LucentBlock Raises Objections After SFC Selection and Elimination

Agenda Postponed Twice... Pressure Mounts Ahead of First STO Approval

"Missing the Golden Window"?Industry Concerns Grow Amid Inevitable Debates Over Fairness and Political Pressure

After the institutionalization of Security Token Offerings (STO), financial authorities are facing prolonged deliberations over the approval of an over-the-counter (OTC) marketplace for fractional investment, which will be responsible for STO distribution. Following LucentBlock's objections-despite being effectively eliminated from consideration-and even President Lee Jaemyung directly addressing the issue, the Financial Services Commission (FSC), with only its final regular meeting remaining, has felt enough pressure to postpone the agenda item twice. Given the symbolic weight of being the 'first approval under the STO institutionalization,' combined with allegations of technology theft and controversy over political pressure, experts now say that any decision is likely to spark further controversy.

FSC’s Prolonged Deliberations... Considering Returning to Subcommittee Stage-Why?

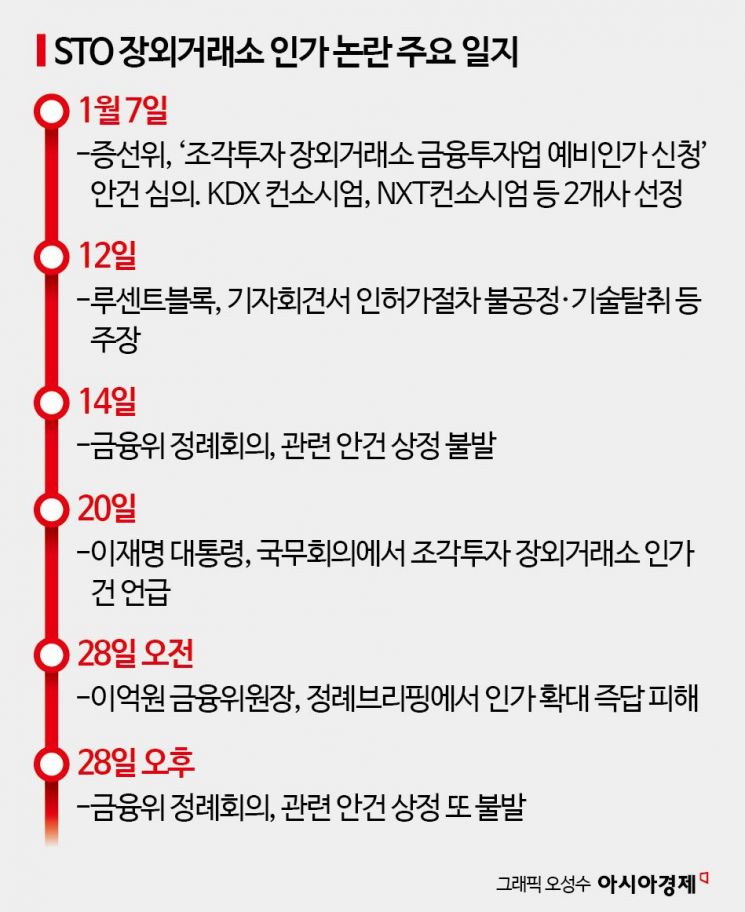

According to the financial investment industry on February 2, the agenda item for preliminary approval of the 'STO OTC Exchange,' which was originally expected to be discussed at the FSC’s regular meeting on January 14, is now projected to be considered no earlier than February 11. Although the agenda had already passed the Securities and Futures Commission (SFC) under the FSC on January 7, it was not included in the subsequent regular meetings of the FSC (January 14 and 28), resulting in a delay of over a month. Given that passing the SFC is typically seen as clearing the most significant hurdle in the approval process, this is considered a highly unusual situation.

Currently, the FSC is also considering sending the agenda item back to the subcommittee stage for further review. Since the FSC’s regular meeting is generally regarded as a formal final approval step after the SFC, this would effectively reverse the review process. An FSC official stated, "We are re-examining the issues that have been raised." Previously, the SFC had reportedly selected the 'KDX Consortium' led by Korea Exchange (KRX) and the 'NXT Consortium' led by Nextrade (NXT).

This shift in atmosphere appears to be influenced not only by LucentBlock’s allegations of unfairness and technology theft, but also by President Lee Jaemyung’s unusual mention of the individual licensing issue during a cabinet meeting, asking, "What decision has been made regarding the approval of fractional investment?" Since the President emphasized the importance of rational standards and sufficient explanation so that "the losing side does not feel wronged," the FSC is now compelled to revisit the matter, even if a decision had already been made.

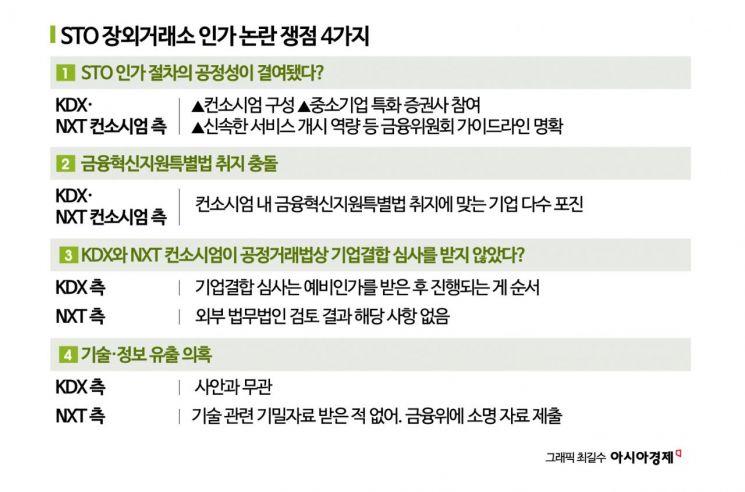

Additionally, there are ongoing calls-centered around the Ministry of SMEs and Startups-for improvements to the regulatory sandbox system. Critics argue that, contrary to the original intent of promoting institutionalization through pilot projects, opportunities are actually being concentrated among large companies with significant capital and scale. LucentBlock, a startup, operated an STO distribution service for seven years through the regulatory sandbox but failed to pass the recent SFC review. Furthermore, controversy has intensified after the Fair Trade Commission revealed that it had not been consulted in advance regarding the preliminary approval, further increasing political and public scrutiny of the issue.

Conditional Approval vs. Upholding SFC Decision... Controversy Unavoidable Either Way

The key issue is whether the financial authorities, who had previously indicated that two preliminary approvals would be granted, will also give conditional approval to the consortium led by LucentBlock, in addition to the KDX and NXT consortia. If LucentBlock is approved, it would amount to the authorities admitting that the previous SFC decision lacked sufficient procedural and formal legitimacy. This could reignite controversy over political pressure from both the political sphere and the market. The fact that public opposition from a specific company has brought the entire approval process to a halt and shaken the market as a whole is itself being criticized as another fairness issue.

Conversely, if LucentBlock is ultimately eliminated, the structural limitations of the regulatory sandbox-where the institutionalization of STOs ends up favoring large, capital-rich companies-will once again come under scrutiny. In this scenario, calls for institutional reform are likely to grow even stronger. Ultimately, no matter which of the three consortia is selected, controversy is expected to persist.

Industry insiders are particularly concerned that the prolonged confusion over the approval of the STO OTC exchange is already delaying the overall timeline for STO institutionalization. The amendment to the Capital Markets Act Enforcement Decree, which paved the way for the introduction of the STO OTC exchange, was passed in September of last year. The longer it takes to select operators, the more the implementation of related institutionalization will be delayed. Industry stakeholders, who have been waiting for institutionalization for years, warn that "missing the golden window for building the STO distribution infrastructure could undermine market trust itself."

Some observers even suggest that the technology theft allegations raised by LucentBlock could escalate into legal disputes. LucentBlock claims that NXT signed a non-disclosure agreement (NDA) under the pretext of investment review, received confidential materials, and then used them in the competitive approval process. Since startup technology theft is an issue the government views with particular sensitivity, if these allegations prove true, significant repercussions are inevitable. On the other hand, NXT acknowledges receiving materials from LucentBlock but argues that none of the contents should be considered confidential.

An industry source commented, "All the issues-including approval fairness, technology theft allegations, and controversy over political pressure-are intertwined. The FSC will be criticized for 'stalling' if it delays the decision, but any decision it makes will inevitably be controversial." The source added, "How the first step is taken will determine the future direction of the STO market." In this context, FSC Chairman Lee Eogwon avoided giving a direct answer to a question about the possibility of expanding the number of OTC exchange approvals to three at last week's regular briefing, saying, "After the decision, we will explain the results fairly and transparently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)