Biggest Rise Since the 2001 IT Bubble

Reflecting Hopes for Revitalization Policies and Expanded Pension Fund Investment

Concerns Over "Artificial Support" and Potential Losses for Individual Investors if the Bubble Bursts

The KOSDAQ index recorded its highest monthly gain in 25 years. Expectations for the government's KOSDAQ market revitalization policies are driving the index upward. Experts believe that, given the strong commitment of the government and the ruling party to support KOSDAQ, the index could rise further. However, there are also warnings that artificially boosting stock prices could create a bubble, potentially resulting in losses for individual investors.

KOSDAQ Index Rises 26% in January Alone... Highest in 25 Years

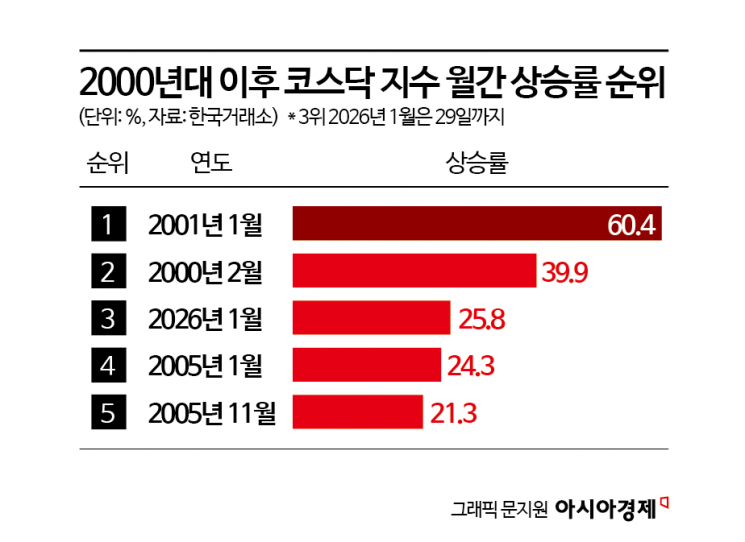

According to the Korea Exchange on January 30, the KOSDAQ index soared 25.8% this month compared to the previous month. This is the first time in 25 years, since January 2001, that the KOSDAQ index has surged more than 25% in a single month. Around the year 2000, the KOSDAQ index soared due to the IT bubble, and the current situation is as heated as it was back then. On this day, the KOSDAQ index opened at 1,166.23, up 1.82 points (0.16%) from the previous trading day. The index has been on a seven-day winning streak since January 22.

By investor type, institutional funds are driving the KOSDAQ index upward. Institutional investors have made net purchases of approximately 8.7 trillion won in KOSDAQ stocks this month. In contrast, individual investors have made net sales of about 7.3 trillion won, and foreign investors have also made net sales of around 20 billion won. However, analysis suggests that a significant portion of institutional funds actually comes from indirect investments by individuals, such as Exchange-Traded Funds (ETFs). As individual investors increased their purchases of KOSDAQ index ETFs, the online education site of the Korea Financial Investment Association (KOFIA) was temporarily paralyzed due to a surge in traffic on the morning of January 27. In Korea, investors must complete online education through KOFIA to purchase leveraged ETFs, and the increase in individual investment in KOSDAQ is believed to have caused the site to crash temporarily.

The main factor heating up KOSDAQ is the expectation for active market revitalization policies from the government and the ruling party. On December 19, the Financial Services Commission announced measures to enhance trust and innovation in the KOSDAQ market, starting a structural improvement of KOSDAQ by strengthening the delisting of underperforming companies, improving institutional investor access, and revitalizing IPOs for promising companies.

President Lee Jaemyung also encouraged the delisting of underperforming companies through his social media account the previous day, stating, "The stock exchange is like a department store. Who would visit if there are too many rotten or fake products with no value?"

The ruling party has also rolled up its sleeves to revitalize KOSDAQ. The Democratic Party's "KOSPI 5000 Special Committee" set a new target of KOSDAQ 3000 on January 22, stating, "We must usher in the era of KOSDAQ 3000 based on new financial infrastructure such as digital assets and token securities."

On the 26th, when the KOSDAQ index surpassed the 1000 mark for the first time in over four years, the KOSDAQ index was displayed on the status board at the Korea Exchange PR Center in Yeongdeungpo-gu, Seoul. Photo by Yonhap News

On the 26th, when the KOSDAQ index surpassed the 1000 mark for the first time in over four years, the KOSDAQ index was displayed on the status board at the Korea Exchange PR Center in Yeongdeungpo-gu, Seoul. Photo by Yonhap News

Market Reflects Expectations for Government and Political Support for KOSDAQ Market Revitalization

With strong determination from the President and the ruling party, the government has decided to include the KOSDAQ index in the evaluation criteria for pension funds, which total 1,400 trillion won. The Ministry of Economy and Budget announced the basic direction for fund asset management for 2026 the previous day, including measures to increase KOSDAQ investments by 67 pension funds.

The key is to combine the KOSDAQ index with the domestic stock return benchmarks, which previously only reflected KOSPI, so that pension funds will naturally increase their participation in KOSDAQ. As of 2024, pension fund investments in KOSDAQ amount to 5.8 trillion won, accounting for only 3.7% of total domestic equity investments. The aim is to open a stable channel for funds to flow into the relatively neglected KOSDAQ market, thereby supporting further index growth.

An official from the Ministry of Economy and Budget stated, "Investing in high-quality domestic companies can be utilized as a virtuous cycle mechanism for the economy and as a strategy to enhance long-term returns through proactive investment. Expanding the inclusion of KOSDAQ stocks in domestic equity portfolios will contribute to investment diversification and the foundation for innovative growth."

Experts believe that, as the government and ruling party are actively working to revive the KOSDAQ market, there is a high possibility that the index will rise further. Kim Jongyoung, a researcher at NH Investment & Securities, explained, "Historically, after the government announced KOSDAQ revitalization policies, the KOSDAQ market capitalization generally increased, benefiting from policy effects." Kim analyzed, "If KOSDAQ enters an overheated phase due to policy expectations and increased liquidity, it could rise to 1,500 points."

Byun Junho, a researcher at IBK Investment & Securities, also commented, "As the government quickly achieved the KOSPI 5000-point pledge, its policy focus is shifting to the relatively neglected KOSDAQ market. Expectations for government policies are likely to be further reflected in the KOSDAQ index."

However, there are concerns that if the government boosts the KOSDAQ index too artificially, a bubble could form. Many KOSDAQ-listed companies have stock prices that have outpaced their actual performance, and if the bubble bursts for these companies, investors could suffer losses.

Namwoo Lee, Professor at Yonsei University Graduate School of International Studies and Chairman of the Korea Corporate Governance Forum, cautioned, "If KOSDAQ is artificially propped up, there could be serious aftereffects. If the bubble bursts, individual investors could suffer significant losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)