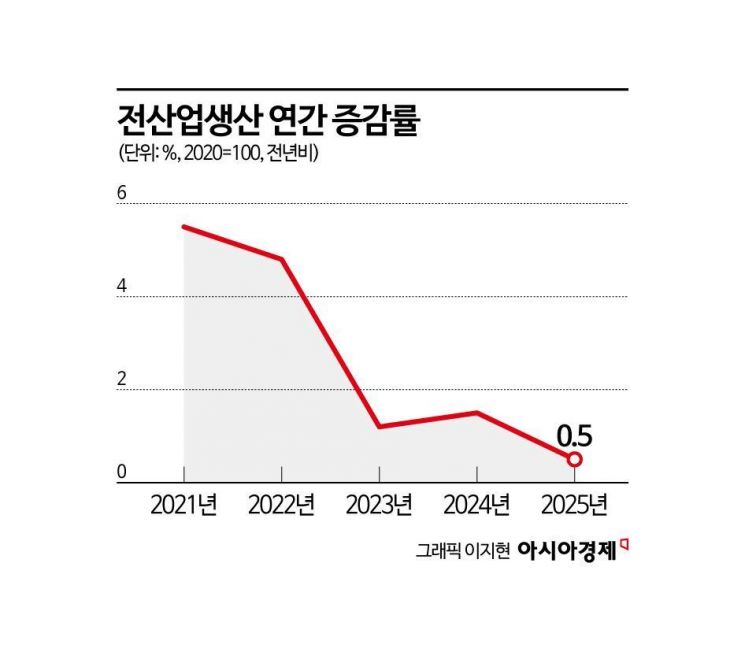

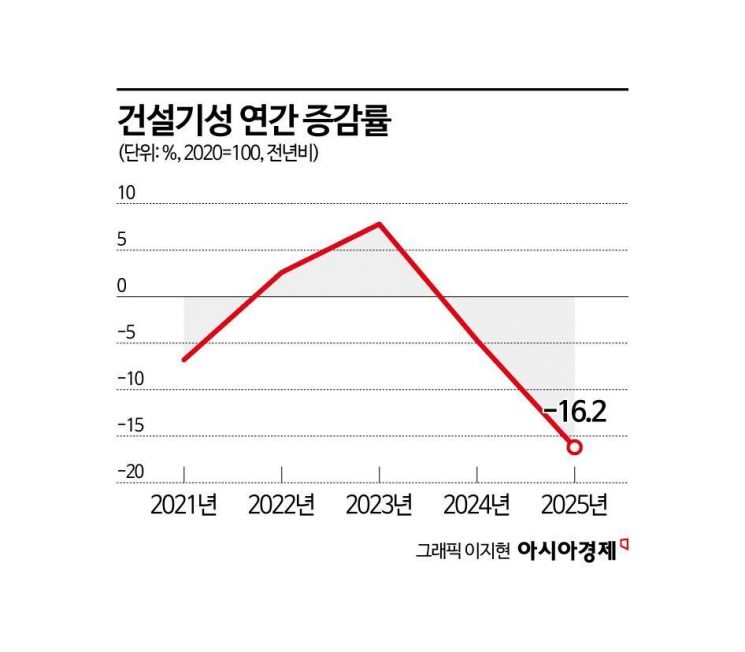

Last year, the growth rate of total industrial production reached its lowest level in five years. While manufacturing and service industries, led by semiconductors, showed signs of recovery, construction performance recorded the largest decline since statistics began, exerting downward pressure on the economic rebound.

According to the "December 2025 and Annual Industrial Activity Trends" released by the National Data Office on January 30, total industrial production in the previous year increased by 0.5% compared to the year before. Although positive growth was maintained, the increase was the lowest since 2020 (-1.1%), when the COVID-19 recovery phase began in earnest. It was also the first time in four years, since 2021, that production, consumption, and investment all recorded positive growth.

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and announced that tariffs on automobiles and semiconductors are also under consideration. On February 13, 2025, export vehicles were waiting to be loaded at Pyeongtaek Port, Gyeonggi Province. Photo by Jinhyung Kang

President Donald Trump signed a proclamation imposing a 25% tariff without exceptions on steel and aluminum products imported into the United States, and announced that tariffs on automobiles and semiconductors are also under consideration. On February 13, 2025, export vehicles were waiting to be loaded at Pyeongtaek Port, Gyeonggi Province. Photo by Jinhyung Kang

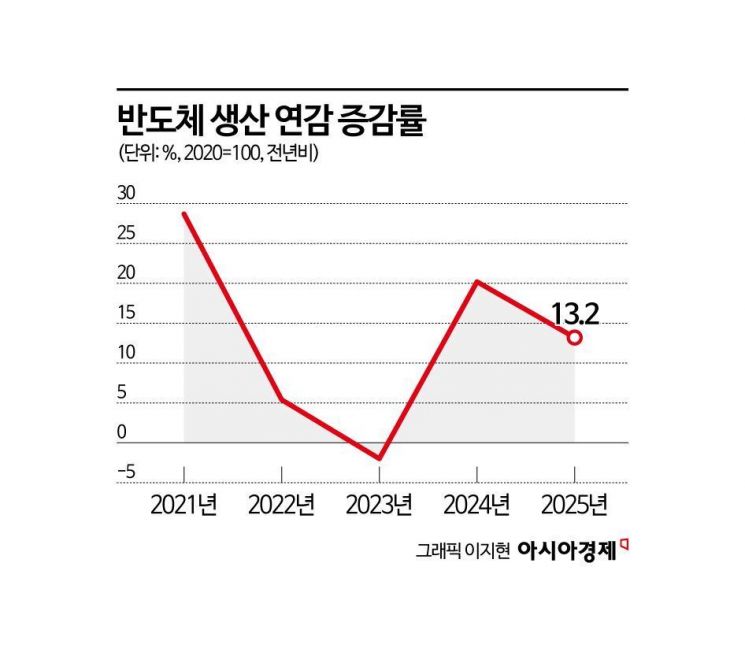

Production Driven by Semiconductors and Shipbuilding

The boom in semiconductors and shipbuilding drove total industrial production last year. Mining and manufacturing production rose 1.6% year-on-year, with semiconductor production jumping 13.2%. Increased demand for high-performance memory for artificial intelligence (AI) servers and mobile application processors (APs) fueled the growth in production. This led to a virtuous cycle throughout the industry, with ripple effects on semiconductor components and equipment, related wholesale and retail, and facility investment.

In shipbuilding, orders for high-value-added vessels such as liquefied natural gas (LNG) carriers and special-purpose ships led to a 23.7% surge in other transportation equipment production. Lee Dowon, Director of Economic Trend Statistics at the National Data Office, analyzed, "Last year, mining and manufacturing production was driven by semiconductors and high-value-added ship types in the shipbuilding sector."

On the other hand, the sluggish construction market acted as a drag on production. Production of non-metallic minerals, including ready-mixed concrete and cement, fell by 12.3%, and primary metals dropped by 3.3%, both recording double-digit declines. The downturn in construction affected related industries across the board, including steel and construction materials.

Retail sales, which had recorded negative growth for three consecutive years, turned positive for the first time in four years, rising 0.5% last year. After a temporary demand stagnation for electric vehicles, passenger car sales increased by 11%, leading to a 4.5% rise in overall durable goods consumption. However, the gap between sectors remained significant. Semi-durable goods such as clothing and footwear fell by 2.2%, and non-durable goods such as cosmetics also declined by 0.3%.

Investment: Facility Investment Recovers, Construction Down by Record 16.2%

Last year, facility investment grew by 1.7%, driven by increased investment in semiconductor manufacturing machinery, precision instruments, and electric passenger car facilities. This is seen as a partial operation of the typical economic recovery path, where production recovery leads to facility investment.

However, construction performance, which reflects the value of domestic construction completed by contractors, fell by 16.2% year-on-year as both building and civil engineering declined. This is the largest drop since statistics began in 1998, and the biggest since the 2008 financial crisis (-8.1%). Director Lee explained, "Construction performance was extremely poor on an annual basis, and this was the biggest downward pressure on industrial activity last year."

Looking at December 2025 alone, total industrial production grew by 1.5% from the previous month. Retail sales also increased by 0.9%. Increased sales of clothing and food products drove the rise in consumption. Government support payments for livelihood recovery are believed to have had some impact.

In contrast, facility investment fell by 3.6%. Investment in machinery such as precision instruments rose by 1.3%, but investment in transportation equipment, including ships and aircraft, declined by 16.1%. Construction performance increased by 12.1%, with both building (13.7%) and civil engineering (7.4%) showing gains.

The coincident composite index of cyclical variation, which indicates the current economic situation, stood at 98.5, down 0.2 points from the previous month. This index has been negative for three consecutive months after turning downward by 0.4 points in October last year. The leading composite index of cyclical variation, which signals future economic trends, rose by 0.6 points to 103.1 compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)