Participation in Foreign Exchange Market Stabilization Measures

Woori Bank Already Participating, Three Others Set to Join

3.6% Interest Paid on Foreign Currency Deposits with the Bank of Korea

Yields Comparable to US Short-Term Treasuries, Additional Foreign Reserves a 'Win-Win'

The Bank of Korea began paying interest on excess reserve requirements (excess reserves) for foreign currency deposits-a foreign exchange market stabilization measure announced at the end of last year-starting on January 8. Major commercial banks have decided to participate in the policy in support of this initiative.

According to the financial sector on January 29, the four major banks (KB Kookmin, Shinhan, Hana, and Woori) are either already depositing or are positively considering depositing excess foreign currency reserves with the Bank of Korea. Woori Bank is already participating, and KB Kookmin Bank has finalized the amount and will soon make its deposit. Shinhan Bank and Hana Bank are also reviewing participation. A commercial bank official stated, "We are comprehensively reviewing the deposit amount, taking into account liquidity such as long-term foreign currency deposits and cash holdings."

Financial institutions are required to deposit a certain ratio of their foreign currency deposits as reserves with the Bank of Korea, known as required reserves. At the end of last year, the Bank of Korea introduced the 'foreign currency excess reserve interest payment' policy, which pays interest on deposits exceeding these required reserves, and this policy has been in effect since this month. The aim is to stabilize the foreign exchange market by encouraging financial institutions to keep their foreign currency funds domestically and to secure additional foreign exchange reserves in response to the National Pension Service's currency hedging activities. The current interest rate is 3.6%, set in consideration of the US Federal Reserve’s policy rate (3.5-3.75%).

This is not a bad option for commercial banks either. Until now, commercial banks have managed their surplus foreign currency funds by entrusting them to overseas financial institutions. However, with this 'foreign currency excess reserve interest payment' policy, banks can earn a monthly return similar to that of depositing dollars overseas simply by depositing with the Bank of Korea, which is the safest option. The yield on US three-month Treasury bills (T-bills) is currently around 3.6% per annum. A financial sector official commented, "Although there is little difference from market rates, it is viewed positively because it allows for returns similar to investing in US Treasury bonds without going through complex financial networks."

There is also a strong intention to actively participate in the foreign exchange authorities’ efforts to stabilize the exchange rate. On January 16, the Bank of Korea reportedly held a meeting with foreign currency managers from commercial banks’ treasury departments to review the status of foreign currency reserve deposits and explain the relevant measures. A commercial bank official said, "We understand that the foreign currency excess reserve interest payment is a policy initiative by the authorities to contribute to foreign exchange market stability, and we support its intent." Another official added, "There is a certain level of consensus among foreign currency managers on this matter."

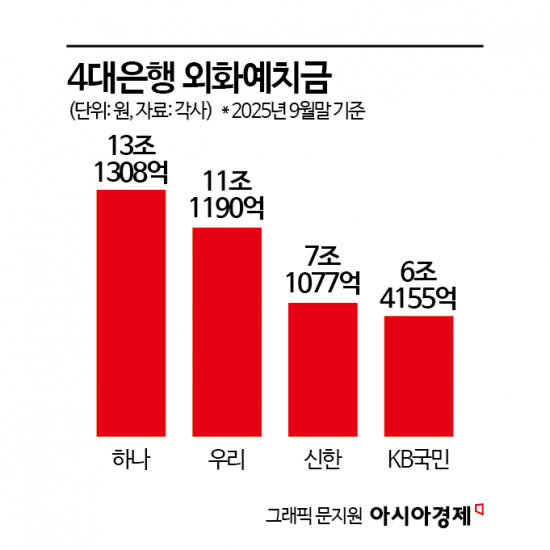

As of the end of September last year, the four major banks held a total of 37.773 trillion won in foreign currency deposits, up 12.8% from 33.493 trillion won a year earlier. Hana Bank held the largest amount at 13.1308 trillion won, followed by Woori Bank with 11.119 trillion won, Shinhan Bank with 7.1077 trillion won, and KB Kookmin Bank with 6.4155 trillion won. If a portion of these dollars remains in the country through the foreign currency excess reserve interest payment policy, it is expected to help prevent further outflow of dollars and improve the tight dollar supply in the market.

A Bank of Korea official stated, "If greater incentives are needed, the interest rate could be raised further. Conversely, if there is a move to deposit not only inflows of overseas funds but also domestic short-term foreign currency funds, the rate could be adjusted downward. We plan to manage the policy flexibly within the range of the US Federal Reserve's policy rate." The official added, "Since this is a temporary system introduced for six months, it will be implemented until June. The Monetary Policy Board will decide whether to extend it after the six-month period ends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)